Last Sunday, a fire at the Songzao coal mine in China halted operations. The latest accident adds to mounting worries about coal supply shortages as we head into the winter heating season.

Domestic production in China was flat year on year between January and August. Safety inspections in Shaanxi during the second half of September, the largest coal producing province in the country, and the scheduled maintenance at Daqin rail line linking Shanxi with Qinhuangdao in October is expected to curb domestic coal supply further.

Meanwhile, imports dropped sharply in recent months as a growing number of ports exhausted their annual import quotas. Despite a surge in the first four months of the year, seaborne arrivals* in 2020 totalled 207.7 million tonnes as of 4 October. This marks a 5.8% decrease from the 219.8mt shipped during the same period in 2019.

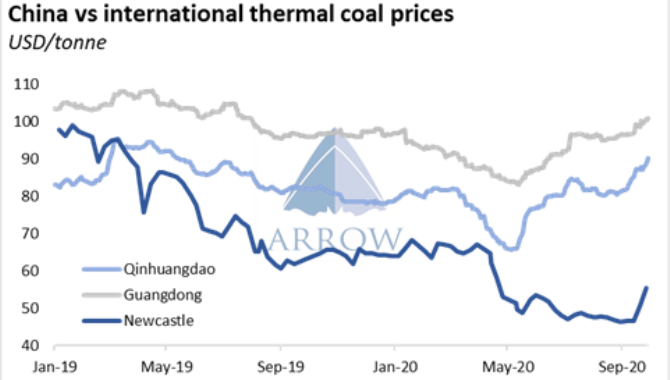

With strong demand and short supply, domestic prices in China rose steadily and are currently trading at a 65% premium to international coal. Thermal coal prices in Qinhuangdao are up by 37% or by over $20 per tonne since mid-May. By comparison, prices in Australia (Newcastle) and Russia (Vostochny) are up by $6.5 (13%) and $6 per tonne (12%) respectively. As for coking coal, the arbitrage window for imports from all major overseas producers, including Australia and Indonesia, has been wide open since May and hit a multi-year high in September.

Growing supply tightness coupled with high domestic prices have prompted talks among trading circles that China might ease import restrictions in Q4. Low port inventories, particularly at northern ports, further fuel the rumours. Average inventories held at the ports of Qinhuangdao, Caofeidian and Jingtang as of 30 September are 26.7% lower year-on-year and 17% below their three-year average for this time of year.

So far, the rumours remain unsubstantiated. Weekly coal arrivals have been sliding steadily since the beginning of Q3. Last week, only 3.1mt of coal arrived at Chinese ports, the weakest volume since December 2018. However, further gains in domestic prices could force the authorities to ease import restrictions in the coming weeks.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

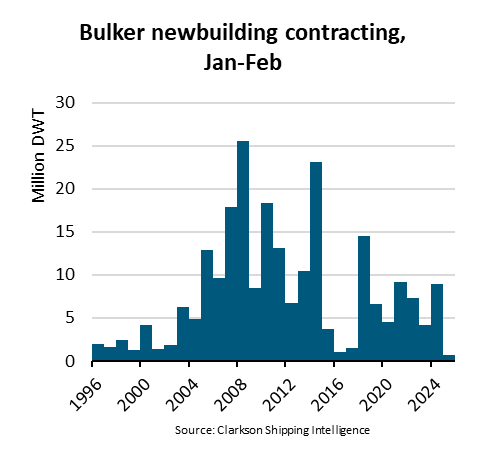

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar