Russian military operations have begun across Ukraine with major cities seeing conflict. There are reports of bombings on port infrastructure, however it’s too early to know the extent of the damage. Attacks have been reported in the key ports of Odessa and Mariupol.

Sanctions altering trade-flows and infrastructure damage/blockades impacting operations will be the two key factors for the shipping market.

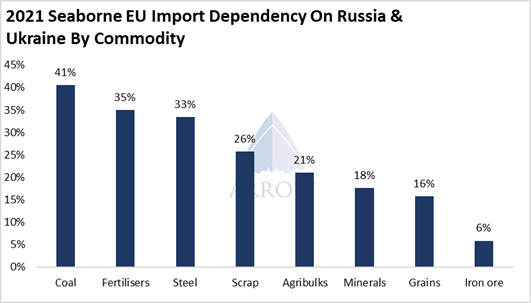

So far, the sanctions have avoided key commodity trades as reliance on Russia is so high, this reliance is deepened by already high commodity prices. The EU is very dependent on Russia for natural gas, however the same is true for coal. Furthermore the fertiliser market is currently in a state of deficit, and the EU would be very cautious to slow this trade.

Sanctions altering trade-flows and infrastructure damage/blockades impacting operations will be the two key factors for the shipping market.

So far, the sanctions have avoided key commodity trades as reliance on Russia is so high, this reliance is deepened by already high commodity prices. The EU is very dependent on Russia for natural gas, however the same is true for coal. Furthermore the fertiliser market is currently in a state of deficit, and the EU would be very cautious to slow this trade.

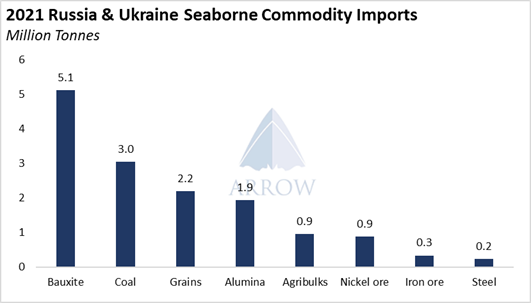

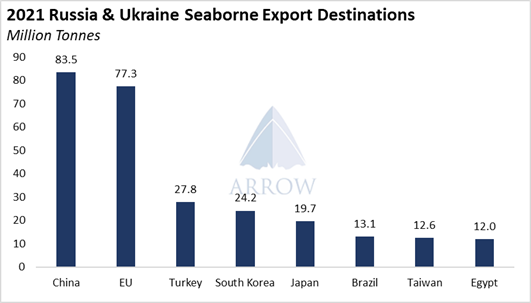

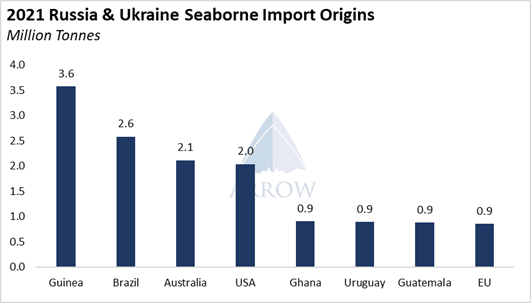

Russia’s coal exports, both from the Western and the Eastern coasts makes up the bulk of impacted volumes. The huge flow of grains exported from the Black Sea means any disruption to trade will continue to support the rally in the agricultural complex. CBOT traded corn limit up today.

China is a keen importer of Russian coal from the East, however it’s worth considering that potential EU sanctions on Russian exports could push Baltic coal to China. This could lead the EU to soak up other Atlantic coal from the USA, Colombia and South Africa.

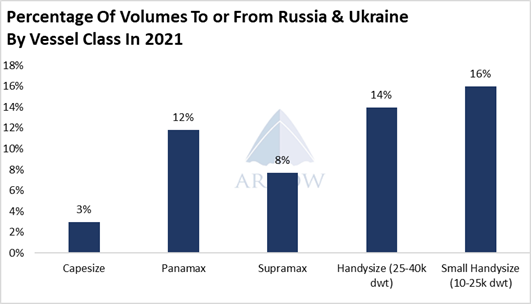

The most exposed vessel class is small Handysizes of which around 16% of trade either loads or discharges in Russia or Ukraine, 10% being just Black Sea. A third of this trade is coal, but the rest is mainly split across grains, steel and fertilisers. Panamaxes are exposed primarily from the Baltic coal trade, but some Black Sea grains too. Capes have a limited exposure from coal and iron ore.

It will take many days before we get a feel for how this situation will pan out. Strict sanctions and protracted fighting could grind seaborne exports to a halt, yet a swift resolution of the conflict and a light Western response could see minimal change.

The Ruble has devalued and Russian stocks have crashed. Once the fighting ends, it will be in the interest of everyone to get trade moving as soon as possible.

The Ruble has devalued and Russian stocks have crashed. Once the fighting ends, it will be in the interest of everyone to get trade moving as soon as possible.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: