Iron ore prices rose on Thursday, propped up by continued speculation that top steel producer China would ease its strict COVID-19 rules along with hopes that Chinese stimulus measures would offset the impact of a global economic slump on demand.

The steelmaking ingredient has rebounded after a rout in October, with gains largely driven by rumours that China would pivot away from its strict zero-COVID policy by next year. Officials have denied knowledge of such a rumoured plan.

It made further gains on Wednesday when Chinese regulators assured investors that economic development remained a priority, and that the central bank would be able to maintain positive interest rates for as long as possible.

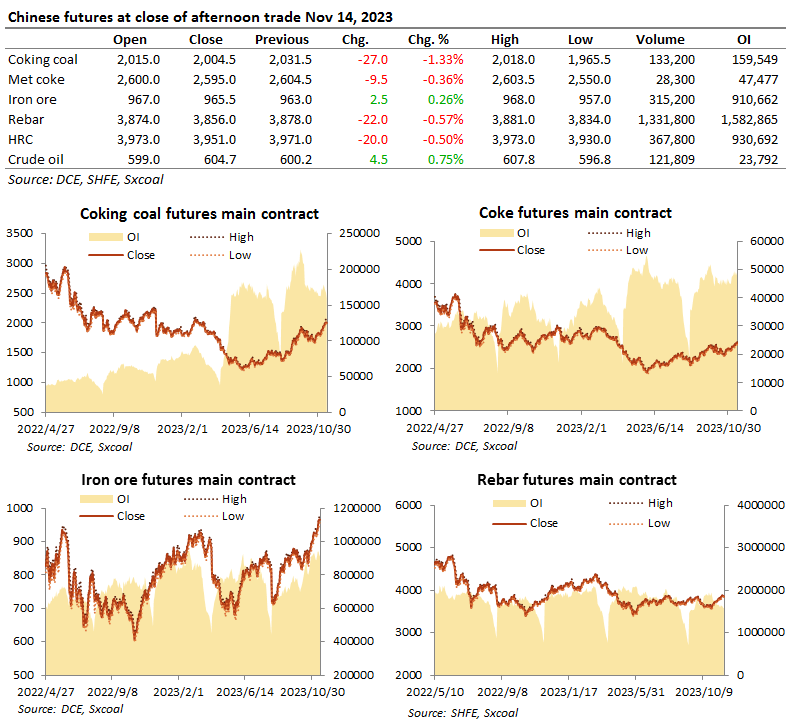

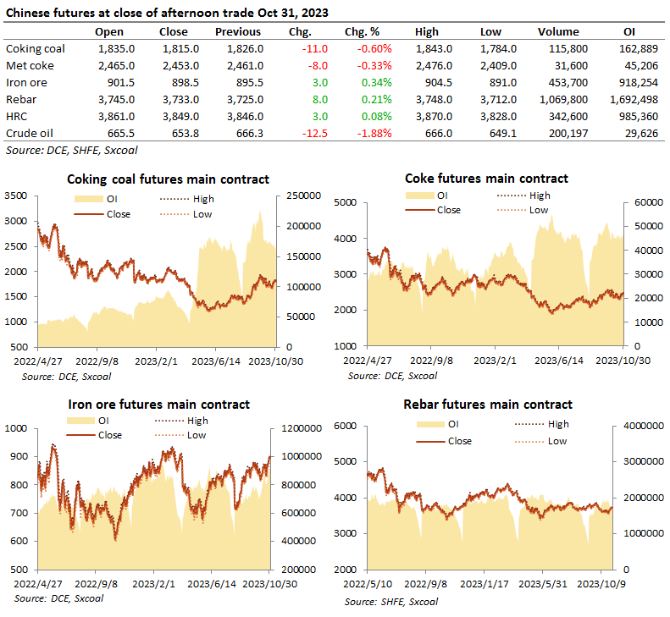

The most-traded January iron ore on China’s Dalian Commodity Exchange DCIOcv1 ended morning trade 1.4% higher at 636.50 yuan ($87.17) a tonne, on track for its third straight day of gains.

Iron ore prices rose on Thursday, propped up by continued speculation that top steel producer China would ease its strict COVID-19 rules along with hopes that Chinese stimulus measures would offset the impact of a global economic slump on demand.

The steelmaking ingredient has rebounded after a rout in October, with gains largely driven by rumours that China would pivot away from its strict zero-COVID policy by next year. Officials have denied knowledge of such a rumoured plan.

It made further gains on Wednesday when Chinese regulators assured investors that economic development remained a priority, and that the central bank would be able to maintain positive interest rates for as long as possible.

The most-traded January iron ore on China’s Dalian Commodity Exchange DCIOcv1 ended morning trade 1.4% higher at 636.50 yuan ($87.17) a tonne, on track for its third straight day of gains.

Other Dalian steelmaking inputs also advanced, with coking coal DJMcv1 and coke DCJcv1 up 2.1% and 1.9%, respectively.

Source: Reuters

Source: Reuters

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: