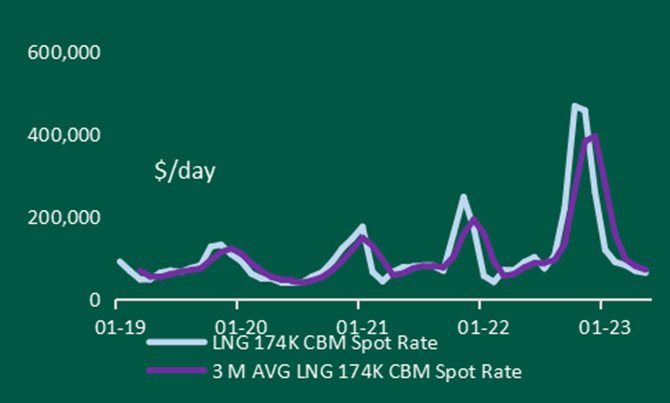

The LNG spot market is softening. But the new building market still is booming. New order of 170K CBM LNG ship has reached $277m comparing less than $200m two years ago. Rich shipyards are bringing innovative designs of LNG units, introducing three cargo tanks instead of the traditional four, an improved boil-off rate of more than 5%, and securing additional loading space of up to 8%.

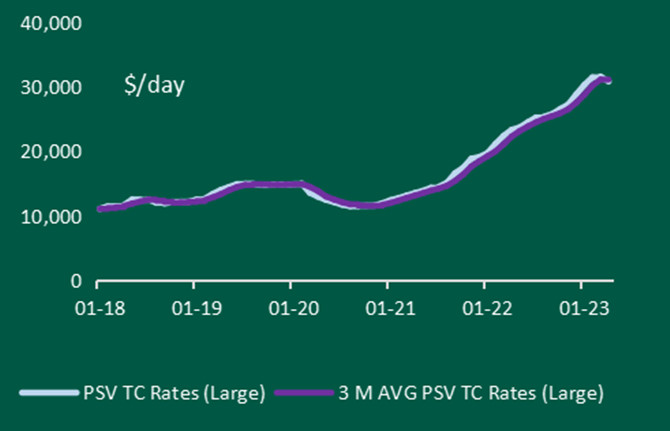

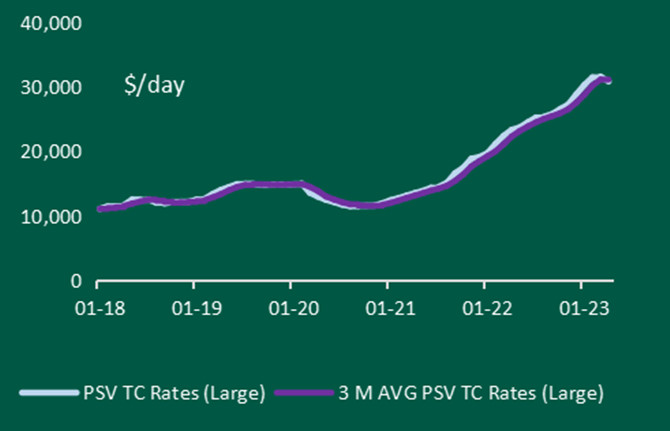

The offshore charter market has reached its five years high and is under downside correction. The offshore wind market is a new favorable investment area. UK offshore support vessel owner and operator North Star has returned to Fincantieri-controlled Norwegian shipbuilder Vard with an order for up to four offshore wind farm commissioning service operation vessels (CSOVs). Japanese companies have committed to invest more than $22bn in the UK, including funding for offshore wind, low-carbon hydrogen, and other clean energy projects.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar