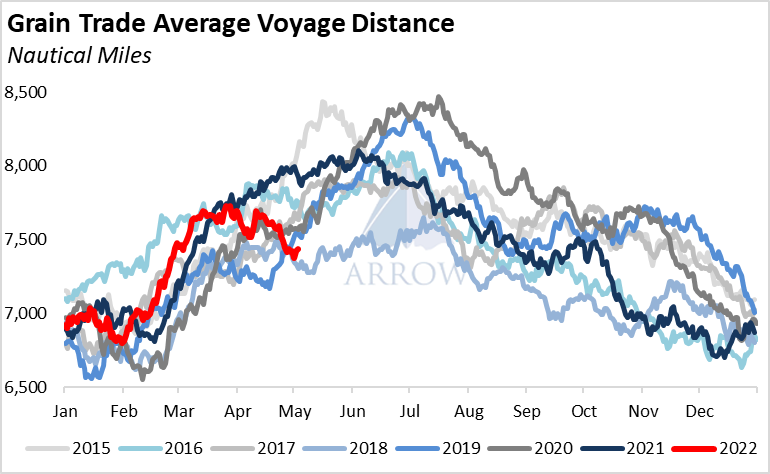

It's been over 90 days since the conflict in Ukraine started and grains from the country stopped flowing into the seaborne market. In order for those lost tonne-miles to be made up elsewhere, longer voyage distances would be required – that is not happening, in fact, so far they are getting shorter.

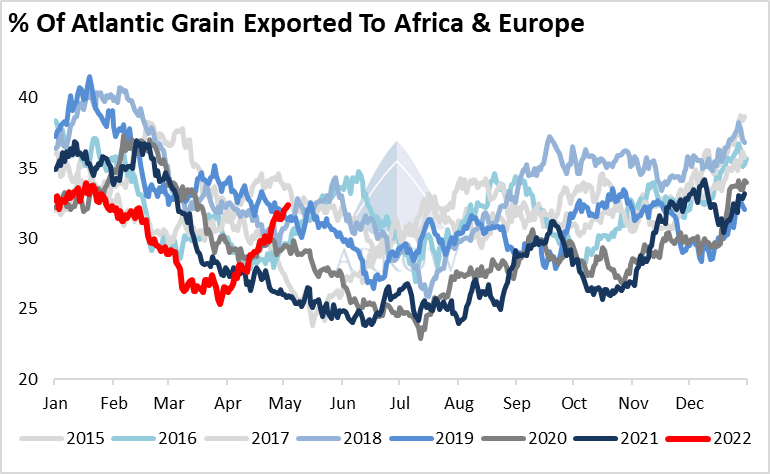

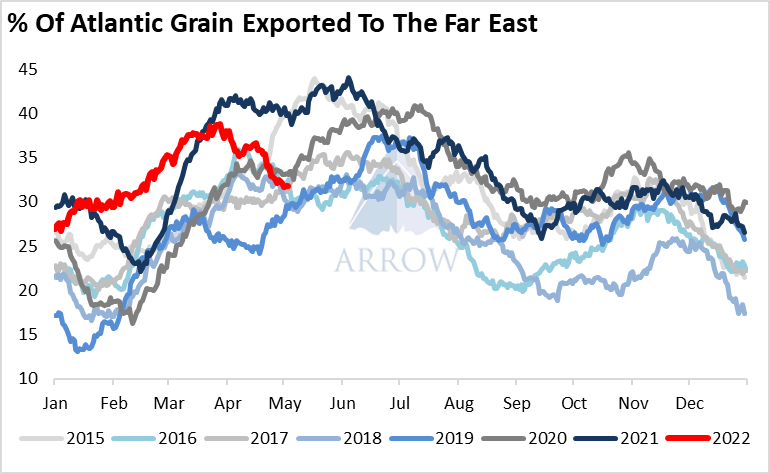

A tighter balance of grains in the Atlantic has led to more cargoes staying within the basin, denting Asia's market share.

A tighter balance of grains in the Atlantic has led to more cargoes staying within the basin, denting Asia's market share.

Normally at this time of year when cargoes are flooding out of South America towards the Far East, average voyage distances increase. However this year the trend is less pronounced, and even looks to be reversing.

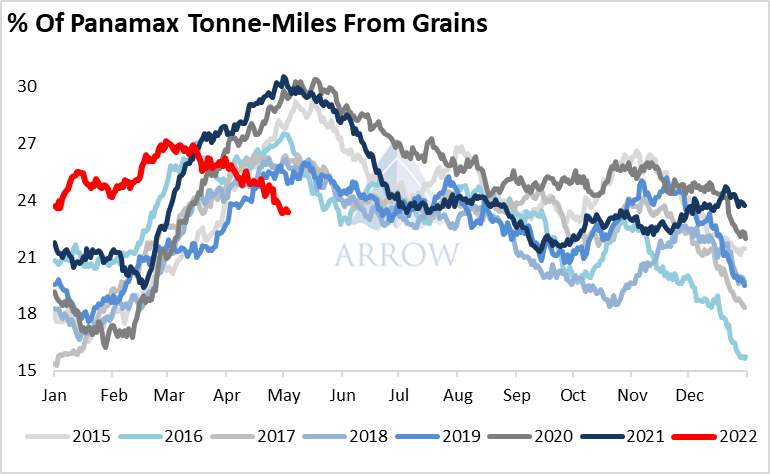

Whilst overall Panamax tonne-miles are at similar levels to last year, the proportion coming from the grain trade is at a seasonally low level. This time last year about 30% of Panamax tonne-miles came from the grain trade, today it is around 23%.

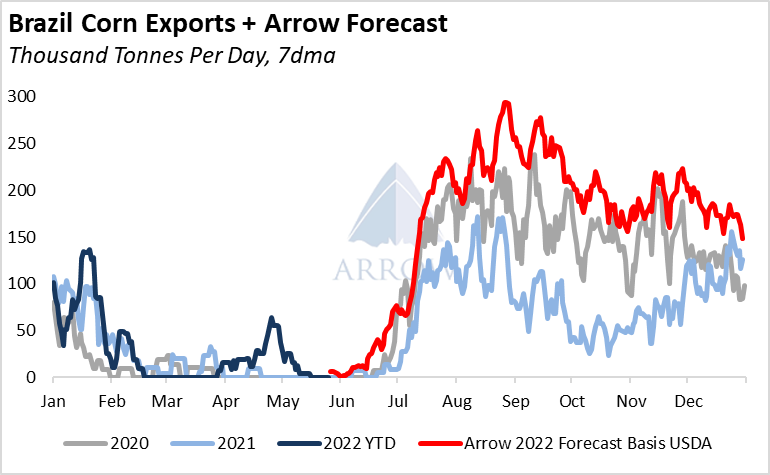

The only notable source of YoY growth in grain exports looks to be the Brazilian corn crop. Although there is still time for the crop to potentially deteriorate in size, so far it looks to be a record at 116 million tonnes. As per the USDA, exports are expected to double from 21 million tonnes last marketing year to 45 million tonnes this year.

After signing a phytosanitary requirement protocol this week, China looks set to start importing Brazilian corn later this year. This new Chinese demand could increase the average voyage distance of Brazilian corn. However with Ukraine out of the market, the total demand growth will be muted.

Furthermore, the USDA's May WASDE report paints a dreary picture of grain exports in the next marketing year, with overall grain export volumes expected to be lower than the current marketing year.

It's looking increasingly unlikely that over the next 12 months the grain market will provide noteworthy shipping demand growth.

Furthermore, the USDA's May WASDE report paints a dreary picture of grain exports in the next marketing year, with overall grain export volumes expected to be lower than the current marketing year.

It's looking increasingly unlikely that over the next 12 months the grain market will provide noteworthy shipping demand growth.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: