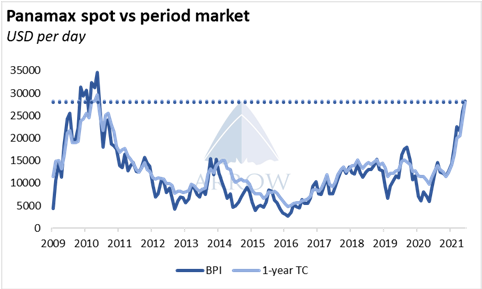

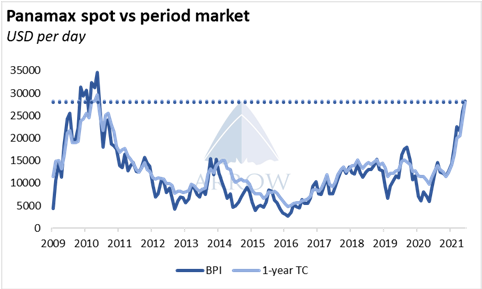

The BPI comfortably sits above $30,000/day, the highest seasonal level since 2010. When rates began taking off in January, we argued that while temporary disruptions contributed to the rally, it was mainly driven by improving fundamentals. Fast forward 5 months, we reiterate our view.

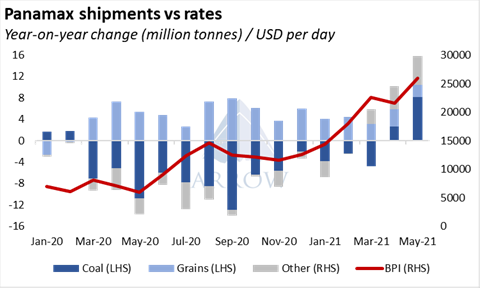

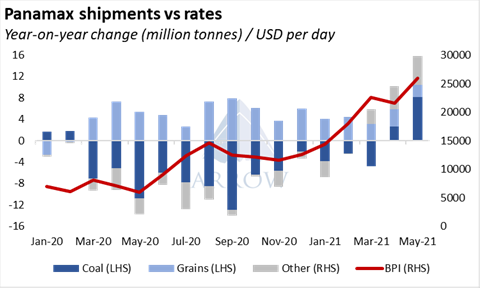

Following the Covid-induced demand shock last year, Panamax shipments¹ plunged by 4.2% in Q2 and a further 6% in Q3 compared to the year before. However, year-to-date² volumes have posted a 6% growth on the year. The growth is particularly skewed to Q2 with April-May shipments surging by 15%. While base effects artificially inflate the figures, 2021 Panamax trades were at par with pre-pandemic³ levels in Q1 and have exceeded them by 10% so far in Q2.

Grain trades lie behind the recovery at large. Following a year of unparalleled imports, China's insatiable appetite is still driving unseasonably high USG exports and record-high volumes from the latest Brazilian crop.

Although Panamax coal trades have grown by 8.1 million tonnes year-on-year (or 9.6%) over April-May, the growth can be mostly attributed to the very low base set in 2Q20 when global lockdowns deepened. That said, May shipments to core markets surpassed 2019 levels; up 10% to China, 4% to South Korea & Japan and 38% SE Asia.

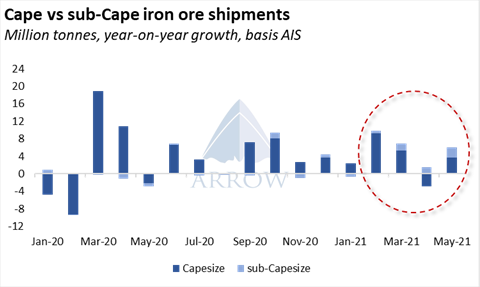

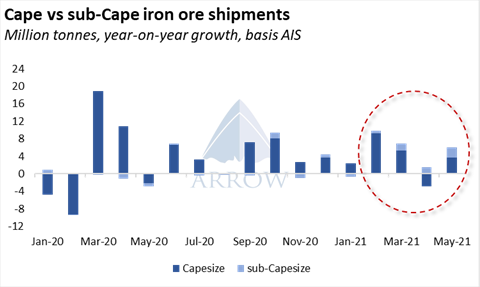

Grains & coal account for roughly 75% of Panamax trades. However, another recent pocket of strength for this segment has been the expanding iron ore trade. Although iron ore made up just 6% of Panamax shipments so far this year, Panamax stems accounted for over 13% of the growth in iron ore seaborne exports.

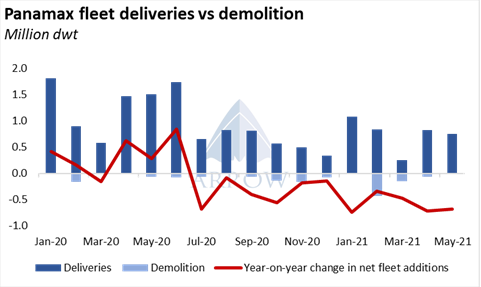

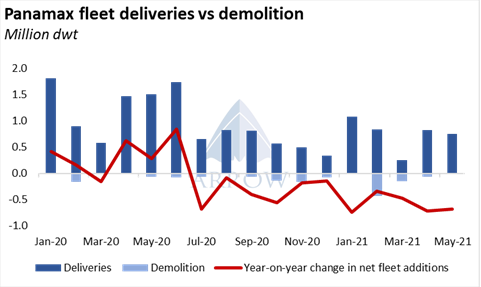

Meanwhile, fleet growth has slowed to just 1.4% year-to-date. By comparison, the Panamax fleet expanded by 5% in 2020 with the quarterly growth peaking at 2% in Q2. So far this year, deliveries have nearly halved to 3.7m-dwt down from 6.6m-dwt over the same period the previous year.

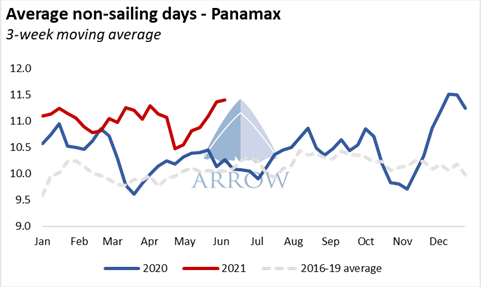

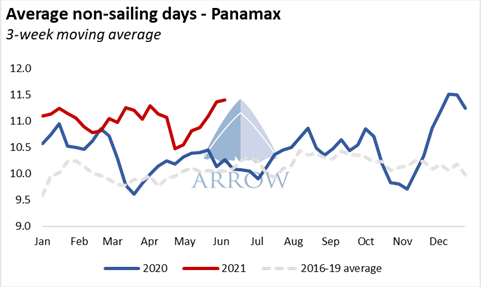

Fleet inefficiencies have also fuelled the Panamax rally. Quarantine requirements and crew change challenges have pushed the number of non-sailing days per trip well above the recent years' average. Congestion also plays a part, whether caused by Covid restrictions at ports, weather delays or increased vessel arrivals. Currently, congestion stands at 16% of the fleet bolstered by a 40% monthly rise in the number of Panamaxes waiting to discharge in China.

All things considered, we do not anticipate any immediate change in market direction. In the Atlantic, the North remains firm and strong grain shipments out of ECSA are drawing more tonnage from the Pacific. Meanwhile, China's coal market is in deficit (as discussed in our Arrow to the point dated 15 June 2021) and Panamaxes are primed to benefit from any incremental increase in imports. Coupled with manageable fleet growth and persisting fleet inefficiencies, Q3 is about to kick off with a very well-supported Panamax market.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar