The anticipated box crunch at European ports following the closure of the Suez Canal at the end of March has been less severe than expected, according to Container xChange.

However, Europe's leading box hubs are still receiving far more boxes than are departing.

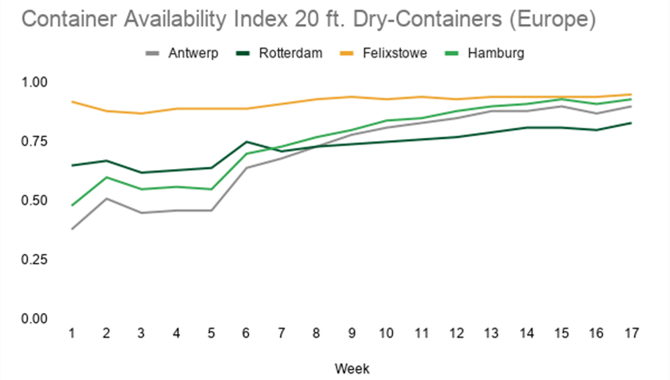

The average CAx reading of incoming 20 foot dry-containers across three of Europe's biggest ports - Rotterdam, Antwerp and Hamburg – climbed just 3% in week 17 compared to the week before.

At Rotterdam, the increase in incoming 20 ft. dry containers was most stark, with box numbers rising +3.75% week-on-week. At Antwerp the week-on-week increase was +3.5%, while at Hamburg it was +2.2%.

At all three ports incoming box traffic has been heavy since March. In Container xChange's Container Availability Index (CAx) an index reading of below 0.5 means more containers leave a port compared to the number which enter. Above 0.5 means more containers are entering the port.

Hamburg has recorded a CAx reading of above 0.8 since week 9 of this year. In week 17 its CAx reading was 0.93, up from 0.48 in week 1.

Rotterdam's CAx reading has also risen steadily in 2021, climbing from 0.65 in week 1 to 0.74 in week 9 and up to 0.83 in week 17.

Antwerp, meanwhile, recorded a CAx of 0.38 at the start of the year, 0.78 in week 9 and 0.9 in week 17.

In contrast, the situation at heavily-congested Felixstowe has been dire all year. The hub's lowest CAx this year was 0.87 in week 3. In week 17 it recorded a CAx of 0.95, up from 0.94 in week 16.

Dr Johannes Schlingmeier, CEO & Founder of Container xChange, the world's leading container leasing and trading platform, commented: “Europe's top container terminals have been struggling to keep congestion at bay, with incoming boxes outweighing outgoing boxes for much of 2021. The closure of the Suez Canal appears to have only made the box crunch at Europe's hubs only slightly worse than it already was.

“What we're hearing from our container leasing and trading members is that they find it increasingly difficult to book export containers with the carriers across Europe. It seems shipping lines are prioritising empty containers in order to move the boxes back to China as fast as possible.”

However, Europe's leading box hubs are still receiving far more boxes than are departing.

The average CAx reading of incoming 20 foot dry-containers across three of Europe's biggest ports - Rotterdam, Antwerp and Hamburg – climbed just 3% in week 17 compared to the week before.

At Rotterdam, the increase in incoming 20 ft. dry containers was most stark, with box numbers rising +3.75% week-on-week. At Antwerp the week-on-week increase was +3.5%, while at Hamburg it was +2.2%.

At all three ports incoming box traffic has been heavy since March. In Container xChange's Container Availability Index (CAx) an index reading of below 0.5 means more containers leave a port compared to the number which enter. Above 0.5 means more containers are entering the port.

Hamburg has recorded a CAx reading of above 0.8 since week 9 of this year. In week 17 its CAx reading was 0.93, up from 0.48 in week 1.

Rotterdam's CAx reading has also risen steadily in 2021, climbing from 0.65 in week 1 to 0.74 in week 9 and up to 0.83 in week 17.

Antwerp, meanwhile, recorded a CAx of 0.38 at the start of the year, 0.78 in week 9 and 0.9 in week 17.

In contrast, the situation at heavily-congested Felixstowe has been dire all year. The hub's lowest CAx this year was 0.87 in week 3. In week 17 it recorded a CAx of 0.95, up from 0.94 in week 16.

Dr Johannes Schlingmeier, CEO & Founder of Container xChange, the world's leading container leasing and trading platform, commented: “Europe's top container terminals have been struggling to keep congestion at bay, with incoming boxes outweighing outgoing boxes for much of 2021. The closure of the Suez Canal appears to have only made the box crunch at Europe's hubs only slightly worse than it already was.

“What we're hearing from our container leasing and trading members is that they find it increasingly difficult to book export containers with the carriers across Europe. It seems shipping lines are prioritising empty containers in order to move the boxes back to China as fast as possible.”

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: