While most vessel types are seeing newbuilding orders plunge, container ships are defying the trend. As of April, more than 100 new boxships have been ordered globally this year – proving once again that the king has returned.

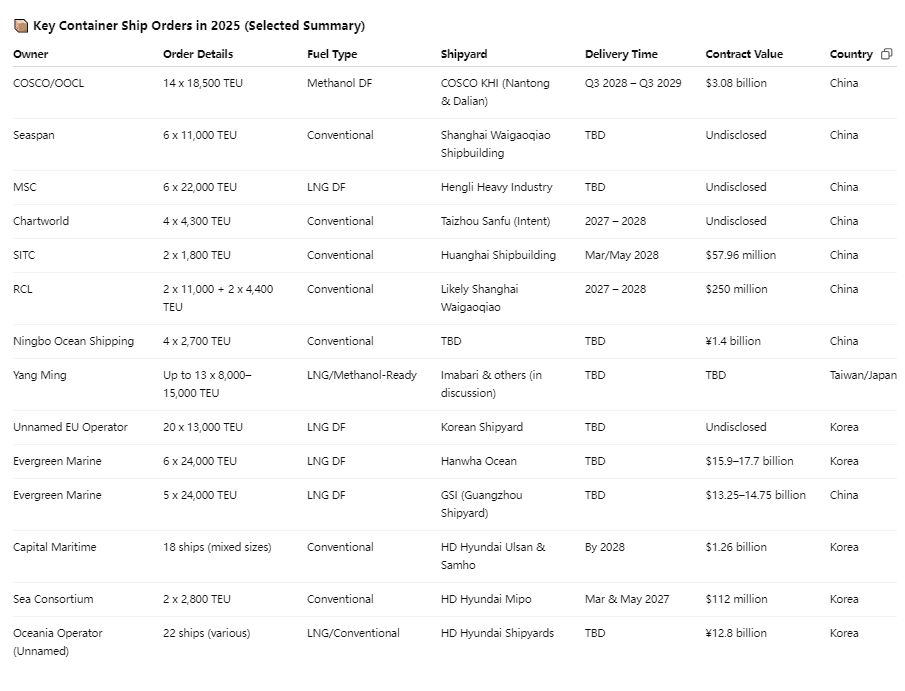

COSCO Shipping Holdings has placed a $3.08 billion order for 14 x 18,500 TEU methanol dual-fuel ships at Nantong and Dalian COSCO KHI.

Seaspan has ordered 6 x 11,000 TEU eco-friendly vessels at Shanghai Waigaoqiao Shipbuilding, using RMB – a symbolic move amid U.S.-China trade tensions.

MSC continues its mega-vessel spree with 6 x 22,000 TEU LNG dual-fuel orders at Hengli Heavy Industry.

Chartworld, Yang Ming, RCL, SITC, and Ningbo Ocean Shipping are all booking new ships across Chinese yards, spanning from 1,800 TEU feeders to 15,000+ TEU giants.

Evergreen, Hapag-Lloyd, and anonymous European majors (likely Hapag) are boosting the orderbook with large dual-fuel units at Korean yards like HD Hyundai and Hanwha Ocean.

According to Clarkson, container ship orders rose 238.1% YoY in Q1 2025 – the only segment with positive growth while the global newbuilding market fell by 58.5%.

Why is this happening?

Fuel transition: Over 70% of new boxship orders are alternative-fuel capable (48% LNG, 23% methanol), aligned with decarbonization goals.

Mega-ship economics: Scale matters. Over 50% of 2024-25 orders are for 10,000+ TEU vessels, driving lower per-unit transport costs.

Fleet power play: Giants like MSC, Hapag-Lloyd, and COSCO are racing to secure future capacity dominance, pushing smaller players to the sidelines.

In 2024, Chinese shipyards won 70.65% of global boxship orders by volume (2.62 million TEU), far ahead of South Korea (21%) and Japan (8%). Among the world’s top 10 container shipyards, China accounts for 7.

by Xinde Marine News Chen Yang

Please Contact Us at:

media@xindemarine.com