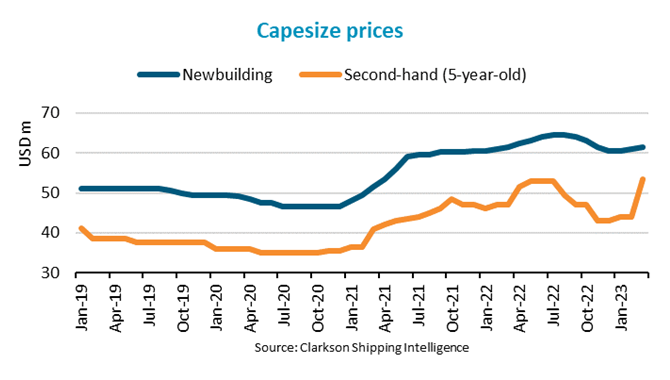

“In March 2023 China’s economic recovery caused a pick-up in capesize freight rates and in sale and purchase activity for this ship type. As a result, five-year-old second-hand prices rallied 22% m/m, reaching USD 54 million by the end of the month,” says Filipe Gouveia, Shipping Analyst at BIMCO.

While capesize spot rates are still weaker than a year ago, they increased threefold in March compared to February levels, according to the Baltic Exchange's capesize 5TC index. Iron ore, coal and bauxite shipments to China rose during the first quarter, strengthening the market’s belief that China’s economic recovery could be a strong driver for capesize demand this year.

China is an important market for capesizes as two thirds of capesizes offload their cargo in the country. Commodity wise, iron ore accounts for 75% of all cargo transported by capesizes world-wide while coal and bauxite account for most of the remaining 25%.

“At current prices, a five-year-old second hand capesize ship is selling for 87% of the price of a newbuild, nine percentage points above the 2022 average. It is clear that buyers are hoping to take advantage of an expected increase in rates in the short run,” says Gouveia.

Despite the market’s optimism for capesizes, risks to the demand outlook remain and the Chinese government could be seen mandating a reduction in steel production in 2023, which would weaken iron ore demand. That would be the third consecutive year that the government implements this type of measure to curb emissions and combat air pollution. China’s real estate sector also remains in a fragile state, which could dampen the recovery in iron ore demand. However, new home sales increased 56% m/m in March which could mark the start of a gradual recovery for the sector.

“To sustain high second-hand capesize prices, rates will need to significantly increase in the coming quarters. While the demand indicators for capesizes look promising, risks to demand still exist,” says Gouveia.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: