A decline in shipments of west African crude to China has pushed freight rates for very large crude carriers (VLCCs) on the route to record lows this summer.

Rates averaged $10.28/t in June, $10.41/t in July and $10.04/t in August to date, the three lowest monthly averages since Argus began assessing the route in 2005. Low demand has been the main driver. Just 840,000 b/d of crude was shipped from west Africa to China last month across all vessel classes, a five-year low. Destocking by China's state-run refiners, restrictions on crude imports for China's independent firms and lower Angolan loadings have combined to constrain Beijing's imports of west African crude.

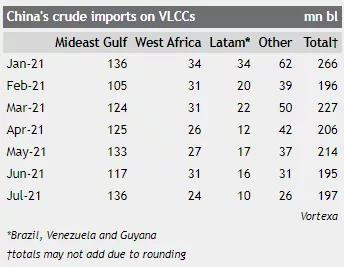

It is not just the west Africa to China market in the doldrums. The entire VLCC market in the south Atlantic basin has been weak this summer. Brazil shipped just 335,000 b/d of crude to China on VLCCs in July, the lowest monthly total since September 2017, according to data from Vortexa. The Brazilian and west African crude markets tend to operate in tandem as they share a tanker pool to a large extent. Brazil to China VLCC rates have also been unusually low this summer.

China is one of the most active participants in the global VLCC market, and crude demand there plays a large part in determining the outlook for the dirty tanker markets. Chinese crude imports have been consistently low this summer. Around 6.5mn b/d departed for China on VLCCs in June and 6.3mn b/d in July, compared with 8.9mn b/d and 7.5mn b/d in the corresponding months last year, according to Vortexa data (see table). If imports continue at these low levels, VLCC rates, and by extension other dirty tanker rates, may struggle to recover.

China and the wider Asia-Pacific region are significant drivers of tanker tonne-mile demand. A laden journey from Bonny in Nigeria to Ningbo in China takes close to 33 days, according to Vortexa, whereas it only takes around 19 days to ship crude from Basrah in southern Iraq to Ningbo. Reduced crude flows on longer-haul routes will weigh on tonne-mile demand in the global tanker complex, which often leads to lower spot market rates.

A recovery in the crude tanker market remains unclear while uncertainty persists around the trajectory of the Covid-19 pandemic, although Greece-based shipping firm Okeanis Eco Tankers said recently that it expects the VLCC market to rebound in October and for rates to continue firming as global crude production grows.

Source: Argus

Source: Argus

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: