Strategic and economic shifts by South Korean builders are designed to counter China’s orderbook dominance, writes Stuart Nicoll, director, Maritime Strategies International

Further upward revisions to MSI’s estimate of the global orderbook within its Q4 2025 update have led to an upward revision of newbuilding price forecasts to 2029. Overall, we now see a much shallower decline in prices at their low point, and a higher trough at close to $2,000/CGT.

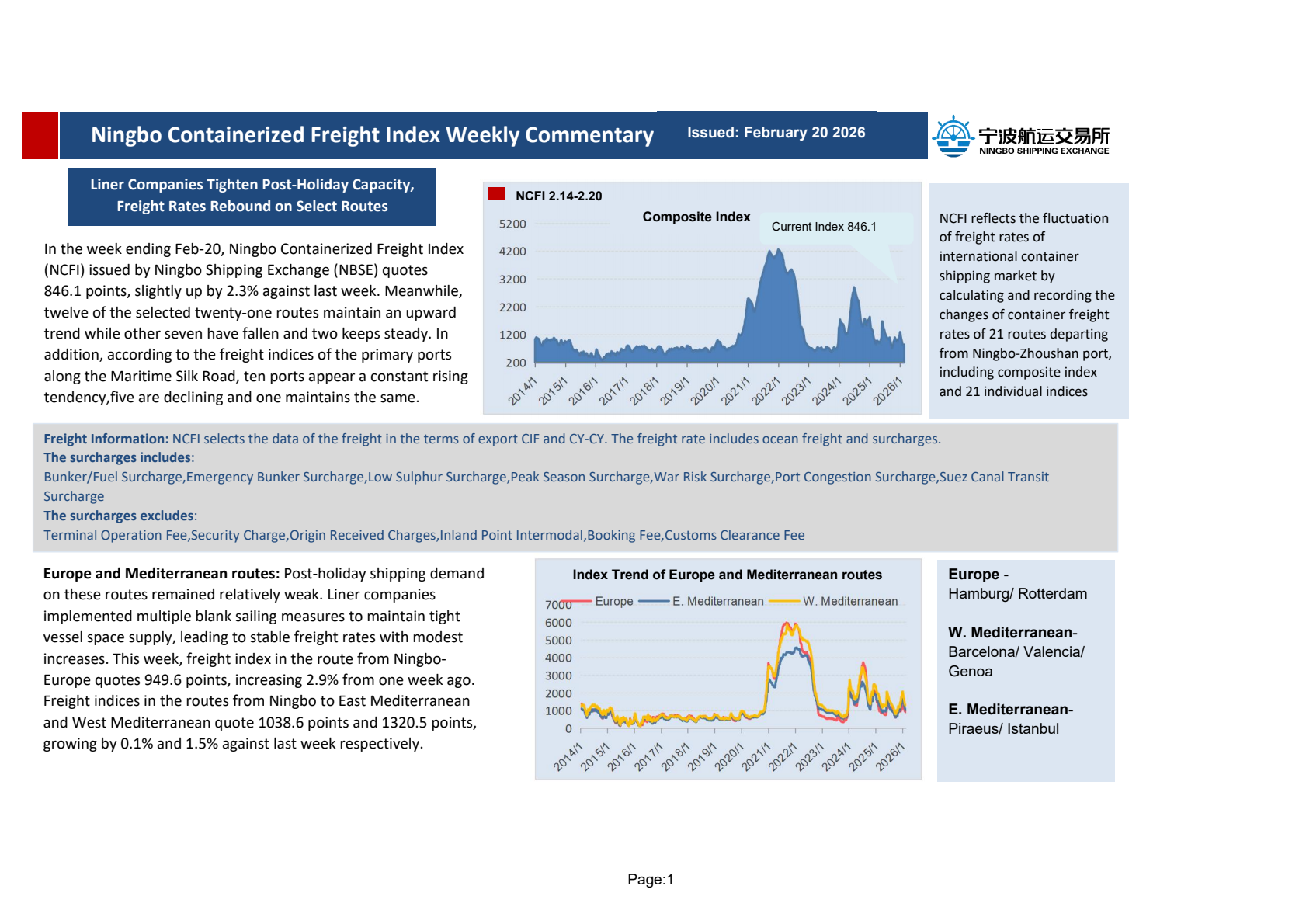

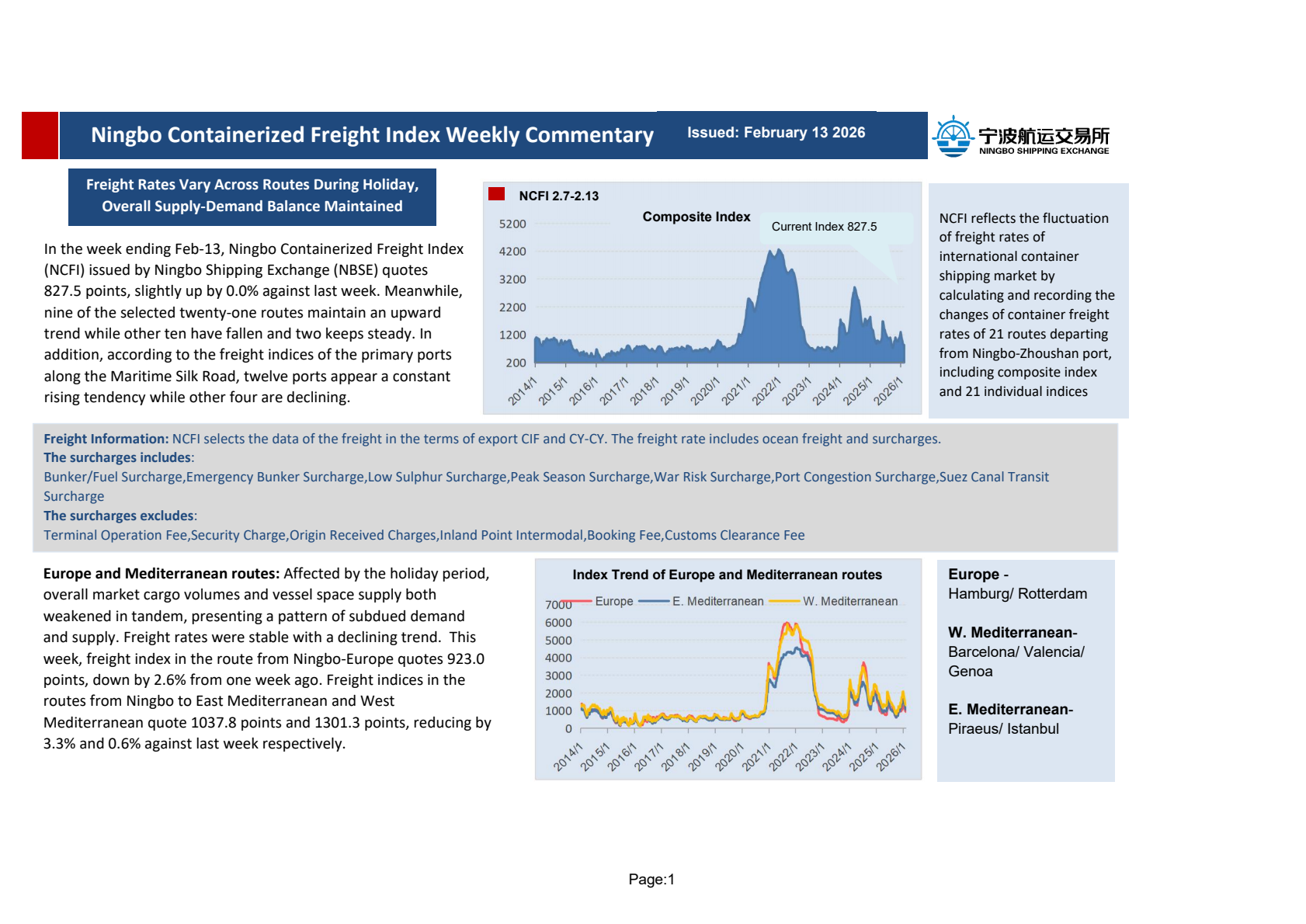

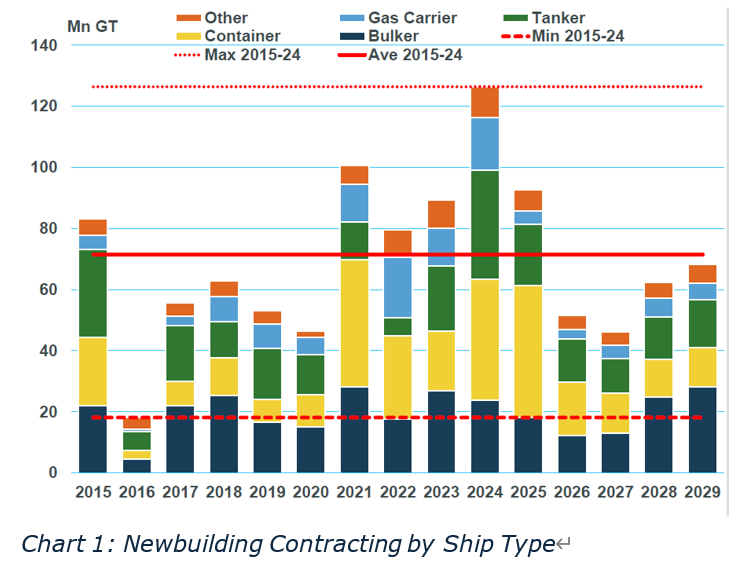

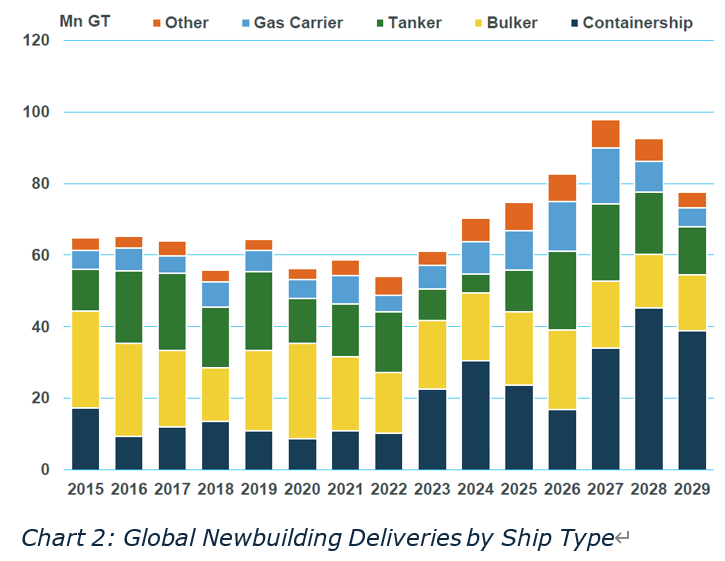

Charts 1 and 2 illustrate MSI’s Q4 2025 forecast for newbuilding market activity, showing the last decade and its forecast to 2029.

Charts 1 and 2 illustrate MSI’s Q4 2025 forecast for newbuilding market activity, showing the last decade and its forecast to 2029.

The last five years have seen a sustained level of newbuilding activity, which has propelled the orderbook to an estimated 293 Mn GT, at the end of 2025. This is the third highest level in history, but falls short the peak seen during the superboom of the 2000s.

Nevertheless, as Chart 2 highlights, the orders already booked promise a rapid increase in deliveries during the next five years, with shipyard capacity expanding rapidly.

New and reborn shipyards are adding new capacity, while expansions and dramatic productivity gains are boosting effective capacity at existing yards, principally in China. Deliveries will exceed 80 Mn GT for three consecutive years and could peak nearly 50% above typical levels of the last decade.

The expansions herald a new era in shipbuilding as geopolitical realities intersect with economic realities in Korea. Expectations of increased naval building by the US and persistently lower prices in China for high-quality tonnage have led to a dramatic rethink at leading yards.

Most notably, HD KSOE is planning to build a new mega yard in India, a plan that would have been unthinkable until recently. In general, the national policy is to shift production to cheaper yards at subsidiaries overseas and focus domestic yards on sophisticated commercial vessels and naval.

As a backdrop to these developments, we anticipate that newbuilding prices will remain higher for longer, though still on a downward trend. Another upward revision to our expectations for newbuilding contracting - to 190 Mn GT during 2025-27, from 177 Mn GT in our previous forecast, plus historical data revisions, raises our projection for the global orderbook by an average of 10% until 2027. This has in turn boosted expectations for newbuilding prices.

There is also increasing speculation that Korean shipyards will shift focus to US-backed naval construction, effectively reducing capacity targeted at the commercial marine sector. This has been factored in to a degree and acts to support newbuilding prices later in the decade.

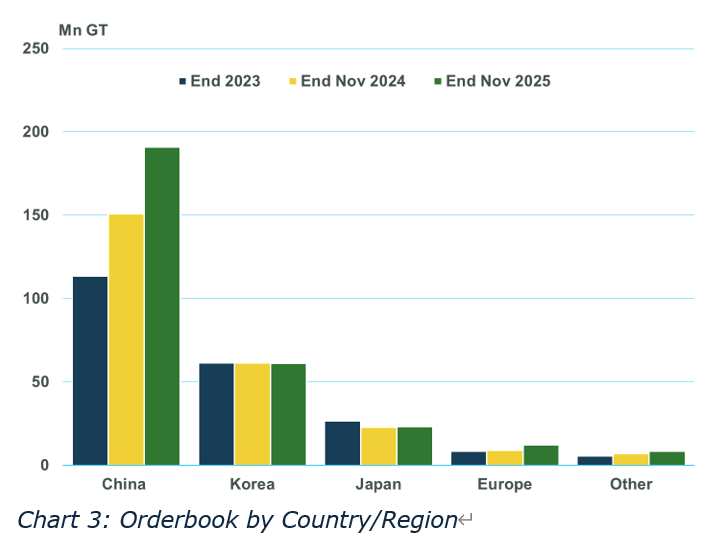

However, it will be developments in China that will determine the future of course of newbuilding prices. As Chart 3 shows, the orderbook in China has reached around 190 Mn GT, rising by more than two-thirds in two years. In contrast, all other regions are remarkably stable, particularly Korea, where the orderbook has flatlined at 60 Mn GT.

Expansion at many yards in China has been impressive, though none more spectacular than Hengli (formerly STX Dalian), which is projected to raise output to nearly 7 Mn GT (the largest in the country) by 2027, from zero in 2023.

Other yards have seen rapid growth in potential output, notably New Times, Hudong-Zhonghua and Qingdao Beihai. How these yards react to a downturn in demand remains to be seen, but it is notable that Chinese capacity declined by 35% during the first four years of the last decade. A similar aggregate decline is expected in the four years from 2028.

The overall assumption is a reduction in global shipbuilding capacity, as demand and newbuilding prices decline at the end of the decade, accompanied by a significant shift in the nature and location of yards targeting the commercial marine sector.

Please Contact Us at:

media@xindemarine.com