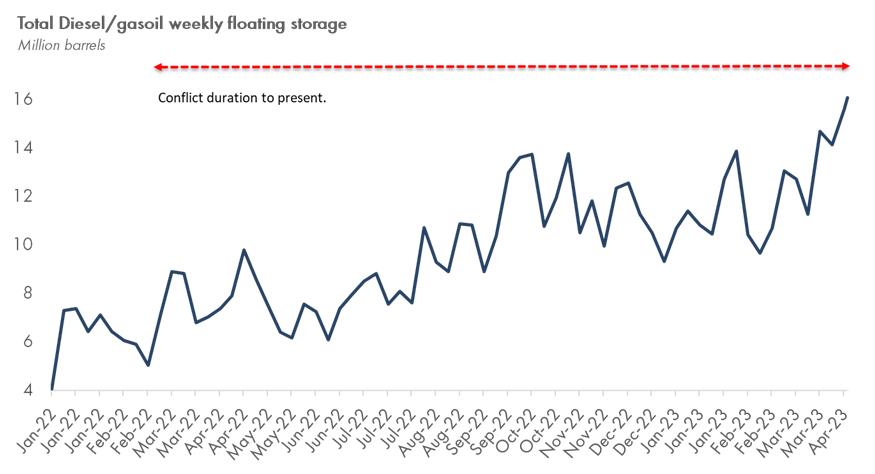

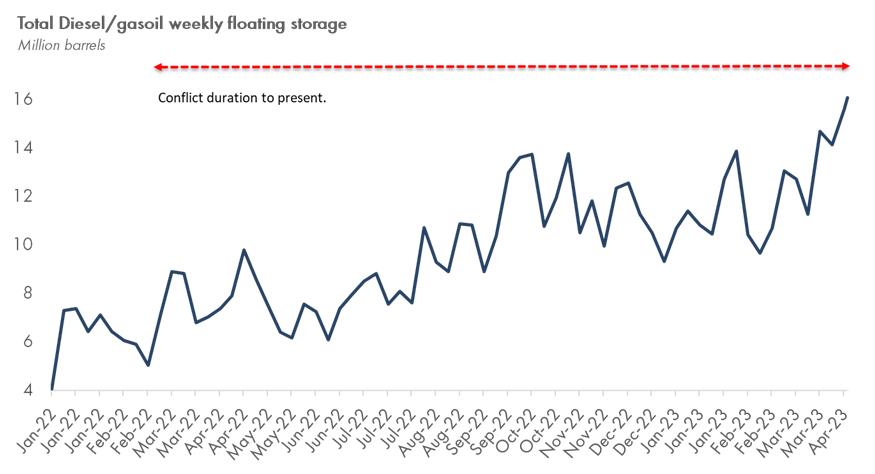

Global diesel and gasoil floating storage volumes have been rising steadily since the beginning of the war in Ukraine. Currently about 15.6mbbls are held on ships, which is 95% higher than the weekly average for April 2022.

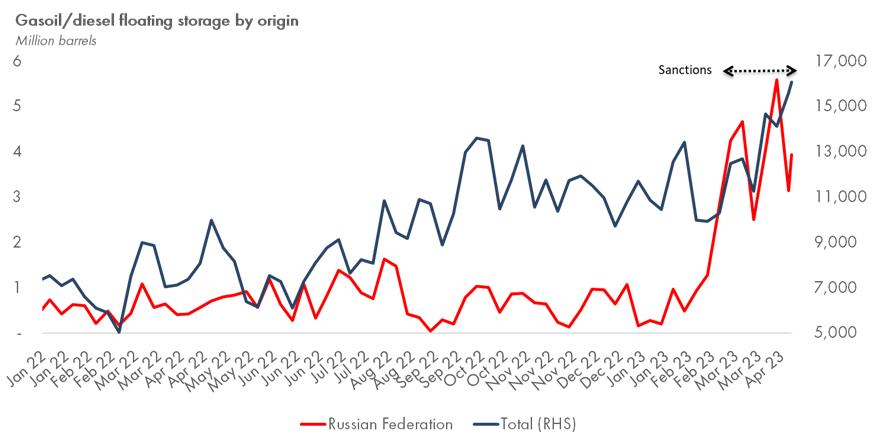

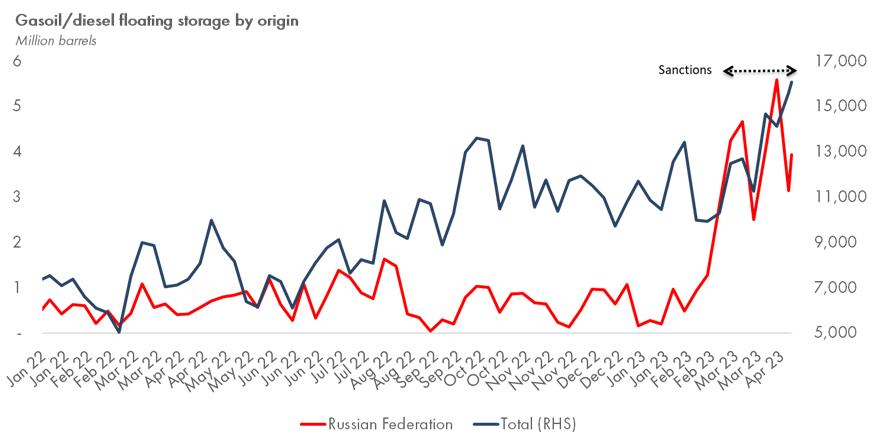

The increase in floating storage is entirely due to the Russian barrels. Russia went from 4% to 40% of global diesel/gasoil stored on ships when it peaked (currently down to 20% of the total). An increase of 1050% in Russian gasoil/diesel floating storage occurred in just 8 weeks from the time the sanctions came into force. Those countries with available diesel on vessels were able to fulfil spot orders quickly, taking advantage of the ULSD price increase, depleting their own proportions of floating storage. Where Russia initially plugged the gap leaving the overall total largely unchanged, now overall totals are being pushed ever higher as more Russian diesel is put into storage. Russia has continued to maintain higher storage levels, only recently starting to drop as their production cuts take hold, and therefore overall refined products exports drop. However, floating storage has spiked, and currently sits 16% higher than 5th February.

The location of this Russian diesel/gasoil remains predominantly in the Black Sea and the Med, suggesting it is taking longer to achieve a buyer. There appears to be low appetite to pay for sanctioned refined products at buyers’ destinations.

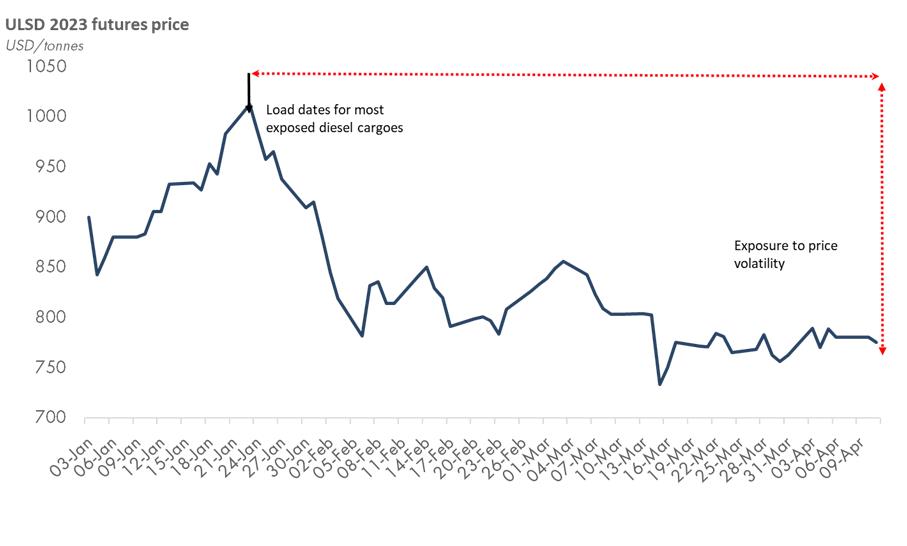

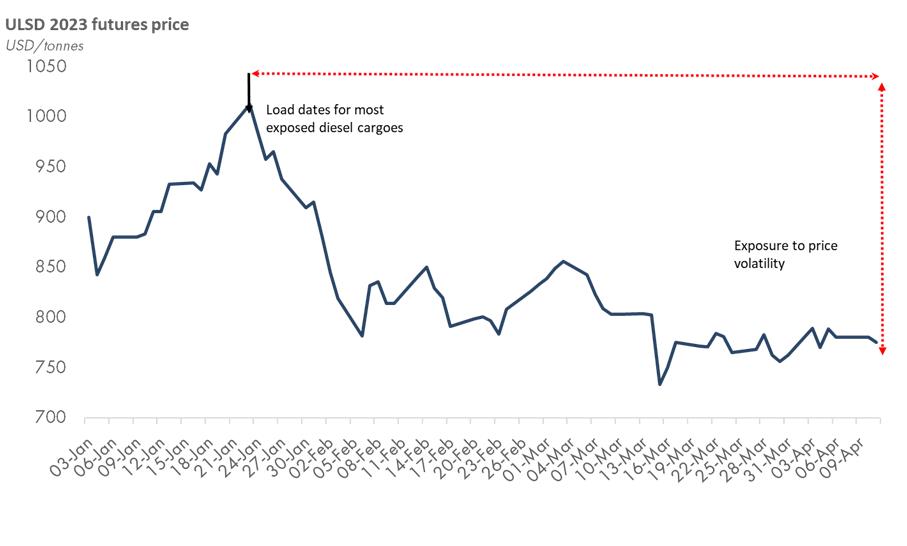

It must not be forgotten, either, that the grade split is very significant. Almost half of the identifiable grade of gasoil/diesel is ULSD, the highest value product. It is not beyond the realms of doubt that the majority of the unidentified product is also ULSD. What this means, is that there is a lot of very high value product sat on the water, thereby meaning that there is also a high likelihood that the ends of these trades have not been transacted, and one party potentially exposed to price volatility. With a number of vessels involved in floating storage, it means that these are not available to lift cargoes, diminishing the size of the clean shadow fleet, and pushing up rates for sanctioned cargoes. This could, in turn, push owners of older vessels, who previously had been on the fence about doing sanction voyages, to get the most out of their over-aged vessels by undertaking these trades. This leads to an increasingly aged fleet being worked hard which has its own implications and dangers. As floating storage rises, we could also see demurrage rates rise, and potential for increased congestion.

Because the dark fleet is involved in storage plays, it is likely to only affect freight involved within this group, and not likely to impact those involved in non-sanctioned trades.

We are potentially likely to see further floating storage as it has not abated. While Russia has managed to largely maintain output and supply of crude via tankers, the clean market is a different beast. Whereas crude demand has been strong, regional product demand, previously satisfied by Russian cpp, is now being supplied by countries further away, including by buyers of Russian crude. Refinery runs, in line with dropping crude production, are likely to drop to counter the storage issue that is starting to arise. It is not a massive leap to foresee that the sanctioned clean fleet is likely to be further hampered by lack of buyers and therefore used as floating storage. That could tighten the availability of tonnage supply the further on in time we go. This could cause a back up to the refineries, leading to decreased run rates. However, It could also mean that countries in the Middle East and Asia might buy Russian diesel as prices drop, then re-export it to other countries rather than run their own refineries to the same extent. After all, this is starting to happen on the crude side.

Source: Arrow Research Report

The increase in floating storage is entirely due to the Russian barrels. Russia went from 4% to 40% of global diesel/gasoil stored on ships when it peaked (currently down to 20% of the total). An increase of 1050% in Russian gasoil/diesel floating storage occurred in just 8 weeks from the time the sanctions came into force. Those countries with available diesel on vessels were able to fulfil spot orders quickly, taking advantage of the ULSD price increase, depleting their own proportions of floating storage. Where Russia initially plugged the gap leaving the overall total largely unchanged, now overall totals are being pushed ever higher as more Russian diesel is put into storage. Russia has continued to maintain higher storage levels, only recently starting to drop as their production cuts take hold, and therefore overall refined products exports drop. However, floating storage has spiked, and currently sits 16% higher than 5th February.

The location of this Russian diesel/gasoil remains predominantly in the Black Sea and the Med, suggesting it is taking longer to achieve a buyer. There appears to be low appetite to pay for sanctioned refined products at buyers’ destinations.

It must not be forgotten, either, that the grade split is very significant. Almost half of the identifiable grade of gasoil/diesel is ULSD, the highest value product. It is not beyond the realms of doubt that the majority of the unidentified product is also ULSD. What this means, is that there is a lot of very high value product sat on the water, thereby meaning that there is also a high likelihood that the ends of these trades have not been transacted, and one party potentially exposed to price volatility. With a number of vessels involved in floating storage, it means that these are not available to lift cargoes, diminishing the size of the clean shadow fleet, and pushing up rates for sanctioned cargoes. This could, in turn, push owners of older vessels, who previously had been on the fence about doing sanction voyages, to get the most out of their over-aged vessels by undertaking these trades. This leads to an increasingly aged fleet being worked hard which has its own implications and dangers. As floating storage rises, we could also see demurrage rates rise, and potential for increased congestion.

Because the dark fleet is involved in storage plays, it is likely to only affect freight involved within this group, and not likely to impact those involved in non-sanctioned trades.

We are potentially likely to see further floating storage as it has not abated. While Russia has managed to largely maintain output and supply of crude via tankers, the clean market is a different beast. Whereas crude demand has been strong, regional product demand, previously satisfied by Russian cpp, is now being supplied by countries further away, including by buyers of Russian crude. Refinery runs, in line with dropping crude production, are likely to drop to counter the storage issue that is starting to arise. It is not a massive leap to foresee that the sanctioned clean fleet is likely to be further hampered by lack of buyers and therefore used as floating storage. That could tighten the availability of tonnage supply the further on in time we go. This could cause a back up to the refineries, leading to decreased run rates. However, It could also mean that countries in the Middle East and Asia might buy Russian diesel as prices drop, then re-export it to other countries rather than run their own refineries to the same extent. After all, this is starting to happen on the crude side.

Source: Arrow Research Report

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: