Singapore

VLSFO availability is super tight in Singapore amid limited cargo inflows. This comes at a time when HSFO has become more readily available with support from higher cargo imports, stretching Singapore's Hi5 spread to nearly $300/mt.

HSFO supply was squeezed from April and into May, following a major organic chloride contamination issue, vigilance about bunkering HSFO and more elaborate quality testing. These concerns have abated somewhat since.

Cargo tracker Vortexa projects that Singapore's fuel oil imports, which include HSFO and low sulphur fuel oil (LSFO), will reach 659,000 b/d for the whole of May, which is slightly higher than April's 647,000 b/d.

Imports of LSFO/HSFO in April were in 64/36 ratio, the ratio has now flipped to 29/71 in May with 222,000 b/d less LSFO inflows.

Recommended lead times for HSFO have come down from a peak of three weeks to around 10 days now. VLSFO lead times have kept more or less unchanged in recent weeks at around two weeks, while LSMGO is more readily available at seven days.

Singapore's fuel oil inventories gained by 8% last week, while middle distillate stocks were roughly steady from the preceding week, according to Enterprise Singapore.

East Asia

Bunker demand has been robust in Hong Kong since April and added pressure on bunker fuel availability, sources say. Recommended lead times for VLSFO and LSMGO are around 10 days. Availability is expected to improve from early June onwards as replenishment stocks are due to arrive.

Supply is not keeping up with demand in Hong Kong, a trader says.

Availability remains tight in South Korean ports after two refiners stopped offering fuel to the bunker market earlier this month. Recommended lead times are around 8-10 days for all grades.

Last week's fire at S-Oil's Onsan refinery had a limited impact on the South Korean bunker market, a source says.

Bunker fuel availability remains tight in China's Zhoushan and Shanghai ports. Most suppliers are unable to offer HSFO and VLSFO for delivery dates in May due to a lack of product, sources say. A supplier can offer VLSFO in Zhoushan from 4 June onwards.

Bunker fuel availability in Indonesian ports is normal. A supplier can offer VLSFO and MGO for prompt deliveries in the ports of Jakarta and Surabaya.

In Philippines' Manila, LSMGO availability is normal and recommended lead times are around three days, a source says. Bunker demand has been sluggish.

South Asia

Bunker fuel availability in the Indian ports of Mumbai and Kochi is normal. Some suppliers can offer prompt deliveries of VLSFO and LSMGO, a source says.

Availability in Indian east coast ports such as Visakhapatnam and Kakinada is normal. Bunker demand has improved slightly this week, sources say.

In Sri Lanka's Colombo, VLSFO and LSMGO availability is normal, while HSFO remains tight due to a lack of product to supply, sources say. Recommended lead times for VLSFO and LSMGO are around five days, while some suppliers can offer prompt deliveries at price premiums, a trader says.

Middle East

In Fujairah, availability of HSFO is tight for prompt deliveries and recommended lead times are around 10 days. VLSFO and LSMGO grades have shorter lead times of seven days.

Some suppliers are not accepting offers in Fujairah for the rest of May as they are fully booked, while a few suppliers can offer limited quantities priced at premiums, a trader says.

In Iraqi Basra, availability remains normal for VLSFO and LSMGO, sources say. A supplier can offer limited prompt deliveries.

VLSFO availability in Saudi Arabia's Jeddah port is normal, while LSMGO is slightly tighter, sources say.

Source: ENGINE

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

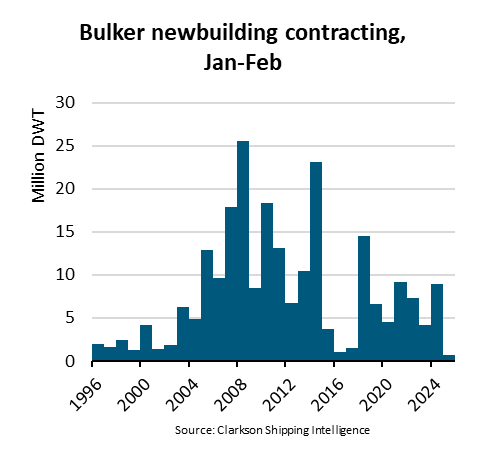

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar