The weather in Brazil is currently having a negative impact on the dry bulk market as rains slow down mining operations whilst elsewhere drought is damaging crop yields.

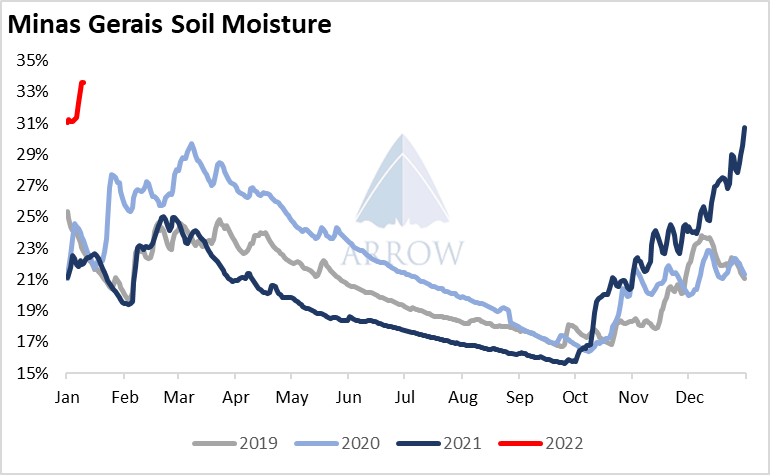

A spell of very wet weather has drenched parts of central Brazil, including key iron ore mining region Minas Gerais. This has forced some operations to shut down for the time being, with no definitive resumption timeline given. Considering the rainy season in Brazil ends in about 2 months' time, the weather will be working against the miners, and puts Q1 iron ore exports into question.

At this stage it's still unclear the extent to which these production shutdowns are due to logistics issues stemming from the flash flooding events, or wider concerns around the safety of tailings dams. If it's the former, then it's more likely that operations will resume swiftly as there would be less damage to the supply chain. However if the safety of tailings dams are in question, then this could become a protracted issue curtailing operations for potentially months. After the Brumadindo tragedy in 2019 the Brucutu mine was ordered by the government to halt operations, it's conceivable now that a similarly cautious approach could be taken. Since the recent rains, the number of dams in Minas Gerais with an emergency level protocol has increased by 4.

Using 1Q21 data from Vale's production report, the mines currently on pause produce around 300k tonnes per day, and therefore if this hangs around for more than a couple of weeks, it will take a chunk out of Capesize demand for Q1, risking bringing the vessel class below opex. The weather forecast for the region is reasonably dry over the coming week giving some respite to recovery operations. However importantly we have not been told the extent of the damage to the rail network, which will likely dictate the speed of resumption. With Feb+Mar FFA trading at an average of around $15k the market appears to be pricing in a reasonably swift resolution to this matter.

A spell of very wet weather has drenched parts of central Brazil, including key iron ore mining region Minas Gerais. This has forced some operations to shut down for the time being, with no definitive resumption timeline given. Considering the rainy season in Brazil ends in about 2 months' time, the weather will be working against the miners, and puts Q1 iron ore exports into question.

At this stage it's still unclear the extent to which these production shutdowns are due to logistics issues stemming from the flash flooding events, or wider concerns around the safety of tailings dams. If it's the former, then it's more likely that operations will resume swiftly as there would be less damage to the supply chain. However if the safety of tailings dams are in question, then this could become a protracted issue curtailing operations for potentially months. After the Brumadindo tragedy in 2019 the Brucutu mine was ordered by the government to halt operations, it's conceivable now that a similarly cautious approach could be taken. Since the recent rains, the number of dams in Minas Gerais with an emergency level protocol has increased by 4.

Using 1Q21 data from Vale's production report, the mines currently on pause produce around 300k tonnes per day, and therefore if this hangs around for more than a couple of weeks, it will take a chunk out of Capesize demand for Q1, risking bringing the vessel class below opex. The weather forecast for the region is reasonably dry over the coming week giving some respite to recovery operations. However importantly we have not been told the extent of the damage to the rail network, which will likely dictate the speed of resumption. With Feb+Mar FFA trading at an average of around $15k the market appears to be pricing in a reasonably swift resolution to this matter.

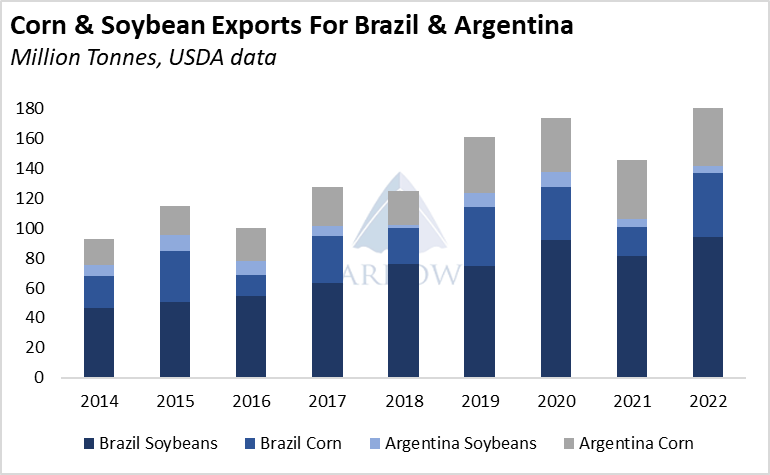

Further south, in southern Brazil and Argentina, hot and dry weather has significantly damaged the soybean and corn crops. In the latest USDA report, Brazilian soybean & corn production was marked down 8 million tonnes verses their previous forecast, however interestingly they left exports unchanged. This is because the USDA is forecasting that Brazil will draw significantly on the stocks built up over 2021.

At this stage of dry weather, the final crop yield will be very sensitive to rainfall over the coming weeks, and therefore some agencies have varying forecasts. The Rosario Grain Exchange's numbers for the Argentinian soy & corn crop were 12.5 million tonnes lower than the USDA's numbers released the day before, likely reflecting different views on the weather.

Although the USDA has left Brazilian corn & soybean exports unchanged, the weather is certainly posing a risk to export volumes. On balance, it still appears as though South America will export a record volume of grains during the coming marketing year.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: