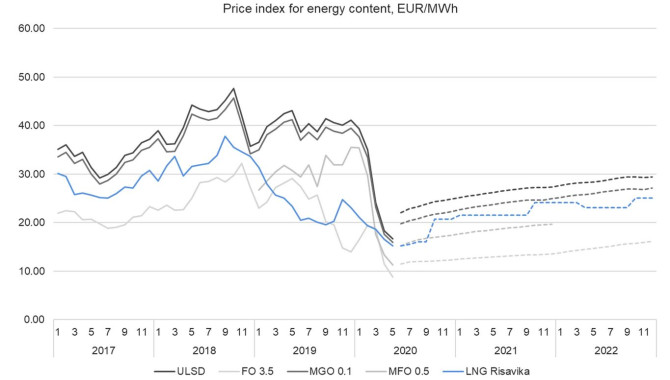

Risavika LNG index continued its downward trend following European gas markets fundamentals, resulting in the index falling by 2 % week on week. Despite lower pipeline gas imports to Europe and colder weather last week, the market remained oversupplied. Most of the oversupply is accounted for LNG imports and historically high gas inventory levels.

Oil prices went up last week on OPEC+ production cuts, lower US oil production, recovering demand and easing fear of lack of oil storage capacity. Fuel oil prices (FO 3.5) front month closed at 160.68 USD/t last week, 8 % higher than previous week. Low Sulphur (MFO 0.5) front month has gained 3 % and closed at 220.40 USD/t. Stocks of all refined product held in independent storage in the Amsterdam-Rotterdam-Antwerp (ARA) oil hub fell 4% as of 14th of May, indicating demand recovery, after a record high level just a week before.

However, the pace of recovery is not going to be fast. According to IEA forecast, global bunker demand will fall by 8 % year on year in the second quarter as covid-19 related restrictions and policies still limit trade movements and passenger travels, while demand from oil and chemical tankers will stay largely unchanged. The agency forecasts that bunker demand from container, dry bulk and cruise ships will marginally recover in the third and fourth quarters. However, it will still result in demand from all vessel types dropping by 5 % this year compared to 2019.

LNG Risavika – LNG FOB Risavika

FO 3.5 FOB Rdam – European 3.5% Fuel Oil Barges FOB Rdam (Platts) Futures Quotes

MFO 0.5 FOB Rdam – European FOB Rdam Marine Fuel 0.5% Barges (Platts) Futures Quotes

MGO 0.1 FOB ARA – Gasoil 0.1% Barges FOB ARA (Platts) Futures Quotes

ULSD FOB ARA – European Diesel 10 ppm Barges FOB ARA (Platts) Futures Quotes

Source:Gasum

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: