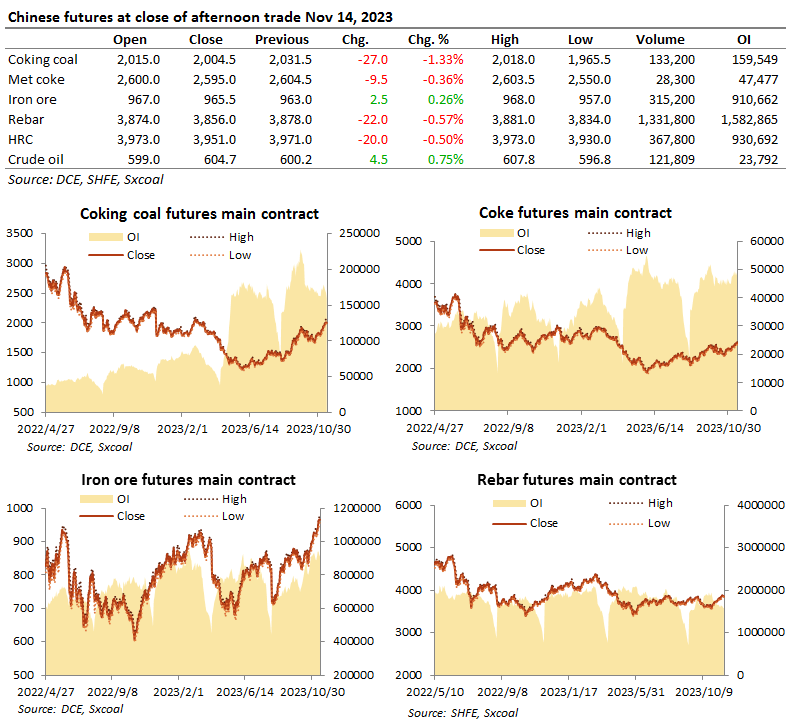

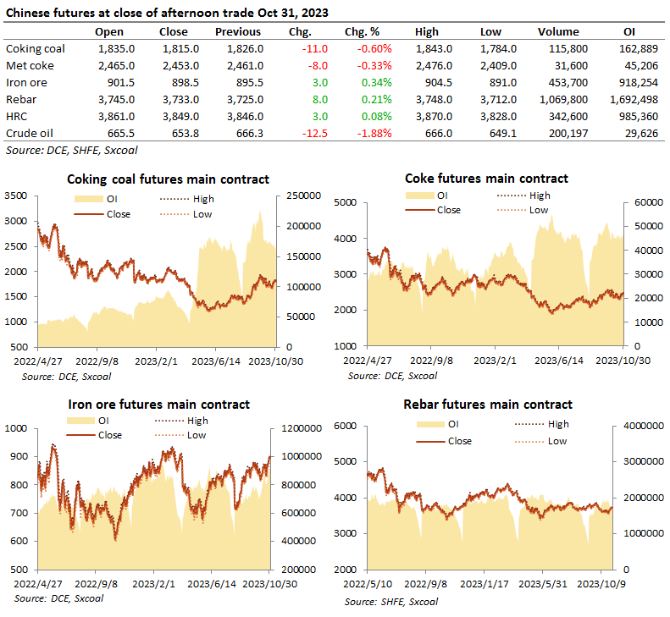

Dalian iron ore futures ended a volatile daytime session slightly higher on Tuesday, while the steelmaking ingredient’s benchmark contract in Singapore also swung from losses to gains amid a guarded outlook for Chinese demand.

The most-traded May iron ore on China’s Dalian Commodity Exchange was up 0.4% at 856.50 yuan ($125.66) a tonne by 0700 GMT, erasing early losses.

On the Singapore Exchange, iron ore’s most-active March contract rose as much as 2% to $122.75 a tonne, after hitting a session-low $119.90.

Iron ore prices have rebounded from a November low below $90 a tonne, as China’s stepped-up policy support for its ailing property sector and dismantling of strict COVID-19 restrictions spurred expectations of demand recovery this year.

China, which produces more than half of the world’s steel output, buys about two-thirds of iron ore supplies.

Some analysts believe the expected iron ore demand recovery has already been priced into the market, while others are cautious in their outlook particularly for China’s real estate industry.

“Any growth in China’s steel demand from a boost in infrastructure construction is likely to be offset by another contraction in China’s property construction this year,” Commonwealth Bank of Australia commodities analyst Vivek Dhar said.

New housing starts in China, which slumped last year, are likely to contract again, which could dampen iron ore demand, he said.

“Weaker Chinese iron ore demand, combined with a modest uplift in seaborne iron ore supply, will weigh on iron ore prices through 2023,” Dhar said in a note, predicting prices will drift lower to $100 a tonne in coming months.

Chinese steel benchmarks and other Dalian steelmaking inputs were subdued.

Rebar SRBcv1 on Shanghai Futures Exchange shed 0.1%, hot-rolled coil gained 0.3%, wire rod climbed 0.4%, while stainless steel slipped 0.3%.

Coking coal edged up 0.1%, while coke DCJcv1 lost 0.3%.

Source: Reuters

Source: Reuters

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: