Congestion for Dry Bulk Carriers at Rotterdam has soared due to the Russia-Ukraine conflict.

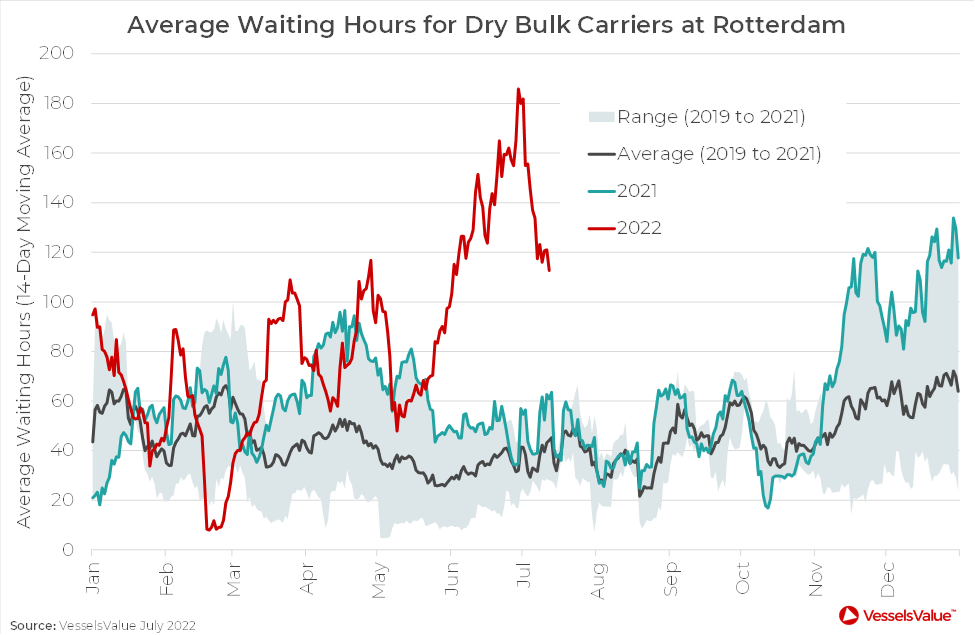

Since the outbreak of war in late February, the average waiting time for a Bulker at Europe's busiest port has often been above the high end of its three year range. But over the seven week period from May 9th to June 29th, it escalated from 48 hours to 186 hours, as shown in Figure 1 below. It has since eased to 113 hours but remains very high for the time of year.

Figure 1: Average Waiting Times for Dry Bulk Carriers at Rotterdam, Netherlands.

Figure 1: Average Waiting Times for Dry Bulk Carriers at Rotterdam, Netherlands.

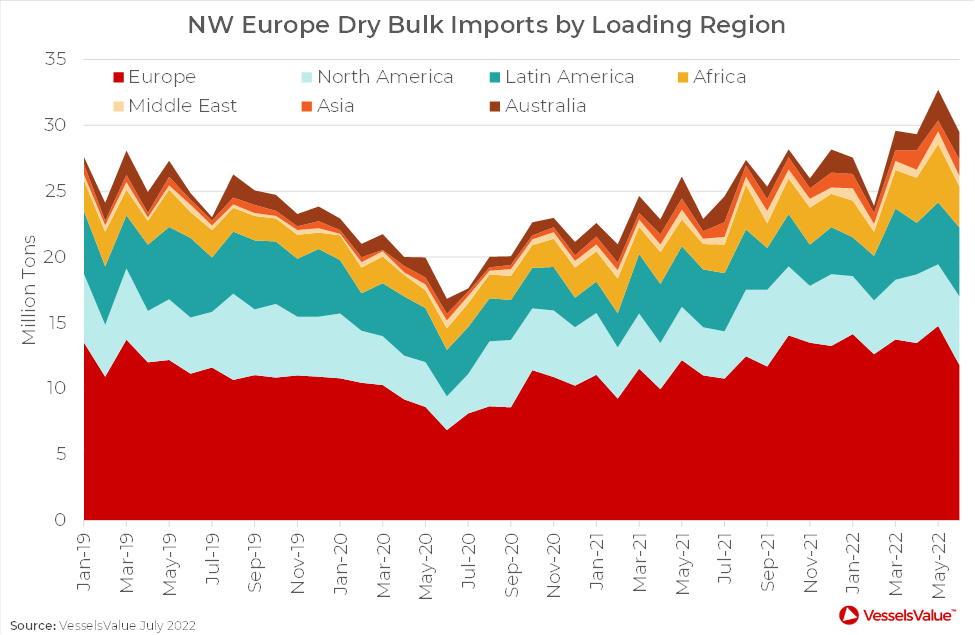

Dry bulk imports into Northwest Europe have been steadily recovering since the depths of the Covid-19 pandemic in mid 2020. But growth has accelerated since the Russian invasion and volumes are now higher than pre pandemic levels.

As shown in Figure 2 below, much of the increase is driven by flows from within Europe. In the April to June period, trade flows from within the region increased by 6.9 million tons, or 21% on the same period last year. Intra-Northwest Europe trade was 8.2 million tons higher, more than offsetting a 2.9 million ton drop in imports from the Baltic Sea region, where there are several key Russian ports.

Figure 2: Northwest Europe Dry Bulk Imports by Loading Region.

Figure 2: Northwest Europe Dry Bulk Imports by Loading Region.

The second biggest driver is trade from Africa, which rose by 4.6 million tons or 72% (01 April to 30 June ’22 versus 01 April to 30 June ’21), and particularly South Africa, which contributed 3.0 million tons of the increase. European power utilities have been eager buyers of South African coal, despite high prices, in the wake of a ban on Russian cargoes. This has lifted coal trade from South Africa to Northwest Europe to levels not seen since 2014. Rotterdam in The Netherlands is the region’s main coal import terminal, but several other countries, including France, Germany, Italy, and Poland, received cargoes, having imported no coal at all from South Africa in the year ago period.

This knock-on effect from the conflict and wider global energy crisis will be a key near term indicator for the Dry Bulk and European power sectors.

VesselsValue data as of 12th July 2022.

Source: VesselsValue

Source: VesselsValue

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: