There is a crude oil market narrative that demand is recovering from the shock of the coronavirus pandemic, and therefore producers that previously cut output can now put more supply back into the market.

While there is evidence to support the view that demand is higher than at the height of pandemic-induced lockdowns in the second quarter, there are questions as to whether it is strong enough to absorb the likely increase in supply.

Much of the optimism remains centred around a recovery in Asia, particularly in China, the world’s largest crude importer, which has been setting records for imports in recent months.

Certainly, August looks set to be another strong month for China, with Refinitiv Oil Research forecasting imports of 12.11 million barrels per day (bpd).

This would be slightly higher than the official customs figures of 12.08 million bpd for July, but short of the record high 12.94 million bpd in June.

If the official August imports are in line with Refinitiv’s estimates, it will mean that the four highest monthly imports have been the May to August period, underlining just how much the crude oil market has depended on China to keep some semblance of demand going during the novel coronavirus pandemic.

It’s also no secret that much of the Chinese surge in imports in recent months was due to a splurge of opportunistic buying during the brief price war between top exporters Saudi Arabia and Russia in March and April.

With oil prices falling to 22-year lows, Chinese refiners took advantage of their financial muscle to vacuum up available barrels across the globe.

That oil has been arriving from late May onwards, and there has been so much that tankers have been forced to wait for up to four weeks at a time to unload at Chinese ports.

More than 90 million barrels of crude was still waiting on tankers outside Chinese ports as at the end of August, Refinitiv said, with another 17.5 million barrels destined for China waiting off the regional oil-trading hub of Singapore.

Working on the assumption that these cargoes will be discharged in September, it’s likely that this alone will keep China’s September imports at a high level, even if the volume of new crude is declining.

Refinitiv said August-loading barrels destined for China were 7.93 million bpd, down from 8.2 million bpd in July and well down from the second quarter average of 11.87 million bpd.

What the data seems to be showing is that the crude oil that has been flooding to China in recent months will probably ease back to more normal levels from October onwards.

While this still means imports of likely above 10 million bpd, it does mean the crude market is going to lose as much as 2 million bpd of demand that it had been getting used to.

REST OF ASIA WEAKNESS

Can rebounding demand in the rest of Asia make up for the loss of 1 to 2 million bpd from China?

The data currently suggests not, even though there are some signs of recovery.

India, Asia’s second-biggest importer, brought in 3.6 million bpd in August, according to Refinitiv, up from 3.44 million bpd in both July and June.

While this is a recovery, it’s worth noting that pre-coronavirus demand in India was in the region of 4.1 to 4.7 million bpd, meaning demand is still crimped.

Given India is still battling the pandemic, it may take longer for demand to fully recover in the South Asian nation.

Japan is usually Asia’s third-biggest crude importer, but such is the weakness in demand there that it is at risk of swapping places with fourth-ranked South Korea.

Japan’s August imports were around 2.35 million bpd, up from 2.09 million bpd in July, but still well below usual levels around 3 million bpd, according to Refinitiv.

South Korea’s August imports were around 2.29 million bpd, down from July’s 2.74 million, and also below the pre-coronavirus levels of around 2.9 million bpd.

Both Japan and South Korea are still battling to contain the coronavirus, putting a question mark over how rapidly their crude demand will recover.

With members of the OPEC+ grouping boosting output in August after they eased their collective production cut by 2 million bpd to 7.7 million bpd, the bet they are placing is that demand is recovering faster than they are putting crude back in the market.

Whether they are correct or not will likely depend on how much of a pullback in Chinese demand does occur from October onwards.

Source:Reuters

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

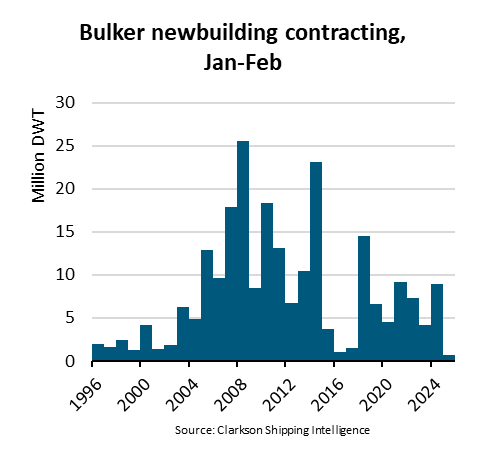

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar