Highlights

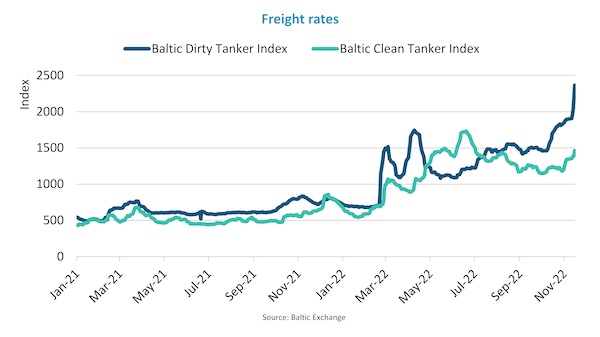

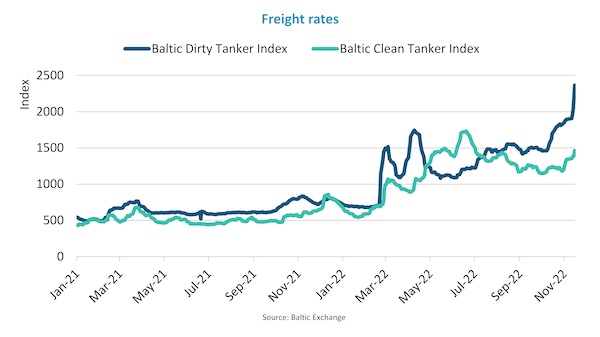

A rebound in the dirty tanker trade has led the Baltic Exchange Dirty Index (BDTI) to increase by 64% since our last report from mid-September. The clean tanker trade has seen the Baltic Exchange Clean Index (BCTI) increase by 21%.

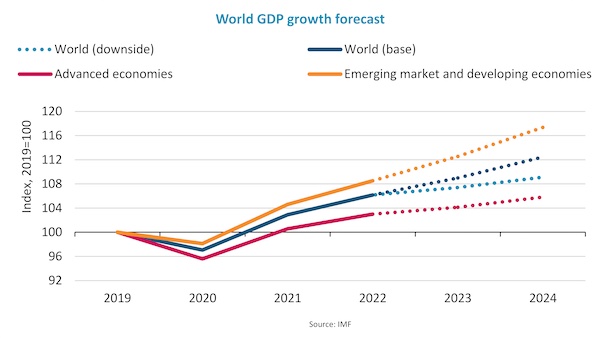

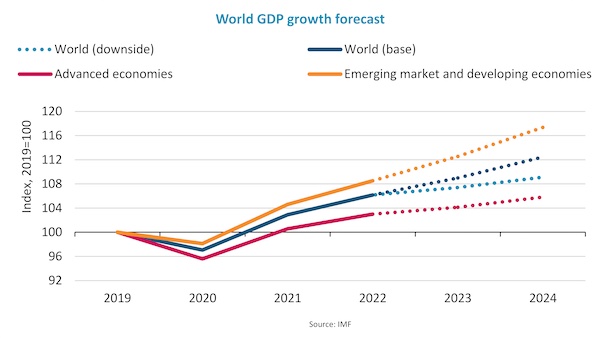

·The outlook for the global economy has once again worsened; the International Monetary Fund (IMF) now forecasts growth of 2.7% in 2023 and 3.2% in 2024.

·The IMF estimates a 25% probability that the global economy will slide into recession, while its alternative downside scenario estimates growth of only 1.2% in 2023 and 1.6% in 2024.

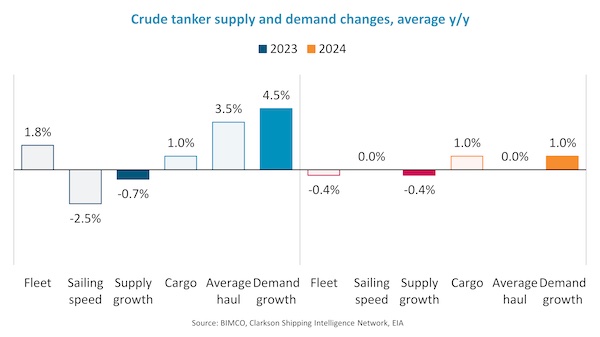

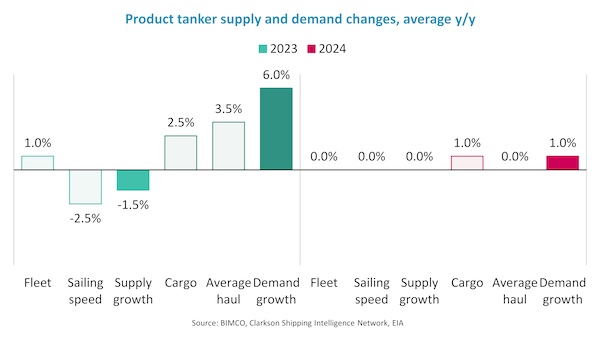

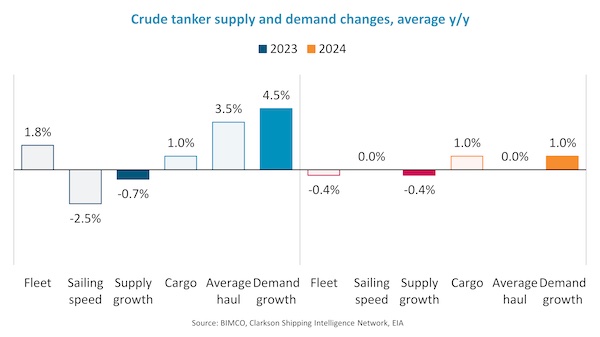

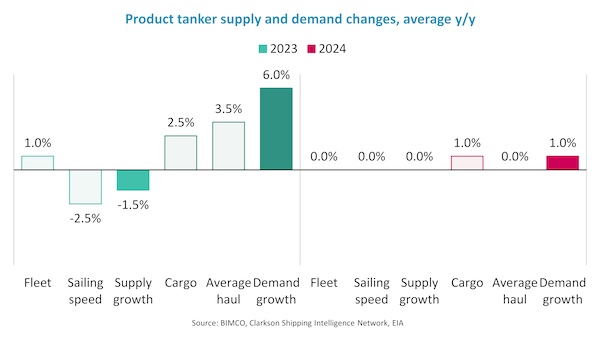

·Minor increases in oil production and consumption combined with increased refining capacity in oil producing countries lead us to forecast cargo demand growth in 2023 of 0.5-1.5% in the crude tanker market and 2-3% in the product tanker market. In 2024, we are projecting cargo demand growth of 0.5-1.5% in both markets. The EU’s forthcoming ban on Russian oil and oil products is expected to increase average haul in both markets by 3-4% in 2023 and add to overall demand growth.

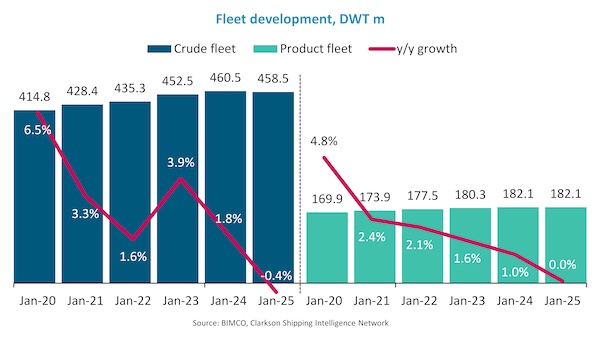

·Supply growth will be minor in both the crude and product tanker markets. Both fleets will grow by 1.0% in 2023, while the product tanker fleet will remain static in 2024 and the crude tanker fleet will fall by 0.4%. The implementation of EEXI and CII regulations may reduce average sailing speed in both markets by 2-3% and cause capacity supply to fall by 1-2% in 2023.

·Overall, we still expect solid improvements in trading conditions for both tanker markets in 2023, followed by minor improvements in 2024. Nevertheless, risks to cargo demand remain but are more likely to temper improvements than eliminate them.

Recent developments

Since our September report two and a half months ago months ago, the dirty and clean tanker trades have taken slightly different paths. The Baltic Exchange Dirty Tanker Index (BDTI) has increased by 64%, whereas the Baltic Exchange Clean Tanker Index (BCTI) has increased by 21%. In the dirty tanker trade, Aframax and Suezmax ships have continued to outperform VLCC ships. According to the Baltic Exchange, freight rates in time charter equivalent (TCE) terms have increased by 163% for Aframax ships and by 98% for Suezmax ships, whereas VLCC TCE has increased by 152% and trails Suezmax and Aframax TCE by USD 38,000/day and USD 33,000/day, respectively.

Time charter rates have followed freight rates and the average daily rate for one-year fixtures has increased by 21% and 12% for respectively crude and product tankers. Second-hand prices have not yet matched this increase. However, the recovery in prices since the beginning of the year remains impressive, and average 5-year-old crude and product tankers are now trading at respective ratios of 0.80 and 0.87 vs. newbuilding prices, which have increased by 5%. At the beginning of the year, the ratios stood at 0.66 for crude tankers and 0.70 for product tankers.

In comparison to September, deadweight tonne days in November have so far increased by 0.7% in the dirty tanker trade whereas deadweight tonne miles have increased 0.3%. The number of vessels awaiting cargo operations has increased steadily, adding to deadweight tonne days. During the same period, the market has seen some significant shifts in deadweight tonne miles to and from the top three origins and destinations. Exports from the Persian Gulf and West Africa are down 4% and 5% respectively compared to September, whereas Gulf of Mexico exports have increased by 4%. On the destination side, deadweight tonne miles into China and India/Pakistan are up by 12% and 24% respectively. The increase in shipments to China has been particularly welcome as low Chinese demand has otherwise been a drag on the market. New and significantly higher export quotas for Chinese refineries have been the key driver.

Compared to September, deadweight tonne miles demand in the clean tanker trade are 1% higher in November so far. As in the dirty tanker trade, there have been some significant shifts in deadweight tonne miles loading or discharging in the top three export and import areas. On the export front, deadweight tonne miles for cargo loading in the Persian Gulf are 14% down compared to September, while cargo loading in the Japan/South Korea region is contributing 20% less. Cargo out of the Gulf of Mexico has contributed 8% more. More importantly, the increased export quotas for Chinese refineries have already led to a spectacular resurgence of Chinese exports that are currently almost double what they were two and a half months ago. China is therefore now challenging the South Korea/Japan region as the third-largest loading area. On the destination side, the top three destinations combined have contributed 5% more deadweight tonne miles than in September.

Demand drivers

The IMF’s estimate for growth in the global economy in 2022 remained unchanged at 3.2% in October’s World Economic Outlook report. However, the challenges for the global economy continue to mount and the effects of the Russian invasion of Ukraine, a cost –of-living crisis caused by inflation, and a slowdown in China remain key concerns.

The IMF’s forecast for global GDP growth in 2023 has therefore been lowered from 2.9% to 2.7%. In 2024, growth is estimated to increase to 3.2%. Significant risks to growth are a cause for concern and the IMF believes that there is a 25% probability that growth in 2023 will fall to below 2%, based on which it has also developed a downside scenario.

The downside scenario considers the possible adverse impacts of higher oil prices, further decreases in real estate investment in China, lower employment combined with lower productivity, and tighter global financial conditions. Should all four risks materialise, global economic growth is estimated to be 1.5 pp and 1.6 pp slower than in the base case in 2023 and 2024, respectively. China would see the greatest slowdown, with a decline in real estate investment being of greatest concern, while tightening financial conditions cause the most concern in emerging markets and advanced economies. Should this downside scenario materialise, the global economy would see the lowest growth over a two-year period since the early 1980s (if excluding the two-year periods surrounding the financial crisis of 2009 and that surrounding the 2020 COVID downturn).

Despite the bleaker economic outlook and the latest OPEC+ agreement to cut production further, the US Energy Information Administration (EIA) is still estimating a further recovery in oil production and consumption, albeit slightly less than previously estimated. The EIA now estimates that production has increased by 4.2 mbpd in 2022, while another 0.8 mbpd will be added in 2023 to take average annual production to 100.7 mbpd. This would take production back above the 2019 level, but only by 0.4%. Consumption in 2023 is equally estimated to exceed 2019 levels only minimally, ending at an average of 101.0 mbpd.

In 2023, OPEC is estimated to produce 0.2 mbpd less than in 2019. Outside of OPEC, production in the North America, Central and South America, and Europe regions is expected to exceed 2019 levels by 1.9 mbpd, 0.8 mbpd, and 0.4 mbpd, respectively. The Eurasia region is expected to account for the biggest fall in production in 2023, with 2.3 mbpd being 16% less than in 2019. Russia will account for almost all of this, caused by a drop of 1.6 mbpd in 2023, on top of the 0.6 mbpd fall in production in 2022.

Only the Asia and Oceania, Middle East, and Africa regions are forecast to consume more in 2023 than in 2019. Consumption in Asia and Oceania is forecast to increase by 2.0 mbpd (5.5%), 1.9 mbpd of which is related to Chinese consumption. Europe will account for the largest reduction in consumption. Compared to 2019, the EIA expects Europe to consume 0.9 mbpd (5.8%) less than in 2019, and it appears likely that Europe has already hit peak oil consumption and will never again use as much as it did in 2019.

The imminent EU ban on Russian oil and oil products still looks to be the main factor behind the change in crude and product tanker trades. As of early December 2022, Russia will no longer be able to export crude oil to the EU, while oil product exports must stop by early February 2023. During 2022, Russia’s share of EU’s imports has dropped from 34% to 20% in the dirty tanker trade, and from 21% to 17% in the clean tanker trade. There has been a similar shift in the EU’s importance for Russian exports; the EU now accounts for 50% and 37% of the country’s clean and dirty tanker exports, respectively. In our forecast, we assume that the new trading patterns will also impact 2024.

We still expect that this shift in the EU’s trading pattern will add 3-4% to average haul lengths for both crude and product tankers. The EIA’s forecast reduction in Russia oil production indicates that the country will not be able to find alternative buyers for all of the oil and oil products that so far have been exported to the EU. However, the average haul lengths for Russian exports will still increase but may be countered by shorter hauls in trades replacing the lost Russian cargo. Therefore, we estimate global average hauls to increase by 3-4%.

In addition, increasing refining capacity in oil-producing nations is expected to convert some crude oil exports to refined oil products exports. We estimate that this could lower growth in crude tanker cargo demand by approximately 0.5 pp, while increasing product cargo demand growth by approximately 1.0 pp.

Unfortunately, several risks to overall consumption exist. As highlighted by the IMF’s downside scenario, global economic growth could slow significantly, and China is a key area of concern. According to EIA estimates, China accounts for 16% of global oil consumption, and a further downturn in the country’s real estate sector is a concern. In the IMF’s base case forecast, growth from 2022 to 2024 will be the fourth-slowest two-year period since records began in 1980. Only 2018 to 2020, 1988 to 1990, and 2021 to 2023 have been worse, and any further slowdown is likely to hit both businesses and consumers and hurt oil demand.

Economic growth below the IMF’s base case scenario will also hurt demand, and an increase in oil prices is a similar concern. Much of the world is experiencing a cost-of-living crisis, and oil prices much higher than the forecasted Brent prices of USD 89/barrel (2023) and USD 83/barrel (2024) could be a concern.

Supply

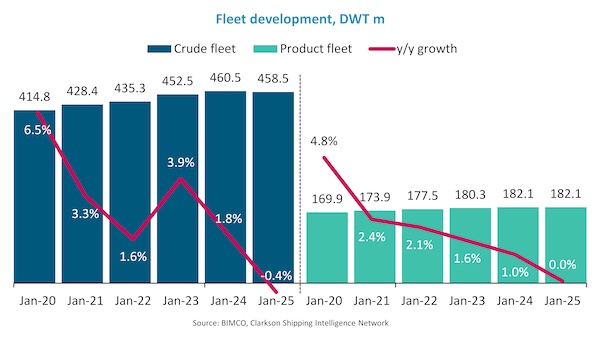

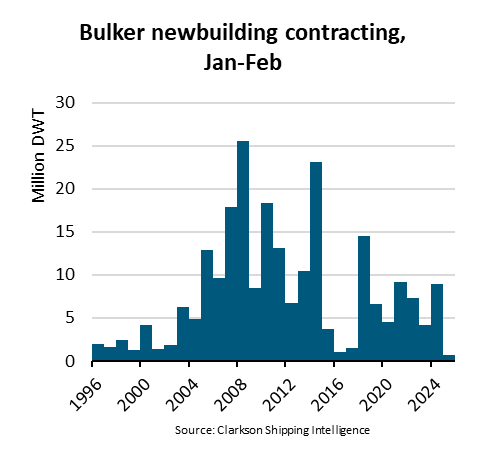

Contracting has remained very low during 2022. Relative to the size of the fleet, the orderbooks for crude and product tankers are now 3.9% and 4.9%, respectively. These are the lowest on our records, which go back to 1996. Most ships contracted in 2022 are scheduled for delivery in 2024 or 2025 and we have therefore assumed that future contracts will be delivered in 2025 at the earliest.

Factoring in our demolition forecast, we forecast that the crude tanker fleet will grow by 3.9% in 2022 and by 1.8% in 2023, before falling by 0.4% in 2024 as the current orderbook dries out and deliveries reduce even further. The product tanker fleet is estimated to grow by 1.6% in 2022 and by 1.0% in 2023. We expect no growth in 2024 as our demolition forecast matches the planned deliveries.

Our estimates reveal that the crude tanker fleet will grow by 23.2 million deadweight tonnes between January 2022 and January 2025, whereas the product tanker fleet will grow by 4.6 million deadweight tonnes. Crude tanker growth is mainly related to an increase in the Panamax, Suezmax, and VLCC fleets, whereas growth in the LR2 fleet accounts for most of the growth in the product tanker fleet.

As we forecast improved trading conditions in both tanker segments, we estimate demolition in 2023 and 2024 to be in line with activity in 2023, but it could still increase if some owners find it uneconomical to retrofit older ships to comply with the EEXI regulation and others are deemed uncompetitive due to CII ratings.

In the past, we would assume that sailing speed should increase in an improving market. However, with EEXI and CII implementation as well as ETS in the EU, it is more likely that sailing speeds will decrease, and that capacity supply will grow slower than the fleet. We consider it likely that sailing speed will decrease by 2-3%.

Conclusion

Our base case forecast predicts a solid tightening of both the crude and product tanker market in 2023 and a further marginal tightening in 2024.

In 2023, the key drivers are the change in trade patterns caused by the EU’s ban on Russian oil and oil products, and the slowing down of ships due to EEXI and CII regulations.

Despite cargo demand only adding limited growth, overall demand growth is expected to far exceed supply growth. We expect demand in the crude tanker market to grow by 4-5%, while supply is estimated to fall by 0-1%. Demand growth in 2024 is estimated to be only 0.5-1.5% as the one-time effects of 2023 are not repeated. Supply is expected to fall by 0.4%. Compared to the crude tanker market, the product tanker market additionally benefits from the shift from crude oil exports to refined oil product exports, and we therefore expect a 5.5-6.5% growth in demand in 2023, compared to supply falling by 1-2%. As in the crude market, demand growth will slow significantly in 2024; we estimate 0.5-1.5% growth, whereas supply is not expected to grow.

Several risks to cargo demand growth exist as global economic prospects are increasingly bleak, and key demand areas may even enter recession during 2023. While the supply/demand balance may therefore not improve by as much as forecast in our base case; the expected strength of the two tanker markets is mostly dependent on unrelated onetime events during 2023, and it is highly likely that the supply/demand balance will tighten in any case. However, an extended downturn in demand could lead to a weakening of the market in 2024, when no onetime effects will support the market.

In conclusion, based on the IMF’s base case economic forecast and the EIA’s oil production and consumption forecast, we predict solid increases in freight and time charter rates, as well as higher prices for second-hand ships. Any possible slowdown in cargo demand may reduce the magnitude of increases but is very unlikely to lead to a weakening of the market. Supply of ships could naturally increase compared to our base case, but this would require a complete stop to demolitions at the very least; however, this would only significantly dent our market expectations if combined with a significantly lower growth in demand.

Source: BIMCO

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar