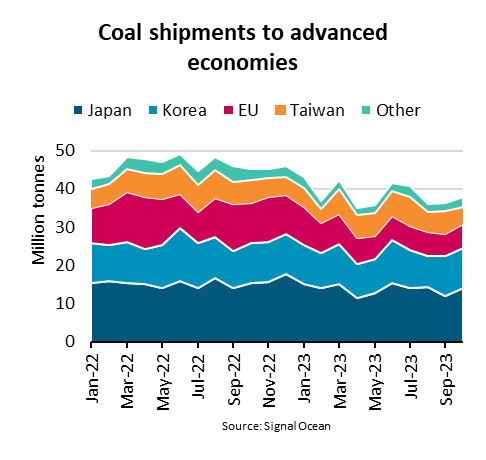

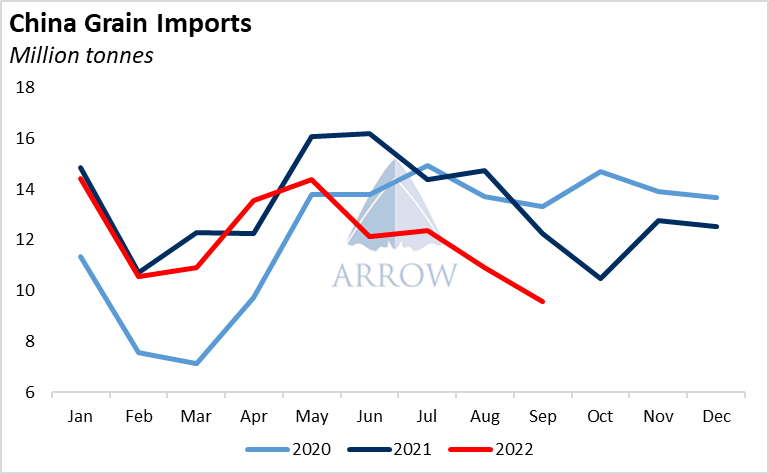

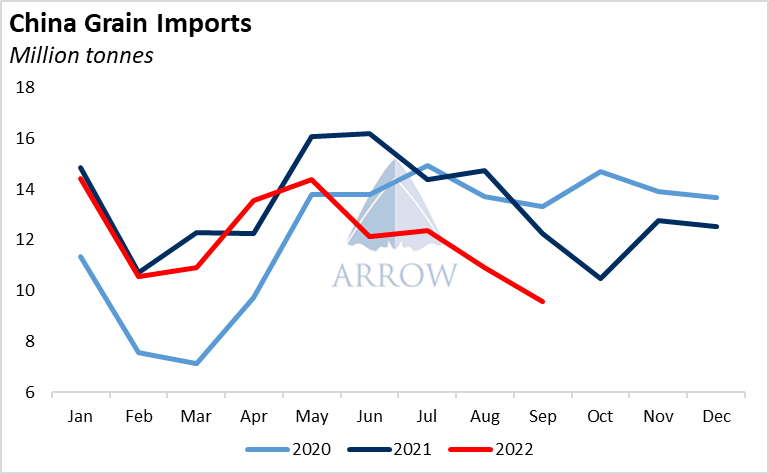

Weak export volumes and lower distances have driven grain tonne-mile demand sharply lower this year. The lack of Black Sea cargoes has driven volumes lower, whilst weaker Chinese demand pulled down average distances. Looking forward over the next 12 months, the picture looks brighter.

The Pork Market

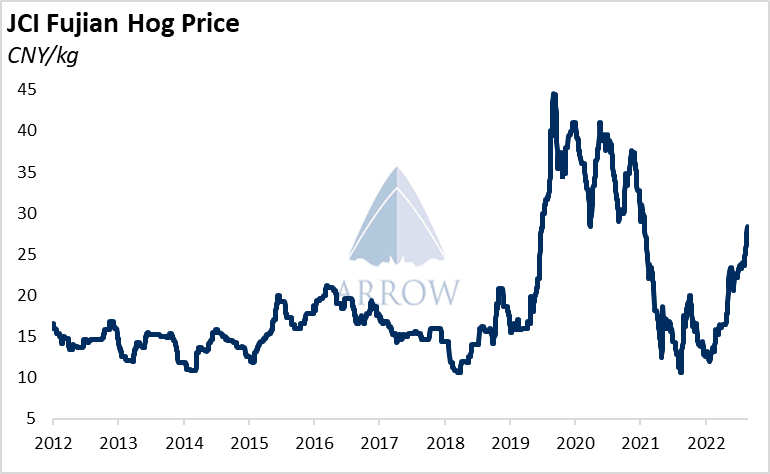

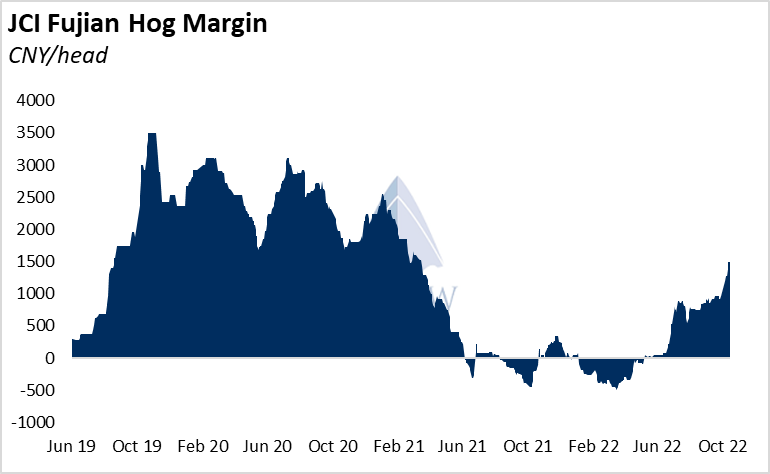

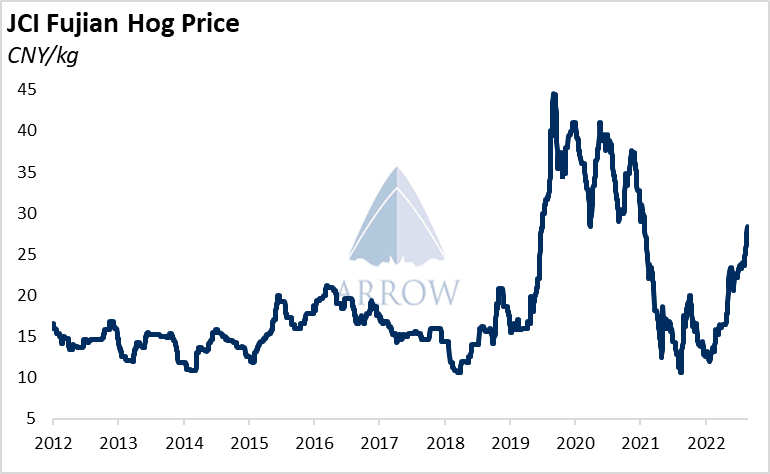

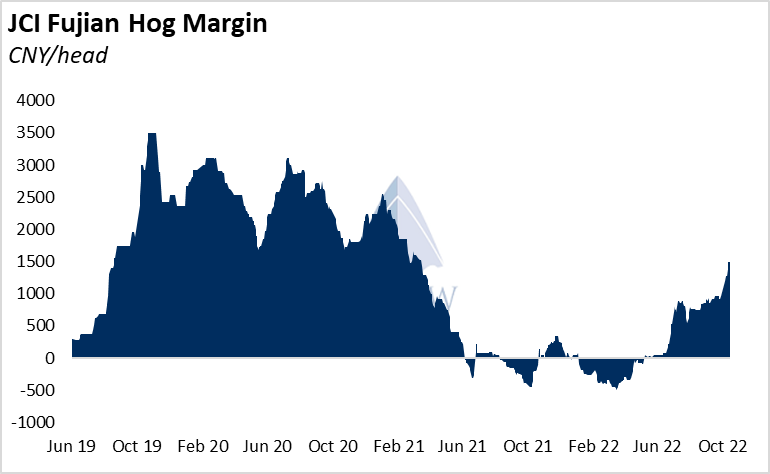

Since the African Swine Fever (ASF) outbreak in 2019, the Chinese hog market has continued to consolidate, and many large producers invested in new capacity. This capacity came online as the outbreak waned, which caused an oversupply driving pork prices lower at a time when input costs remained high. The market became largely loss making from mid-2021 until mid-2022 which caused producers to trim excess output to stem the losses.

However, it looks like supply is falling short again. Hog prices and margins in China have surged to levels only seen during the catastrophic ASF outbreak.

However, it looks like supply is falling short again. Hog prices and margins in China have surged to levels only seen during the catastrophic ASF outbreak.

Why does this matter to shipping?

Soybean demand.

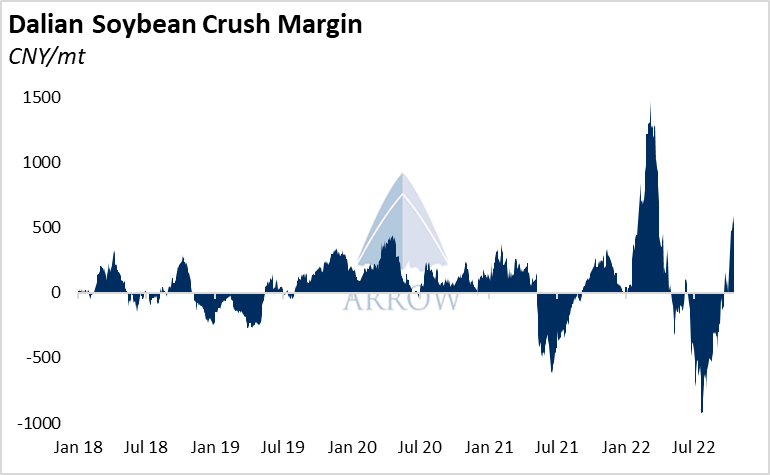

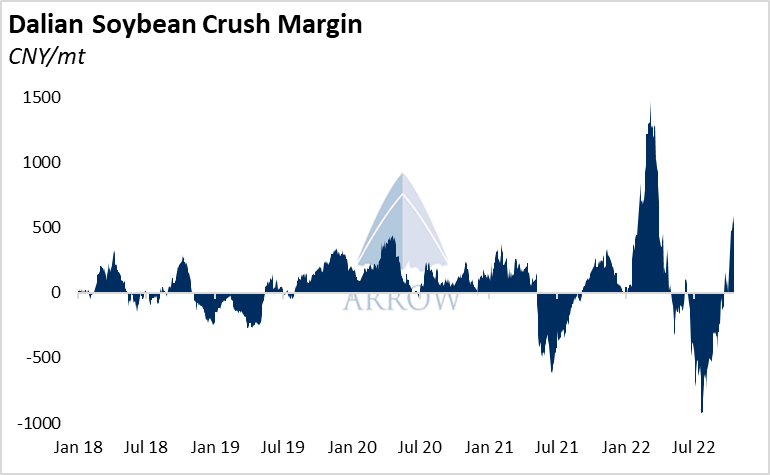

Chinese imports of soybeans have been lacklustre this year as negative crush margins over Q2 & Q3 disincentivised imports. Soybean prices have been high whilst soymeal & soy oil prices didn’t keep up, so crushers’ utilisation dropped close to 50%.

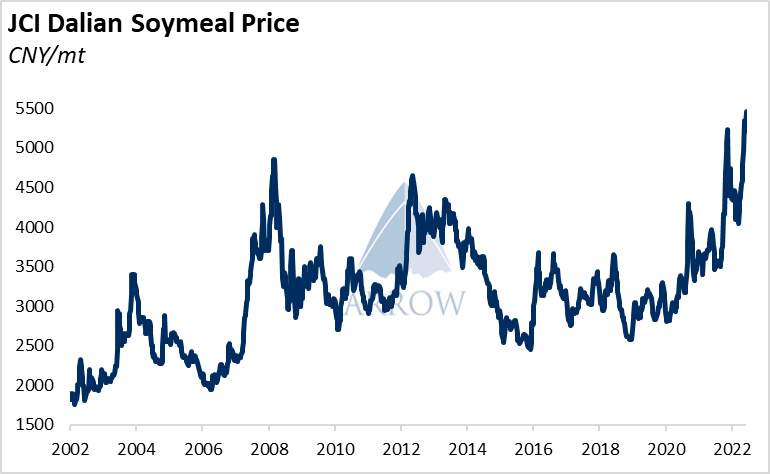

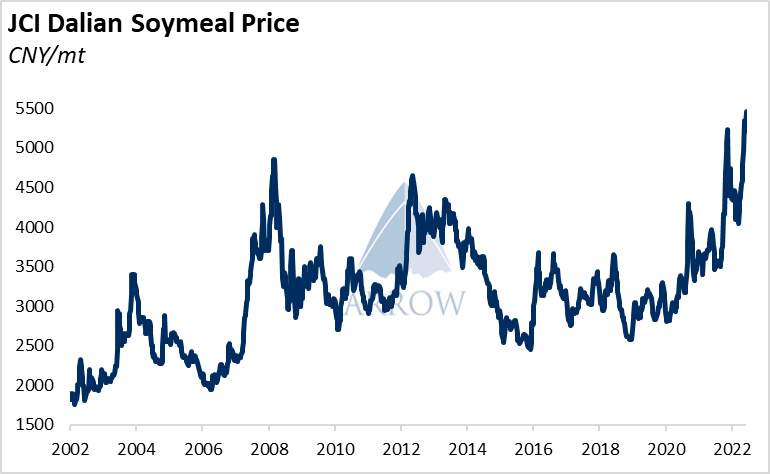

Now, improving feed demand is sending soymeal prices close to record highs.

Consequently, crush margins are leaping higher, which should support soybean demand as crush plant utilisation picks up.

As Chinese soybean prices flirt around decade highs, it appears that weak import pace over the past 6 months is insufficient to meet the current level of demand.

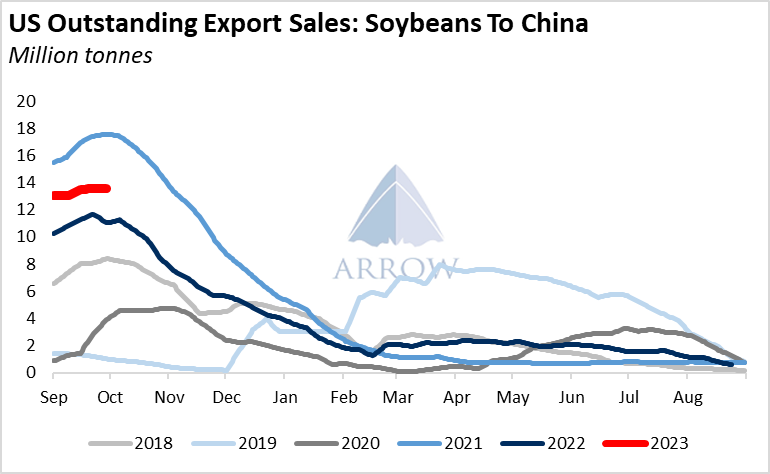

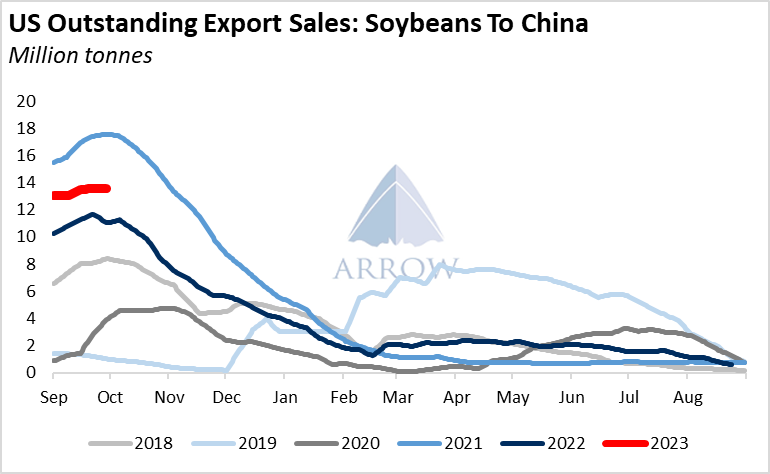

US export sales indicate strong Chinese demand this marketing year for US soybeans. While the low water level on the Mississippi is causing the US export season to get off to a slow start, we expect Chinese purchases to remain strong over the coming months as the US is the cheaper source of prompt cargoes. Chinese soybean futures are close to record highs, whilst US soybean futures are about 20% off the highs of the year – the import incentive is growing.

Furthermore, early next year a potentially record Brazilian soybean crop should provide ample supply if Chinese demand holds.

Consequently, crush margins are leaping higher, which should support soybean demand as crush plant utilisation picks up.

As Chinese soybean prices flirt around decade highs, it appears that weak import pace over the past 6 months is insufficient to meet the current level of demand.

US export sales indicate strong Chinese demand this marketing year for US soybeans. While the low water level on the Mississippi is causing the US export season to get off to a slow start, we expect Chinese purchases to remain strong over the coming months as the US is the cheaper source of prompt cargoes. Chinese soybean futures are close to record highs, whilst US soybean futures are about 20% off the highs of the year – the import incentive is growing.

Furthermore, early next year a potentially record Brazilian soybean crop should provide ample supply if Chinese demand holds.

The Bottom Line

Record soymeal prices indicate that recent crush volumes have been insufficient to support improving feed demand in China. To meet rising crush volumes, we expect China to source soybeans from the US, where they are significantly cheaper than domestic produce. In addition, a potential record Brazilian soybean crop early next year should provide ample supply for whatever demand materialises throughout 2023.

The hole in freight demand left by the war in Ukraine remains unfilled. However, with firm Chinese purchases of US Soybeans, we expect tonne-mile demand from the grain sector to improve over the coming months back towards levels seen in 2021.

The hole in freight demand left by the war in Ukraine remains unfilled. However, with firm Chinese purchases of US Soybeans, we expect tonne-mile demand from the grain sector to improve over the coming months back towards levels seen in 2021.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: