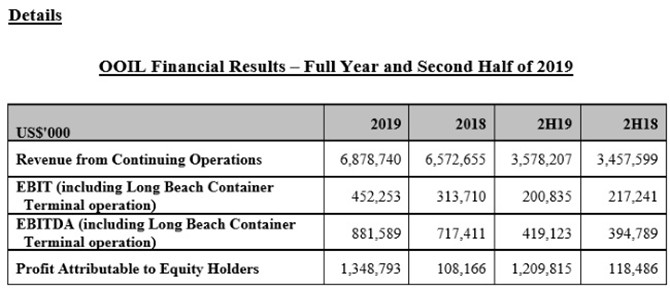

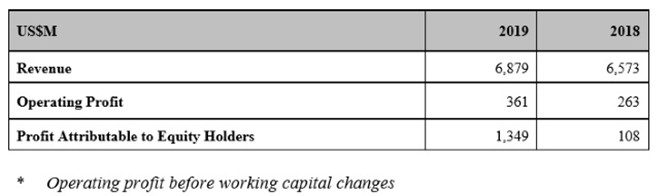

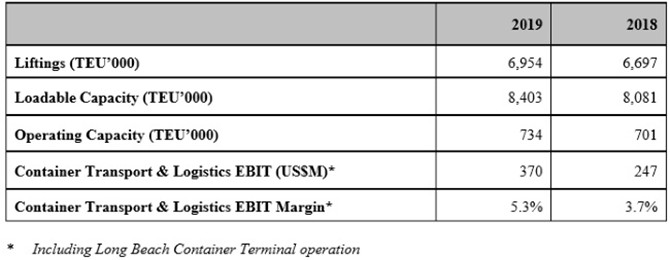

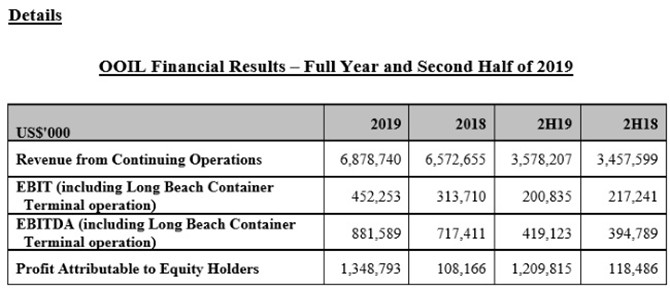

• OOIL’s Container Transport and Logistics business (including Long Beach Container Terminal operation) reported EBIT of US$370 million, representing an EBIT margin of approximately 5.3%.

• Liner liftings grew to 7.0 million TEU.

• Placed order for five 23,000 TEU new vessels in 2020.

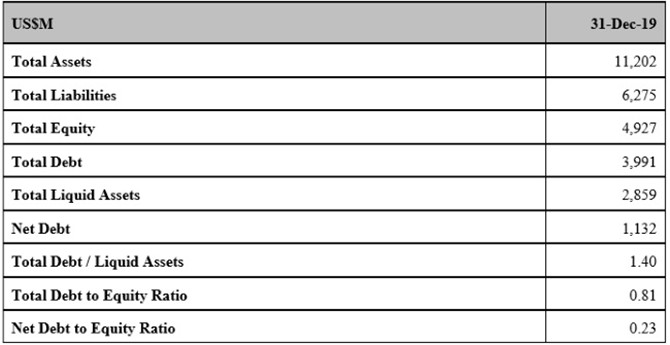

• Liquid assets of US$2.9 billion as at 31st December 2019 (excluding cash and bank balances set aside for special dividend payment)

Earnings per ordinary share in 2019 was US215.5 cents, whereas earnings per ordinary share in 2018 was US17.3 cents.

The Board of Directors has recommended the payment of a final dividend of US2.69 cents per ordinary share and a special dividend of US24.0 cents per ordinary share for 2019.

It is particularly pleasing to note that this solid performance was achieved in a context of an uncertain global economic and trade environment. Economic growth in most major economies continued to be relatively low, and seemingly escalating trade frictions gave rise to uncertainty throughout the year. It is a tribute to the professionalism and the “We take it personally” spirit of our staff that we managed to navigate these challenging times so smoothly. We believe that it is also further proof of the success of the entry of OOIL into the wider China COSCO SHIPPING Group, combining the strengths of both sides in one momentous step forward.

We continued to enjoy significant synergy benefits in 2019. Indeed, our original synergy targets established during the acquisition process have already been exceeded, and our teams continue to work hard to identify and exploit further areas where synergy benefits may be obtained. These highly tangible benefits, achieved through effective network planning, equipment management, joint procurement and co-operation in IT, will be a key success factor for our group in 2020 and beyond.

For many years, the OOIL balance sheet has been one of the most robust in the container shipping industry. This strength has been boosted in 2019 by year-on-year improvements in operating cash inflow, which increased from US$589.7 million in 2018 to US$753.4 million in 2019, and in our EBIT, which increased from US$313.7 million in 2018 to US$452.3 million in 2019.

In 2019, global economy had only 2.9% growth which was the lowest level since 2008-09. The uncertainties of the on-going US-China trade discussions and Brexit further hampered economic growth.

In container shipping industry, global demand growth in 2019 was only 2.6%, half of the growth in 2018. The global supply growth was 4%. However, effective supply growth was contained during the year because of few new vessels entering the market and the increase in the number of idled vessels, some of which were idled for the purpose of retrofitting scrubbers. Therefore, the market equilibrium of supply and demand was stable, which was favourable to freight rate stabilization.

In the cautiously optimistic environment of 2019, benefiting from the synergy arising from the “dual-brand” strategy of COSCO SHIPPING Holdings, we expanded our presence into new trade lanes, not only to benefit from the dynamic growth seen in many emerging markets, but also in order to further build up our global coverage.

OOCL has been growing its business in a measured and intelligent way for a number of years. This pattern continued in 2019, with total liftings growing by 3.8% and total revenue growing by 5.2%. We will continue this steady growth, and it is in this context that we have decided to implement the ship renewal plan that was made five years ago, by ordering five new building vessels. These are the first vessels to be ordered by the OOIL Group since 2015. Not only will these modern, efficient vessels improve our cost structure, fill the capacity gap caused by the future expiry of chartered-in capacity, and further improve the Group’s environmental protection and green operation level, but they will also serve as clear evidence of the entire group’s continuing commitment to our very successful dual brand strategy.

For many years now, we have commented on the benefits of alliance membership. Our situation within the Ocean Alliance continues to provide us significant advantage, and ensures that we are able to offer a broad, high-quality service network to our customers. We have been members of the Ocean Alliance for three years, and look forward to attaining further benefit from our continued membership into a fourth year.

We concluded the sale of our terminal in Long Beach, California. Recognising the high quality of the terminal, a good sales price was achieved, resulting in a profit of US$1,153.6 million. The new buyer has thereby acquired a very attractive asset, and as part of the overall arrangements, OOCL will continue to have access to the terminal to service the requirements of our Trans-Pacific trade.

Our logistics business, OOCL Logistics, in line with the wider environment in which it operates, grew more slowly than in some recent years. However, it laid good foundations for 2020, with new customer contracts and an ongoing strong commercial effort. We will continue to grow this business at a steady pace, bringing diversification to our overall activities, and thereby involving the Group in all parts of the end-to-end supply chain, which is becoming of greater and greater strategic importance.

The Group has long enjoyed a reputation for being at the forefront of digital technology advances in the sector. We continue to build on this strength, promoting digital development in the information era. In July 2019, CargoSmart, a subsidiary of OOIL, announced the execution of the Global Shipping Business Network (“GSBN”) service agreements with the following leading industry participants, CMA CGM, COSCO SHIPPING Lines, COSCO SHIPPING Ports, Hapag-Lloyd, Hutchison Ports, OOCL, Port of Qingdao, PSA International and Shanghai International Port Group. GSBN aims to promote the establishment and information sharing of digital standards, and thereby to improve the operational efficiency of the industry, and the quality of its customer service.

Looking forward into 2020 more broadly, we see the market is becoming increasingly complex, with two conflicting signals.

On the one hand, the signing of the first-phase trade agreement between China and the United States has removed some of the uncertainty in the escalation of trade frictions, and the narrowing of the gap between demand and supply in container shipping market has led to reasonably positive expectations for the industry at the start of 2020.

On the other hand, the sudden outbreak of COVID-19 creates a tremendous amount of uncertainty. Since February, we have witnessed the rapid control of the epidemic in China with the joint efforts of the Chinese government and the people, which made us believe that the economic growth may be massively reduced for a short period of time, accompanied by supply chain interruptions, but quite quickly a combination of catch-up demand and economic stimulus could help the global economy recover swiftly. In March, the outlook has become more pessimistic as the virus spreads around the world. If the epidemic is further escalated globally and lasts for a long time, the medium and long-term impact will be more extensive and significant, and the growth of the global economy and container shipping demand will decline.

In general, the impact of the epidemic in 2020 may be longer, and market uncertainty is further increasing. We expect the governments of many countries and regions may launch further stimulus packages to alleviate the downward pressure on the global economy. We firmly believe that China’s economy will continue to maintain stable growth in the medium and long term, and will continue to be an important stabilizer for global economic growth, thereby supporting global trade demand and the development of the shipping industry.

The current situation of our industry is very challenging. Nevertheless, we can say that OOIL is well prepared to resist any potential headwinds, and has a good track record of adapting quickly to changes in demand and in the operating environment. We have introduced special working procedures to protect our staff, and have been in regular communication with our customers and vendors. We stand ready to work with all our stakeholders to deal with the situation as it evolves.

More than 18 months have passed since OOIL became part of the China COSCO SHIPPING Group. Together, we have made tremendous progress, as the results for 2019 attest. We will continue to work pro-actively and diligently to be at the forefront of our industry, in technology, in environmental efficiency, in customer service, as an employer, and in profitability and financial health. We will continue to create greater value for our shareholders and for all our stakeholders.

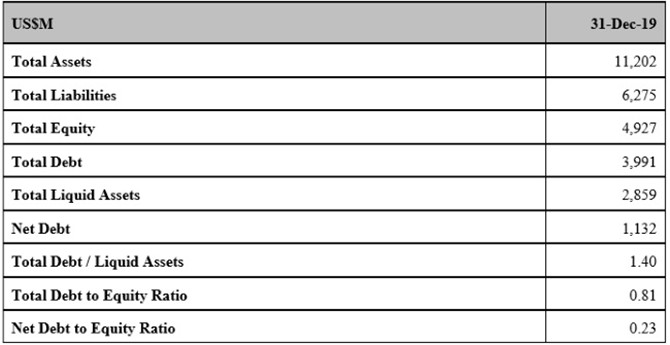

As at 31st December 2019, the Group had total liquid assets of US$2,858.8 million compared with debt obligations of US$648.9 million repayable in 2020. The net debt to equity ratio remained low at 0.23 : 1 at the end of 2019. The Group from time to time prepares and updates cashflow forecasts for asset acquisitions, to serve project development requirements, as well as working capital needs, from time to time with the objective of maintaining a proper balance between a conservative liquidity level and an effective investment of surplus funds.

OOIL owns one of the world’s largest international integrated container transport businesses which trades under the name “OOCL”. With more than 410 offices in over 85 countries/regions, the Group is one of Hong Kong’s most international businesses. OOIL is listed on The Stock Exchange of Hong Kong Limited.

Source: OOCL

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

admin@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar