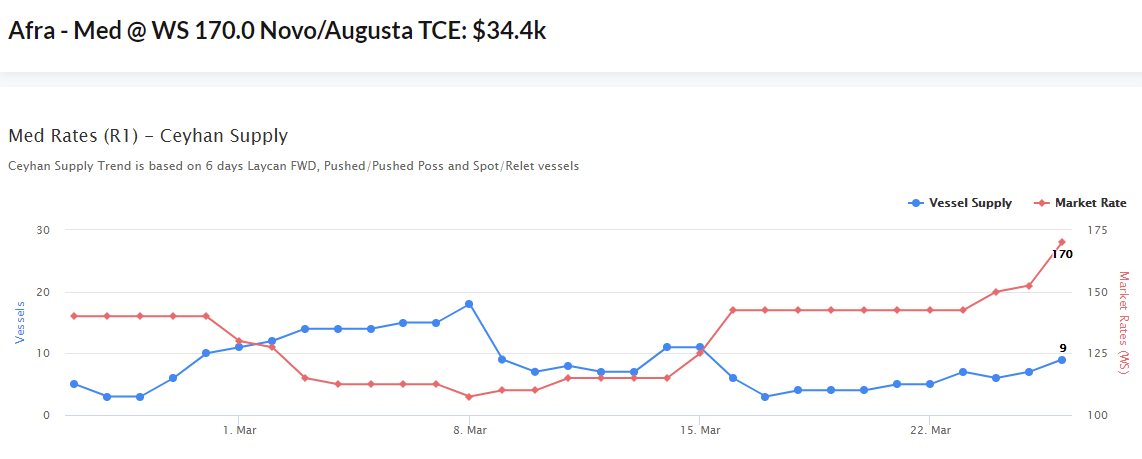

There are currently around 30 tankers above 25,000 dwt waiting to cross the Suez Canal. We expect most vessels in ballast will decide to wait until the situation clarifies and, if fixed on a charter party, will likely get cancelled by charterers through protection clauses related to missing agreed upon laycan dates. This will no doubt affect vessel supply on both sides of the Canal, as well as market rates. Black Sea-Med Aframax seems to be leading the charge with WS170 on subs late on Friday 26th.

Over the coming days and weeks, more vessels are expected to have to decide if they will cross through the Suez Canal or via the Cape of Good Hope. For reference, a vessel currently crossing the Indian Ocean would take 14 days to reach Malta via the Suez versus 33 days via the Cape of Good Hope. The cost for a laden Aframax to pass through the Suez Canal is roughly $300,000.

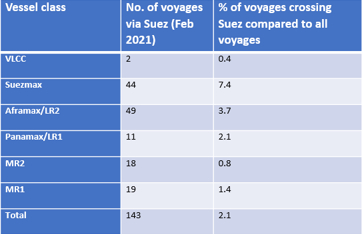

Analysis of tanker types normally transiting the Suez shows that the most impacted are the Suezmaxes, Aframaxes and LR2 vessels. These vessel types trade through the Suez in both directions.

The table below looks at the previous month's canal crossings as an indicator of which vessel sizes might be more likely to be affected by delays or the need to take alternative routing.

Analysis of tanker types normally transiting the Suez shows that the most impacted are the Suezmaxes, Aframaxes and LR2 vessels. These vessel types trade through the Suez in both directions.

The table below looks at the previous month's canal crossings as an indicator of which vessel sizes might be more likely to be affected by delays or the need to take alternative routing.

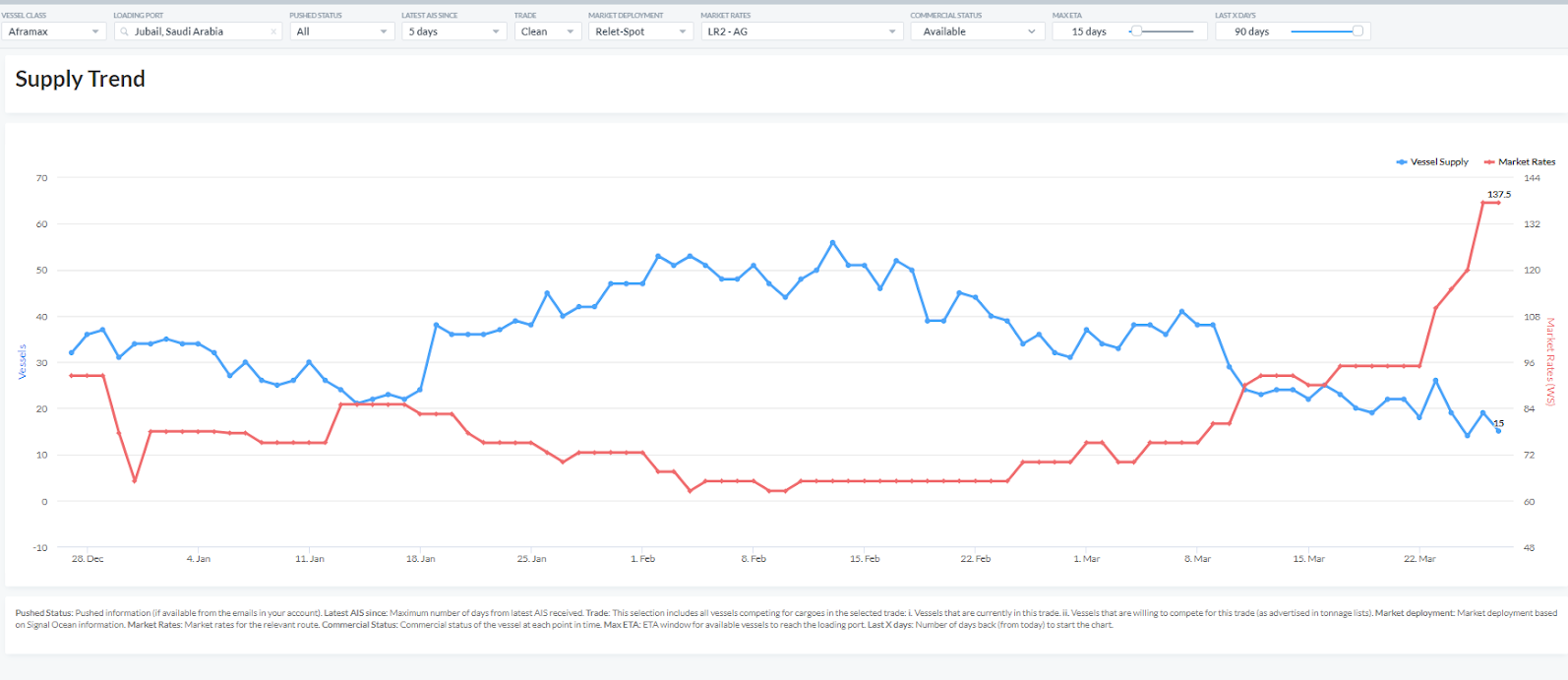

The LR2 market, being particularly thin, with a very small number of vessels both East and West, will potentially see significant changes on freight rates. The graph below shows the commercially available vessel supply in the Arabian Gulf (Jubail) within the next 15 days, the typical fixing window. It is obvious that vessel supply is already at the lowest we have experienced in the last three months. Freight rates have already reacted earlier this week as shown below.

Point in time commercially available vessel supply in Arabian Gulf in the next 15 days window vs LR2 market rates for the same region

A major shipping lane is clearly closed, but this will most probably have a short-term effect for a few charterers and owners that are trying to carry cargo through the Canal at present. Most large crude tankers (VLCCs) have historically taken the route around the Cape when undertaking long East to West or West to East voyages. Mid-sized tankers (Suezmax, Aframax) are more likely to be affected, maybe more so on the carriage of refined products. Low levels of crude oil demand due to the third wave of coronavirus across Europe and the USA are keeping oil prices in check, yet we still saw a 4% rise in prices on a Friday.

Visual illustration of number of tankers involved in the Canal crossing

Source: The Signal Group

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: