Introduction

2022 was an eventful year for the Offshore industry. Geopolitical tensions between Russia and Ukraine caused the price of oil to hit USD 100 per barrel and reach highs of c. USD 130 per barrel. Oil majors announced record profits, and the vessel and rig owning sector witnessed both an increase in asset values and a firming in charter rates.

2022 was the year the market saw two large consolidation plays:

·Tidewater purchased Swire Pacific Offshore in March for USD 190 million, adding an extra 50 Offshore support vessels to their fleet and making them the largest publicly owned OSV owner in the world

·ADNOC L&S acquisition of Zakher Marine International, adding c.60 Offshore vessels to their fleet, including both OSVs & OCVs

·On the restructuring side, we saw DOF agree a debt to equity swap in June, which was shortly followed by shareholders blocking the plan and thus went onto oust the company’s board of directors.

Within the sale and purchase (S&P) market, the buyer to compete with was Rawabi Holding of Saudi Arabia. Rawabi had purchased most of the ex-Chinese yard PSV units at very attractive prices, and a number of other modern units (PSV and AHTS) from fellow Offshore owners. This is a move which fully positions them to take advantage of the huge oil and gas expansion plans by Saudi Aramco within the KSA region.

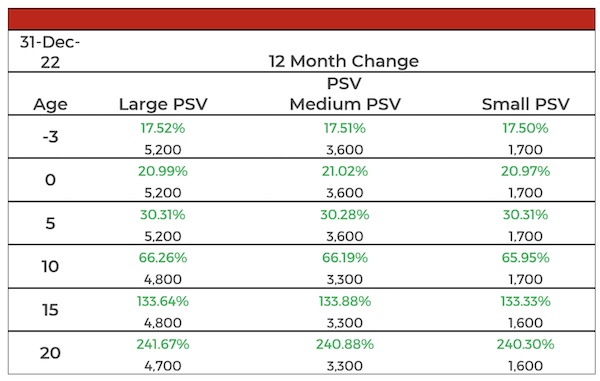

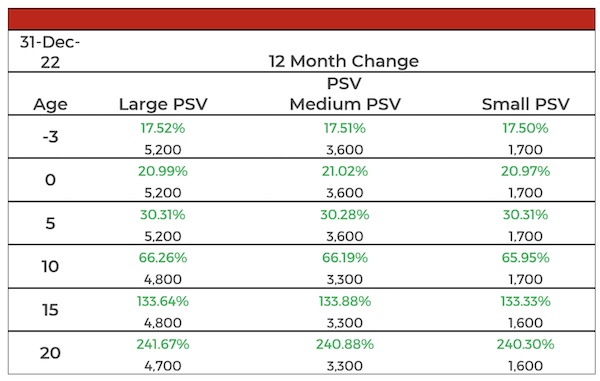

PSV Values

The below Matrix table shows the % change in Market Values of PSVs since the 1st of January and the 31st of December 2022.

PSV values have witnessed a significant firming in market values across the whole age and size curve. This firming is a due to a variety of factors on each side of the supply and demand scale. These factors are outlined below:

PSV values have witnessed a significant firming in market values across the whole age and size curve. This firming is a due to a variety of factors on each side of the supply and demand scale. These factors are outlined below:

Supply

·Lack of newbuild orders

·Majority of Chinese resale tonnage now sold

·Significant reduction in second hand sale and purchase candidates

·Large number of OSVs scrapped during downturn

·Larger owners completed their mass fleet sell offs

·Large number of vessels sold out of the Offshore sector, never to return

·Large number of vessels sold into Chinese markets, which rarely return to international markets

Demand

·Strong oil price

·CAPEX increases from oil majors

·Geopolitical instability and energy security

·Increased renewables demand

·General increased demand within operating regions, such as Saudi Arabia

·Increased charter rates

An example of a significant sale within the PSV sector and the assets incremental firming over the year is outlined below:

Rem Star ex. Ocean Star 5,700 dwt blt 2014 Myklebust was sold, along with sister vessel Rem Art for USD 21.6 mil each in July 2022.

o VV Value Jan 2021 USD 13.80 mil

o VV Value Jan 2022 USD 15.90 mil

o VV Value Dec 2022 USD 22 mil

Moving forward, we expect PSV market values to continue to firm due to the above mentioned supply and demand fundamentals.

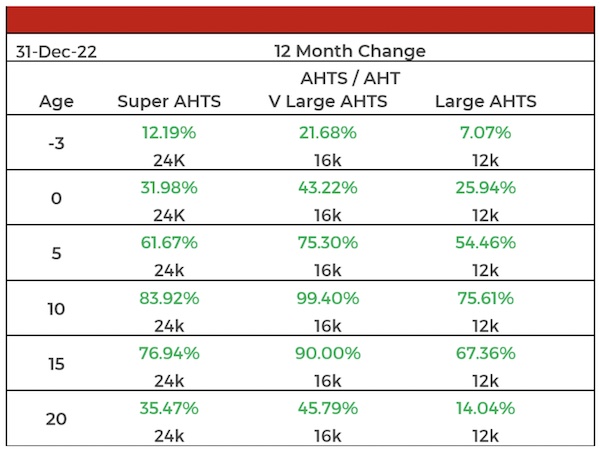

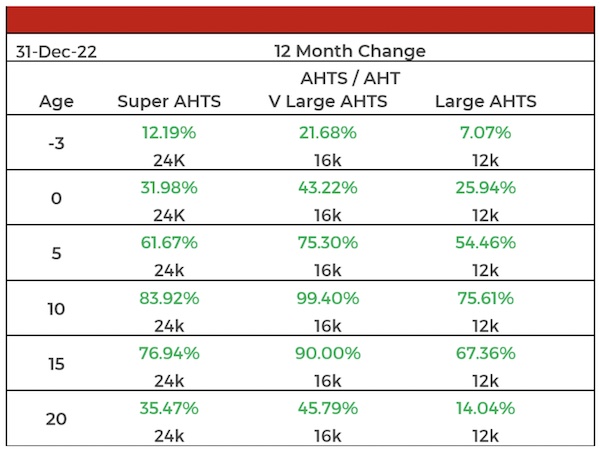

AHTS Values (Large, Very Large and Super Large)

The below Matrix table shows the % change in AHTS Market Values of since the 1st of January and the 31st of December 2022.

Market values for Large, Very Large and Super Large AHTS assets have firmed across the whole age curve and size curve. Like PSVs, this firming is due to a variety of factors based on supply and demand metrics.

Supply

·Lack of newbuild orders

·Limited sale and purchase candidates

·High number units sold out of the Offshore sector, never to return

·China purchasing AHTS to service their growing renewables market, which rarely return to international markets

·Large number of AHTS assets sent to demolition yards during downturn

Demand

·Strong oil price

·CAPEX increases from oil majors

·Geopolitical instability and energy security

·Increased demand from floating wind

·Increased charter rates

An example of a significant sale within the AHTS sector and the assets incremental firming over the year is outlined below:

Kan Tan 222 ex. Ena Shogun 16,315 bhp blt 2011 Keihin, sold in February 2022 for USD 13 mil, SS freshly passed to Tianjin Zhihai of China

o VV Value Jan 2021 USD 4.50 mil

o VV Value Jan 2022 USD 5.00 mil

o VV Value Dec 2022 USD 13.30 mil

o VV Value Jan 2022 USD 5.00 mil

o VV Value Dec 2022 USD 13.30 mil

Moving forward, we expect Large AHTS market values to continue to firm due to the above mentioned market factors.

Offshore Jack Up Rig market

Within the Middle East, particularly Saudi Arabia and Abu Dhabi, investment into their respective oil and gas industries has been top priority. Saudi Arabia announced a rapid scaling up of oil production in the region, producing 12 million barrels per day and aiming for 13 million barrels per day by 2027. Abu Dhabi state oil company ADNOC has projected a target of 5 million barrels of oil per day in production by 2025.

To meet the target within KSA, Saudi Aramco proposed a target of 90 Jack Ups operating within the region by the end of 2024. This has led to significant S&P activity by one KSA player, ADES International. In 2022 alone, the company purchased 21 rigs and spent about USD 1 billion.

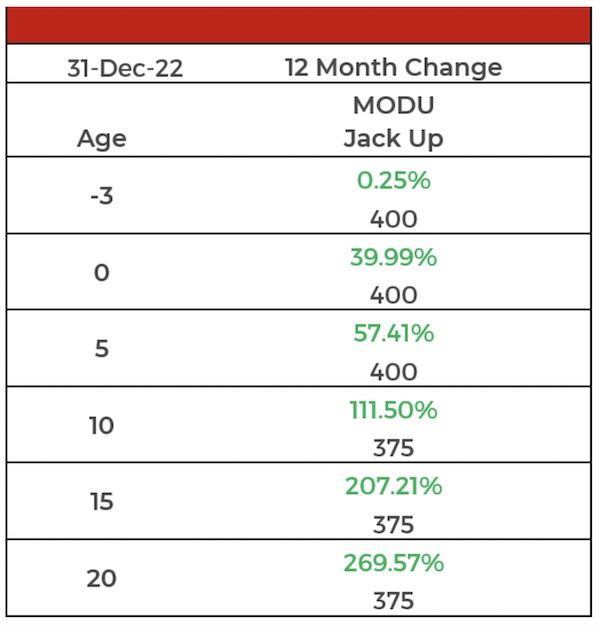

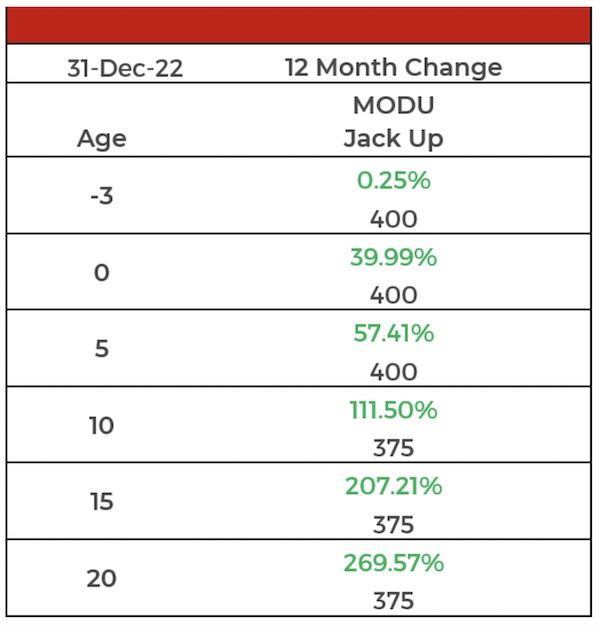

Jack Up Rig Values

The below Matrix table shows the % change in Market Values of Jack Up Rigs since the 1st of January and the 31st of December 2022.

An example of a significant sale within the Jack Up sector and the assets incremental firming over the year is outlined below:

Admarine 688, ex Deep Driller 1 375 ft 2006 blt PPL was sold in January 2022, warm stacked since Nov 2016, SS/DD overdue to ADES International for USD 12.25 mil.

o VV Value Jan 2021 USD 16.70 mil

o VV Value Jan 2022 USD 13.30 mil

o VV Value Dec 2022 USD 40 mil

Like PSVs and AHTS’s, this firming is due to a number of factors based on supply and demand metrics.

Supply

·Lack of newbuild orders

·Limited sale and purchase candidates

·High number units sold out of the Offshore sector, never to return

·Most of good quality resale tonnage that remained in shipyards sold

·Market share controlled by a few large owners

·Large proportion of older units within fleet

·Large number of assets sent to demolition yards during downturn

Demand

·Increased S&P activity

·Strong oil price

·CAPEX increases from oil majors

·Geopolitical instability and energy security

·Increased demand due to Middle East expansion

·Increased charter rates

·Moving forward, we expect Jack Up Rig values to continue to firm due to the above mentioned market factors.

Conclusion

It has been a long and arduous downturn for anyone involved or invested within the Offshore vessel and rig owning sector. 2022 really illustrated how quickly markets can move when the supply and demand fundamentals support it. Within the period of a year, the market is a shadow of its former 2021 self and the improvement looks set to continue.

However, it must be noted that we are by no means back to the glory days of 2010 to 2014, and there is still some way to go within this recovery. But if 2023 is anything similar to 2022, then the Offshore vessel and rig owning sector is on the right track to usher in a new period.

VesselsValue data from 1st January to 31st December 2022.

Source: VesselsValue

Source: VesselsValue

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: