A Harsh Winter For Iron Ore Demand, But Brighter Spring

The essential story for iron ore demand at the moment is the energy crisis afflicting China as well as the rest of the world. Power rationing is both dampening steel demand as factories shut down, and curtailing production as steel mills cut run-rates. October is the ‘shoulder period’ for electricity demand in China as air conditioning demand wanes and heating demand is weak, yet it's clear there's currently an acute shortage. At the moment there is little to suggest that this crisis will be resolved over the winter as heating demand rises – power supply would be prioritised to households rather than industry if push came to shove. It appears likely that Chinese iron ore consumption will remain much below 2020 levels in 4Q21.

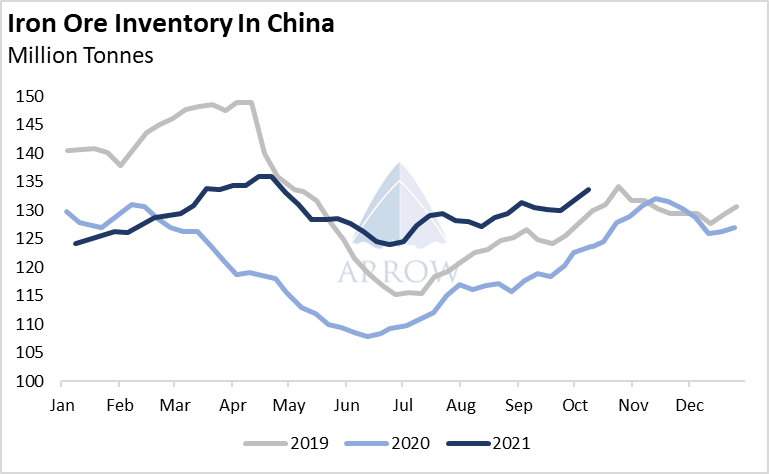

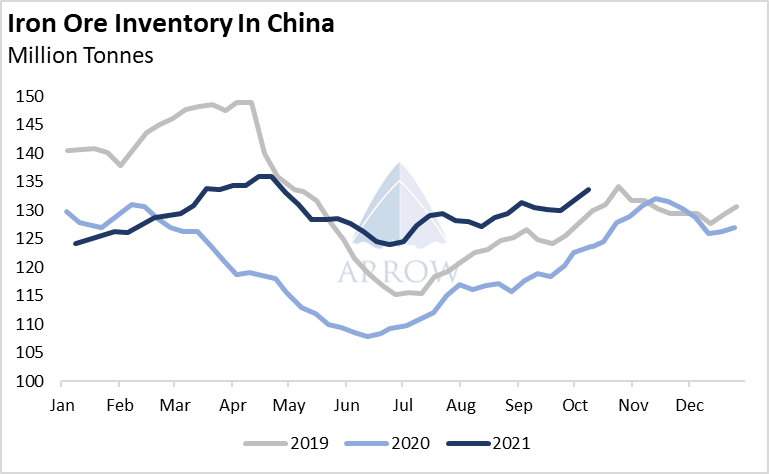

Stockpiles of iron ore are approaching more comfortable levels and currently stand at the highest seasonal level since 2018. Alongside this, the drop in steel production means inventory in days of consumption is around 31, a historically average level and leaves China neither desperate for imports nor in a glut. We expect inventory building to continue throughout the winter.

The air pollution controls associated with the upcoming Winter Olympics have the potential to dent iron ore demand. Tight air pollution controls may be enforced early next year to maintain clear skies for the event, however at this stage it's unclear exactly what effect it will have. The usual winter sintering restrictions are likely to take effect over the coming months regardless.

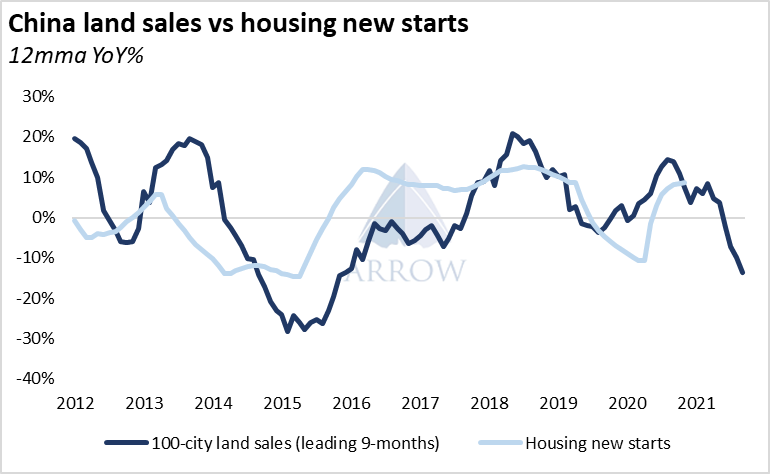

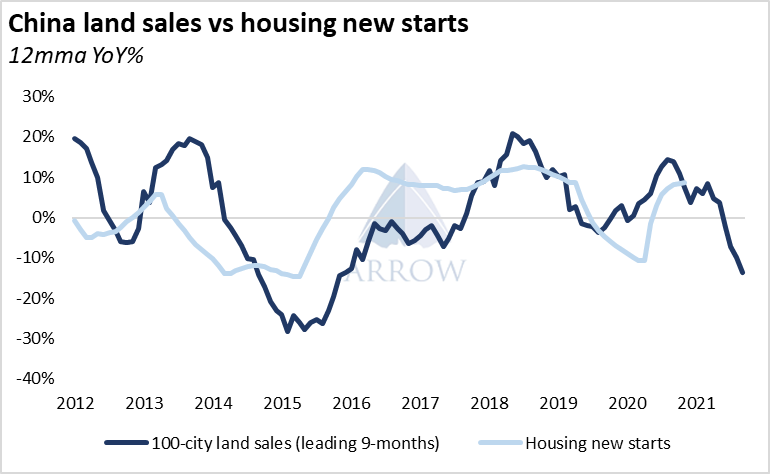

The Evergrande debacle has also highlighted how the construction sector is slowing in China. Leading indicators such as land sales by property developers are also hinting at a slowdown. However we do not envision strong immediate impacts from the defaults as the government ensures an orderly restructuring.

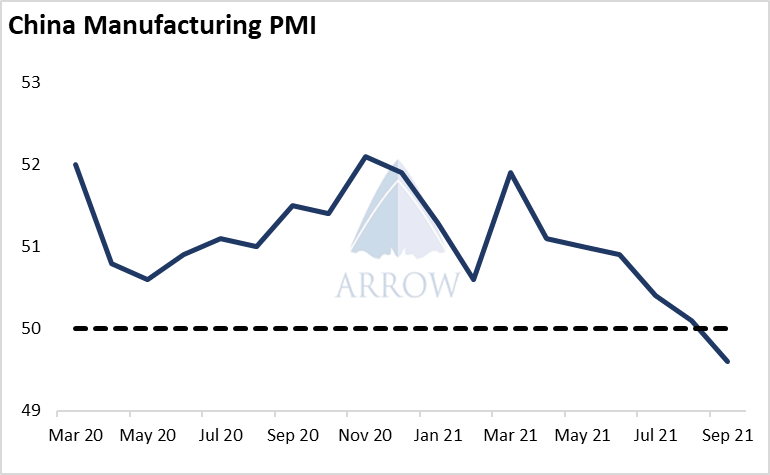

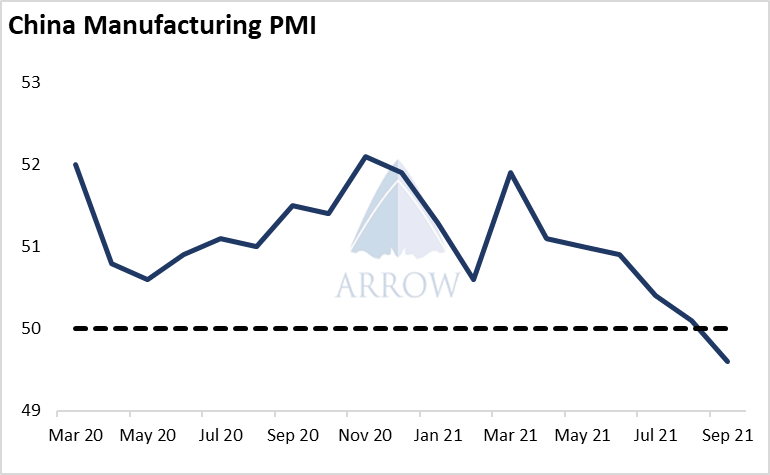

There are broader concerns that the whole Chinese economy is slowing down after the fast bounce-back from Covid-19. Weak retail spending and contractionary PMI data point to economic conditions being unfavourable, and the onset on the energy crisis is set to worsen the situation. Estimates have put the property sector at around a 29% of GDP, and so as this sector weakens, there will be a broader economic drag.

The stories highlighted above point to a weak outlook for iron ore demand this winter in China. Whilst the domestic market is in a surplus, stockpiles can build, however there's an increasing chance that import demand will be negatively affected as the power shortage, weak economic activity and pollution controls take their toll.

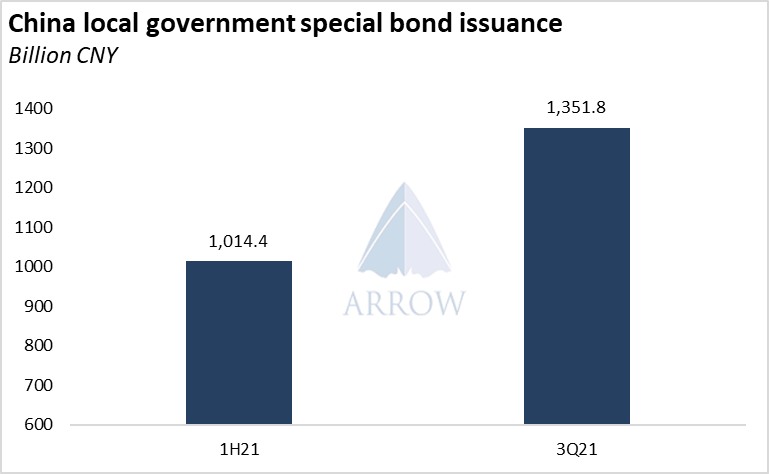

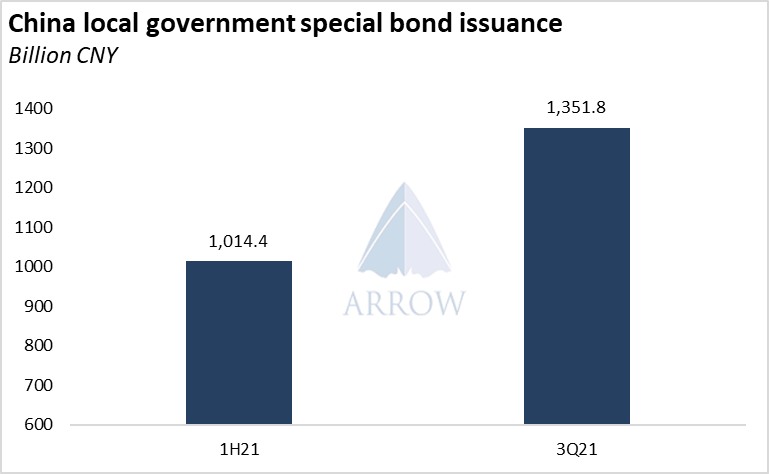

However, the story is not all sour, looking ahead to March next year we envision that there could be strong resurgence of iron ore demand. A winter of weak economic data combined with the end of the Winter Olympics and an easing of the power shortage could lead Beijing to ease financial conditions in order to boost an ailing economy, plus relax most output restrictions on industry as power supply allows. With Core CPI running at a mild 1.2%, there is plenty of room for financial easing. Local government special bond issuance has begun picking up since July with Q3 issuance 33% higher than the first half of the year, which could be an early signal of further stimulus to come.

Whilst Chinese iron ore demand may surprise to the downside over the Winter, there is the potential for a Spring blossoming.

The essential story for iron ore demand at the moment is the energy crisis afflicting China as well as the rest of the world. Power rationing is both dampening steel demand as factories shut down, and curtailing production as steel mills cut run-rates. October is the ‘shoulder period’ for electricity demand in China as air conditioning demand wanes and heating demand is weak, yet it's clear there's currently an acute shortage. At the moment there is little to suggest that this crisis will be resolved over the winter as heating demand rises – power supply would be prioritised to households rather than industry if push came to shove. It appears likely that Chinese iron ore consumption will remain much below 2020 levels in 4Q21.

Stockpiles of iron ore are approaching more comfortable levels and currently stand at the highest seasonal level since 2018. Alongside this, the drop in steel production means inventory in days of consumption is around 31, a historically average level and leaves China neither desperate for imports nor in a glut. We expect inventory building to continue throughout the winter.

The air pollution controls associated with the upcoming Winter Olympics have the potential to dent iron ore demand. Tight air pollution controls may be enforced early next year to maintain clear skies for the event, however at this stage it's unclear exactly what effect it will have. The usual winter sintering restrictions are likely to take effect over the coming months regardless.

The Evergrande debacle has also highlighted how the construction sector is slowing in China. Leading indicators such as land sales by property developers are also hinting at a slowdown. However we do not envision strong immediate impacts from the defaults as the government ensures an orderly restructuring.

There are broader concerns that the whole Chinese economy is slowing down after the fast bounce-back from Covid-19. Weak retail spending and contractionary PMI data point to economic conditions being unfavourable, and the onset on the energy crisis is set to worsen the situation. Estimates have put the property sector at around a 29% of GDP, and so as this sector weakens, there will be a broader economic drag.

The stories highlighted above point to a weak outlook for iron ore demand this winter in China. Whilst the domestic market is in a surplus, stockpiles can build, however there's an increasing chance that import demand will be negatively affected as the power shortage, weak economic activity and pollution controls take their toll.

However, the story is not all sour, looking ahead to March next year we envision that there could be strong resurgence of iron ore demand. A winter of weak economic data combined with the end of the Winter Olympics and an easing of the power shortage could lead Beijing to ease financial conditions in order to boost an ailing economy, plus relax most output restrictions on industry as power supply allows. With Core CPI running at a mild 1.2%, there is plenty of room for financial easing. Local government special bond issuance has begun picking up since July with Q3 issuance 33% higher than the first half of the year, which could be an early signal of further stimulus to come.

Whilst Chinese iron ore demand may surprise to the downside over the Winter, there is the potential for a Spring blossoming.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: