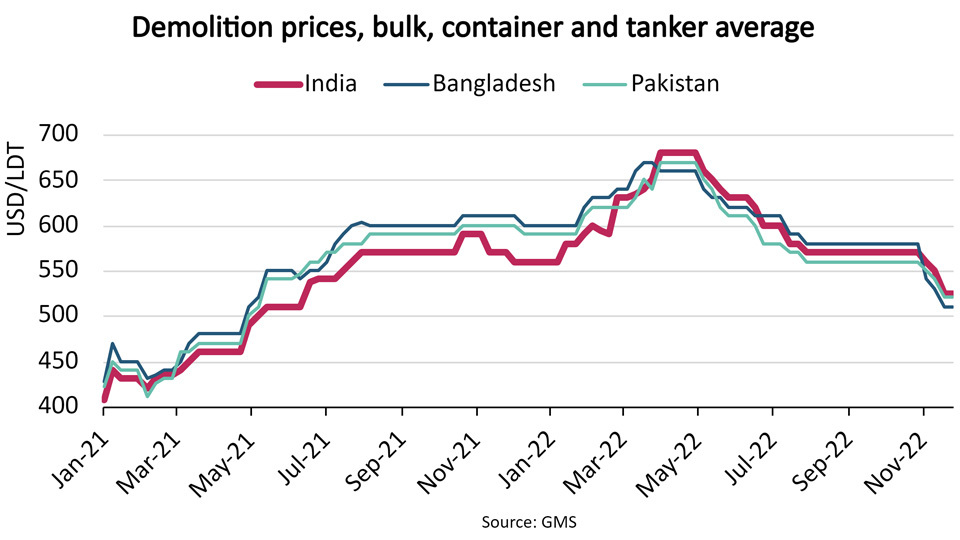

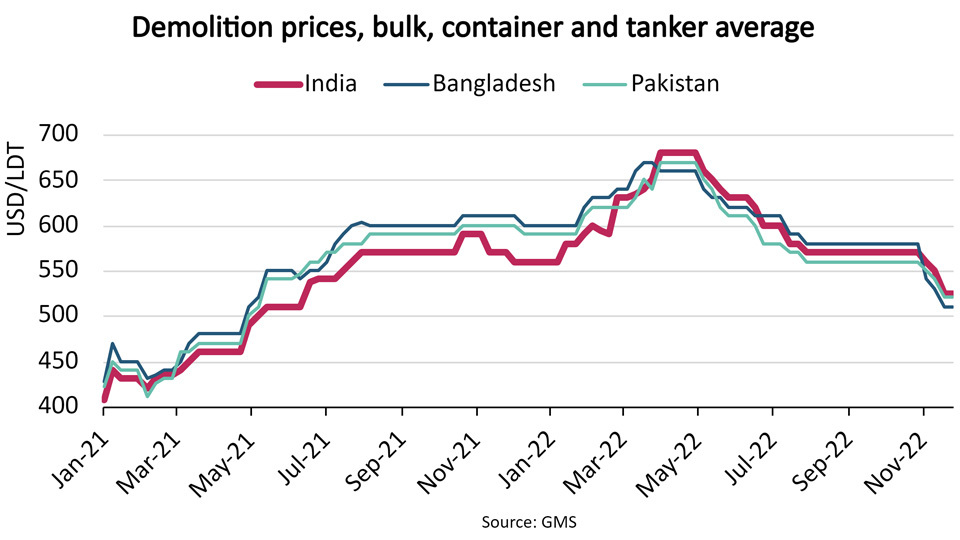

On 18 November, India’s government removed export tariffs on iron ore and some intermediary steel products. However, this was not enough to keep domestic ship demolition prices from dropping to USD 525 per Light Displacement Tonnage (LDT) at the end of November, 7.9% lower than at the end of October.

The export tariffs were implemented in May to boost domestic supplies of iron ore and combat inflation. By May, domestic and global steel prices had already started to fall due to the energy crisis and worsening global economic conditions.

The export tariffs were implemented in May to boost domestic supplies of iron ore and combat inflation. By May, domestic and global steel prices had already started to fall due to the energy crisis and worsening global economic conditions.

The government of India has now decided to remove the tariffs due to a fall in steel exports. India’s share of global steel exports is estimated to fall 0.8 percentage points to around 3.5% in 2022, despite the loss of steel exports from Ukraine.

The removal of tariffs had little immediate impact on steel and demolition prices, and it remains unlikely that they should recover in the short term. However, we believe that exports should rebound due to this policy change, and as a result, the downward pressure on domestic prices could ease.

Domestic market conditions should remain strong, as the World Steel Association estimates India’s steel demand to rise 6.1% and 6.7% in respectively in 2022 and 2023. Global steel demand should also grow 1.0% in 2023, an improvement over the 2.3% drop in 2022, leading to a stabilisation of global steel prices.

If year-to-date rate reductions in the bulk and container sectors take hold, or reduce even further, owners may consider recycling more of the oldest ships in the fleet during 2023. A reduction in demolition prices is unlikely to have significant impact on these decisions.

Based on demand drivers and steel futures contracts, we believe that demolition prices should begin to stabilise and could even recover during the first half of 2023. However, we acknowledge that much uncertainty remains concerning economic conditions, and that a more negative scenario remains a possibility.

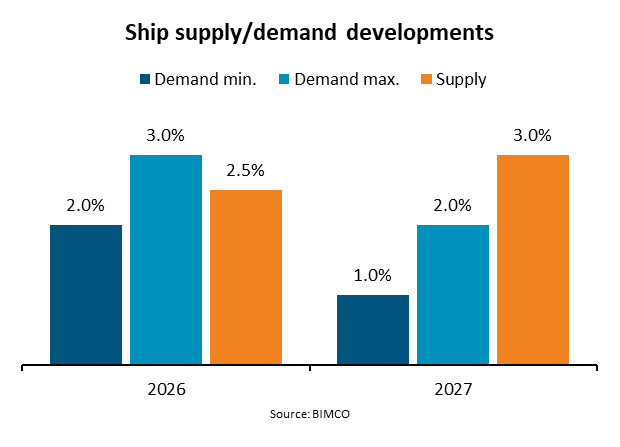

Source: BIMCO

If year-to-date rate reductions in the bulk and container sectors take hold, or reduce even further, owners may consider recycling more of the oldest ships in the fleet during 2023. A reduction in demolition prices is unlikely to have significant impact on these decisions.

Based on demand drivers and steel futures contracts, we believe that demolition prices should begin to stabilise and could even recover during the first half of 2023. However, we acknowledge that much uncertainty remains concerning economic conditions, and that a more negative scenario remains a possibility.

Source: BIMCO

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: