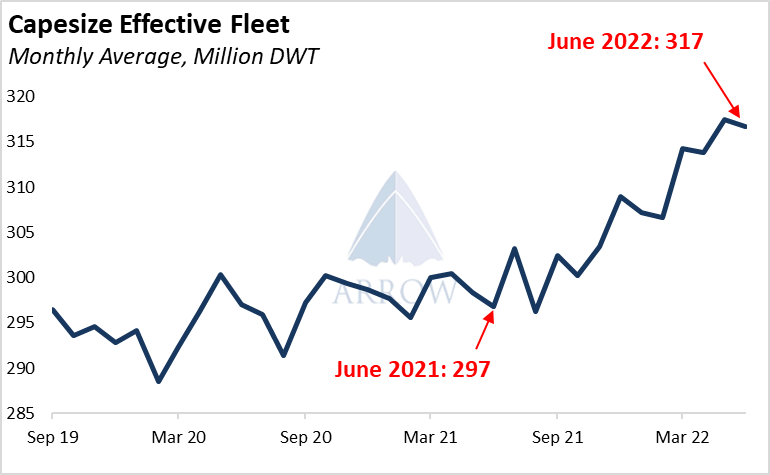

Congestion was one of the key stories of the dry bulk market in 2021, it was slowing/halting supply growth, for the Capesize segment especially. Now the congestion picture looks different, and is telling us a different story.

Capesize

From mid-2020 until the start of this year, effective fleet growth in the Capesize market was around zero. Progressively higher congestion levels were hiding vessel deliveries. However over the past 6 months we have seen congestion drop back, and this has revealed nearly 2 years’ worth of vessel deliveries: year-over-year effective fleet growth is at 6.8% for the Capesize market.

It's also worth noting that on a historical basis, Capesize congestion as a percentage of the fleet is at the second highest seasonal level going back to 2017. If congestion drops back to levels seen in 2017, we could see a further 3% of supply come back.

Panamax

Panamax congestion has been running on the higher end of the historical range over the past 2 years, and this has supported the market. However this move has been less pronounced when comparing to Capes, as the effective fleet has consistently drifted higher over recent years.

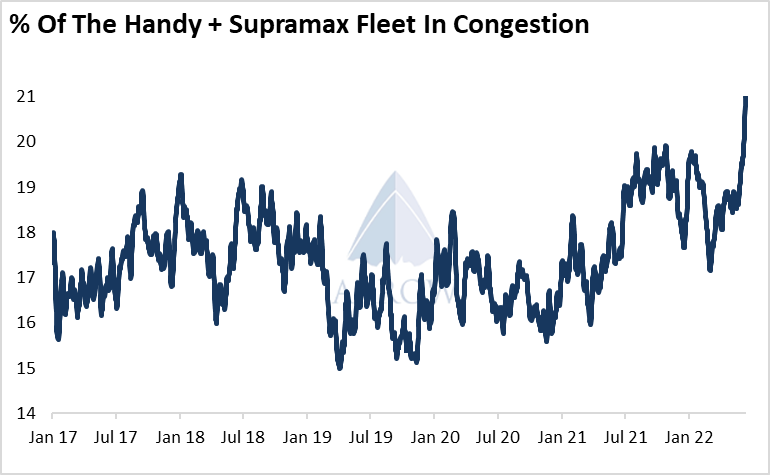

Supramax/Handysize

On the smaller vessel classes, congestion has picked up this year, and has halted effective fleet growth. In the short term this is supporting the market – spot rates for Supras & Handies are exceeding their larger counterparts. However this support is fragile, as a normalisation of congestion would release around 3% of supply back into the market.

Bottom Line

Given Capesize demand is broadly holding up this so far year, we see the congestion unwind as a key factor holding back Capesize rates – effective fleet growth close to 7% is huge. With this Capesize experience fresh in our minds, we turn our heads to the smaller vessel classes, which may undergo a similar fate.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: