Maersk's MECL "structural return" to Suez: from a trial passage to an institutionalized route comeback, Red Sea reopening enters a new phase

On January 15, 2026, Maersk issued its latest notice: its independently operated MECL (Middle East Container Line) service, linking the "Middle East/India—U.S. East Coast," will implement its first "structural" adjustment to return to the Trans-Suez route via the Suez Canal. The immediate trigger for this decision was that two vessels previously deployed on MECL—Maersk Sebarok and Maersk Denver—have completed successful validation voyages via the Suez/Red Sea direction. Based on that, Maersk is upgrading MECL from "trial runs on individual voyages" to a "fixed routing at the service level." A U.S.-flagged Maersk container ship is transiting the Red Sea!

For the market, this is not merely "another ship passing through the Red Sea," but a much stronger signal: leading liner companies are beginning to rewrite the Red Sea–Suez corridor into "normal network design," shifting it back from an optional/emergency choice. Against a backdrop where supply-demand dynamics and geopolitical variables remain highly sensitive, "structural return" represent a comprehensive reset across organization, scheduling, customer delivery, and commercial commitments."

Key takeaways: Maersk turns "trial voyages" into a "structural adjustment"

From the announcement, Maersk's move is very clear: MECL will no longer decide whether to detour based on "single-voyage assessments", but will restore the originally designed service model in the form of a "service product," with the aim of providing customers with more efficient transit times. MECL is independently operated by Maersk and covers the Middle East and India to the U.S. East Coast, which also makes this structural adjustment more "implementable," without repeated coordination within an alliance framework.

In execution, Maersk provided clear first-sailing milestones: the first westbound sailing will be operated by Cornelia Maersk (603W), departing Jebel Ali on January 15, 2026, taking the westbound Trans-Suez routing; the first eastbound sailing will be operated by Maersk Detroit (602E), departing North Charleston on January 10, 2026, becoming the first eastbound MECL vessel to adopt Trans-Suez, and subsequent voyages will follow this routing. This phrasing—"clear milestones + ongoing continuation"—indicates the company has recalibrated schedules and stowage logic around the Suez routing.

Why MECL leads the way? Choosing a "more controllable" corridor for an institutionalized return

Maersk's choice to make MECL the first service to "structurally return" in itself reflects a practical trade-off between risk and efficiency. Unlike products involving slot-sharing among multiple parties or alliance operations, MECL is independently run by Maersk, with a shorter decision chain and more consistent execution. Once the company judges that safety and operating conditions have reached an acceptable threshold, it can quickly upgrade "case-by-case transits" into "service rules," returning certainty to customers.

More importantly, the regions connected by MECL mean the cost of detouring is often more "hard." Rerouting around the Cape of Good Hope not only lengthens distance and turnaround cycles, but also amplifies pressure on vessel deployment, schedule reliability, equipment circulation, and customers' inventory management. For trunk services where timeliness and predictability are core value, when a security window shows improvement, returning to Suez almost naturally carries strong economic drivers—this is also why "MECL first, others later" better fits commercial and operational logic.

Red Sea security: Maersk's "return" comes with two layers of insurance

Notably, Maersk places "safety first"very prominently in its notice and explicitly ties MECL's return to continued stability in the Red Sea and a non-escalation of regional conflict. This means that a so-called "structural return" does not imply that risk has been fully eliminated; rather, Maersks assessment is that the current risk level remains manageable, allowing it—on the basis of strengthened security measures and operational contingency plans—to resume a more efficient routing.

At the same time, Maersk sets out a clear "reversibility mechanism" for this structural adjustment: if the security situation deteriorates, the company retains the option to divert individual MECL voyages back around the Cape of Good Hope, and, if necessary, to roll back broader structural return arrangements. For customers, this is a practical risk-management framework: efficiency returns, but the operating strategy still maintains "switch-at-any-time" contingency flexibility, ensuring the company is not forced into a passive position when safety margins change.

Industry impact: what chain reactions can an "institutionalized return" of one service trigger?

From a market perspective, a "structural return" typically means higher efficiency—and in shipping economics, higher efficiency is equivalent to "implicit capacity release." When voyage distance shortens and turnarounds accelerate, the same fleet size can complete more effective transport, creating structural impacts on slot tightness and freight rates. The magnitude depends on the scope and durability of the reopening, and whether other services follow in parallel. In other words, the return of a single service may not immediately rewrite the overall picture, but it may become a starting point for supply-demand rebalancing.

For shippers and forwarders, the most direct benefit is improved transit time and planning reliability, but contract and clause management may become more granular. Because the "reversibility mechanism" remains in place, agreements between carriers and customers on rerouting notices, surcharges, insurance, and force majeure may place greater emphasis on scenario-based trigger conditions and boundaries of responsibility. For the Suez Canal and regional ports, when a leading carrier upgrades "pilot transits" to an “institutionalized return,” it often becomes a weathervane for subsequent market assessment: it may not mean "a full return has arrived," but it often signals that "the feasibility of returning is strengthening."

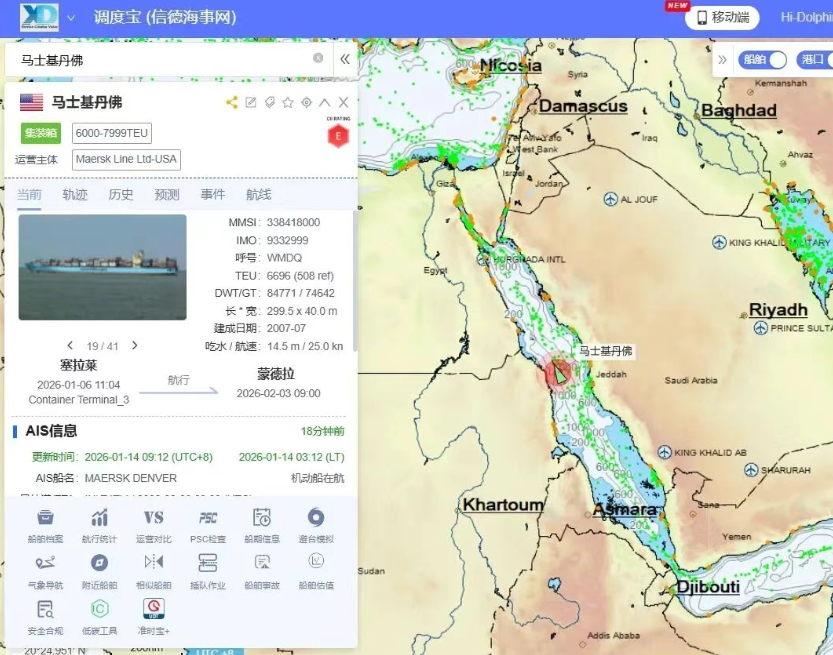

Back to Maersk Denver: the symbolic meaning of a U.S.-flag transit through the Red Sea

In Maersk's narrative, the successful passage of Maersk Denver is given a validation role: it is not only a key practical pivot for MECL's return to Trans-Suez, but also more symbolic because of its "U.S.-flag" status. Transits through high-risk waters often involve multiple dimensions—flag state considerations, compliance, security configuration, and external perceptions—so the information that "a U.S.-flag container ship successfully transited the Red Sea" can, by itself, amplify market psychological expectations.

More realistically, any "structural return" requires operational validation through real voyages: from route passage feasibility and escort/security arrangements, to AIS strategy, operational notifications to customers, and onward port connectivity and schedule stability—these are the dividing line between a "paper return" and a "product return." The fact that Maersk Denver and Maersk Sebarok are named at this time is, in essence, Maersk telling the market: it has verified "whether it can go" into "it can go by the rules"

This is "the start of reopening," not "the end of risk"

Overall, the greatest significance of MECL’s return to Trans-Suez is that it pushes Red Sea transits from "trial runs on individual voyages" to "service productization and institutionalized execution." This step is symbolically important for industry confidence, network efficiency, and customer expectation management, and it is also more likely to trigger market-wide assessments about "whether more services will follow."

But it must also be emphasized: Maersk places "safety first, continuous monitoring, and reversibility at any time" at the core of its announcement, indicating that the Red Sea corridor is regaining "usability," but has not yet returned to being "unconditionally usable." What will truly determine whether the industry returns on a broader scale in the future is not any single transit, but how long a stable window can be sustained, whether the operational security paradigm can be replicated, and whether insurance and risk costs can form a long-term structure that is commercially bearable.

by Xinde Marine News

by Xinde Marine News

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com