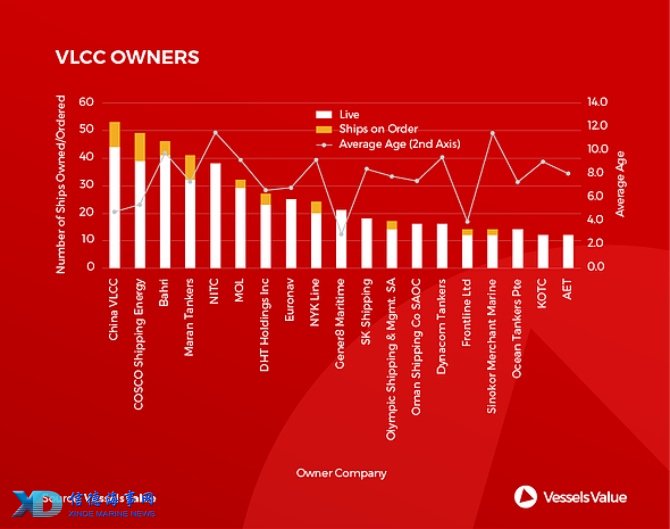

The concentration of ownership of VLCCs is increasing. There have been high profile acquisitions and mergers over the past several years by owners of all nationalities, and consolidation of market share should continue. The clear dominance for control of ships sits with Chinese companies. The top two owners, China VLCC and COSCO, have 83 VLCCs on the water, and another 19 on order. The average age of their fleet is five years old, substantially lower than the other top five owners.

The potential acquisition of the Gener8 fleet by Euronav would push the combined ownership of live vessels to 56, nudging them slightly ahead of China VLCC, assuming the deal concludes as planned. However, it is not expected they would be able to maintain a lead for long. It is worth noting that China VLCC and COSCO combined own 11.2% of all VLCC tonnage that is currently on the water.

Chinese built ships make up 110 ships of the total 227 VLCCs owned by the five largest owners, with South Korea trailing at 98 VLCCs. Ordering activity should slow as the large crude tanker market digests the expected delivery of new ships over the next two years amid weak rates. Chinese owners are well positioned to weather the down cycle with a young fleet on the water poised to capture the upswing over the next several years.

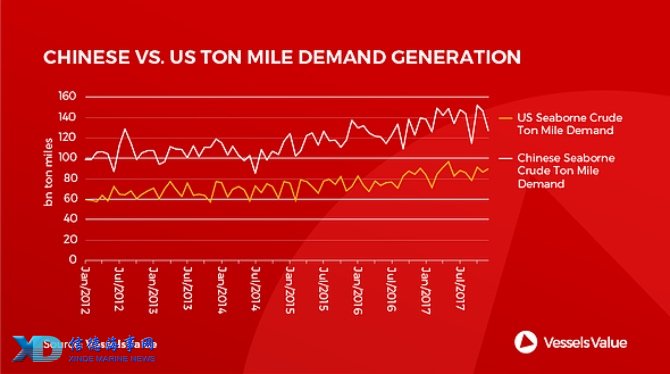

Chinese demand growth for oil continues to rise, and it has been the worlds largest importer of crude oil since early 2014, displacing the United States. However, the country has been a more significant driver of ton mile demand for a much longer time given the reliance on seaborne grades of crude. The expansion of their large tanker fleet makes sense from a strategic viewpoint, washing aside concerns over the softer rates seen in the freight markets. China’s growth is expected to continue, and as the economy expands more oil will flow into the country.

Please Contact Us at:

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar