Orient Overseas (International) Limited and its subsidiaries (the “Group") today announced a profit attributable to equity holders of US$102.1 million for the six-month period ended 30th June 2020, compared to a profit of US$139.0 million for the same period in 2019.

Earnings per ordinary share for the first half of 2020 was US16.3 cents, whereas earnings per ordinary share for the first half of 2019 was US22.2 cents.

The Board of Directors is pleased to announce an interim dividend of US4.89 cents per ordinary share.

We saw extremely radical changes to many growth forecasts for 2020 cargo volume, after the impact of the pandemic on container shipping started to materialise. Faced with dire predictions of dramatically falling demand from our customer base, OOCL reacted by paying careful attention to customer demand and reviewing and calibrating our services accordingly on a timely basis. The container shipping sector has recent experience of significant falls in demand that hurt the industry badly, both in 2009 and 2016, and so OOCL has prioritised cost management during the anticipated tough conditions of 2020. This adaptability is one of the factors that has allowed OOCL to resist the headwinds of the pandemic, and to produce these solid results. Since May, demand on some trade appears to have improved somewhat, with OOCL providing additional capacity to support our customers' requirements. However, this tentative demand recovery is far from secure, and we will continue to monitor the situation closely.

The financial outcome has also been helped by a fall in fuel prices, although it is not known how long this will last, as well as by a low interest rate environment and a reduction in the Group's debt.

Compared to the first half of 2019, OOCL total liner liftings decreased by 2.6%, but revenue per TEU increased by 6.0%, allowing total revenue to increase by 3.2%. Negative market growth occurred on several trades, but in some cases this drop in liftings was outpaced by an improvement in the freight rates.

In terms of overall liftings, for the first half of 2020, we observed only a small reduction in liftings on the Trans-Pacific trade as a whole. Liftings declined on the Asia-Europe trade, as well as on the Intra-Asia and Australasian trades, but increased on our Trans-Atlantic trade. Revenue increased on our Trans-Pacific, Asia-Europe, and Australasian trades, and was slightly down for our Trans-Atlantic business. Revenue per TEU increased for majority of the tradelanes as compared to 2019.

The average price of bunker recorded by OOCL in the first half of 2020 was US$424 per ton compared with US$441 per ton for the corresponding period in 2019. The price drop in fuel oil and diesel oil led to the decrease in bunker costs by 11.3% in the first half of 2020 when compared to the corresponding period in 2019.

During the first half of 2020, OOCL placed orders for two 23,000 TEU vessels from Dalian COSCO KHI Ship Engineering Co., Ltd. and three 23,000 TEU vessels from Nantong COSCO KHI Ship Engineering Co., Ltd. in China. The expected delivery for these five vessels will be in the year 2023.

For the first half of 2020, OOCL Logistics revenue increased by 5.3% while contribution dropped by 12.2% compared with the same period last year. The contribution from International Supply Chain Management Service (ISCMS) decreased by 23.9% because many retail shops and outlets were forced to close due to the COVID-19 outbreak and city lockdowns which significantly reduced the volume in the first half of the year. Although the volume of Import/Export Services increased but the overall contribution decreased slightly by 4.9% due to the increased procurement costs. There was a 28.5% improvement on Domestic Logistics contribution after effective cost control initiatives, improved utilisation of warehousing resources and new customers being secured.

OOIL continues to benefit from its co-operation with the wider COSCO SHIPPING group. The ability to keep costs under control, through for example our effective joint management of our container boxes, has been a key attribute of our success. In addition, our close co-operation has also allowed us to plan multiple adjustments to our network offering, in line with the huge changes seen in expected customer demand. The many synergies achieved through our joint efforts are one of the underpinning drivers of our highly successful Dual Brand strategy.

Looking forward, the pandemic will have long-lasting effects, and the epidemic prevention and control measures adopted in many countries have become part of daily life. Thanks to the tremendous efforts of all parts of society, as well as economic stimulus packages, many economies have re-emerged from lockdowns and have restarted activity. Against the difficult backdrop, China has managed to expand its GDP 3.2% year on year in the second quarter of 2020, a sign that production activity is steadily improving, which gives us some degree of hope for a more widespread recovery. While the pandemic could continue to bring uncertainties in the rest of the year, tensions in global trade relationships or other factors such as oil prices could also have an impact on our business in the coming months. In this situation, the only rational response is to remain cautious.

Despite the challenges, we remain confident in our long-term future. The order we placed in March this year to build five 23K TEU vessels is a tremendous display of our enduring confidence in container shipping. We are playing a leading role in the digitalisation of our industry and building on very solid foundations in providing integrated container logistics services, which will help us to respond better to the evolution of our customers' requirements in the post-epidemic era. OOIL is among the best-placed groups to handle whatever difficulties may be faced by our industry.

As at 30th June 2020, the Group had total liquid assets of US$2,420.6 million compared with debt obligations of US$601.3 million repayable within one year. The net debt to equity ratio remained low at 0.20 : 1 as at 30th June 2020. The Group from time to time prepares and updates cashflow forecasts for project development requirements, as well as working capital needs, from time to time with the objective of maintaining a proper balance between a conservative liquidity level and an effective investment of surplus funds.

OOIL owns one of the world's largest international integrated container transport businesses which trades under the name “OOCL". With more than 410 offices in over 85 countries/regions, the Group is one of Hong Kong's most international businesses. OOIL is listed on The Stock Exchange of Hong Kong Limited.

Source:OOIL

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Sea-Cargo and Norsepower continue their collaborati

Sea-Cargo and Norsepower continue their collaborati  Alfa Laval expands its portfolio with ultrasonic an

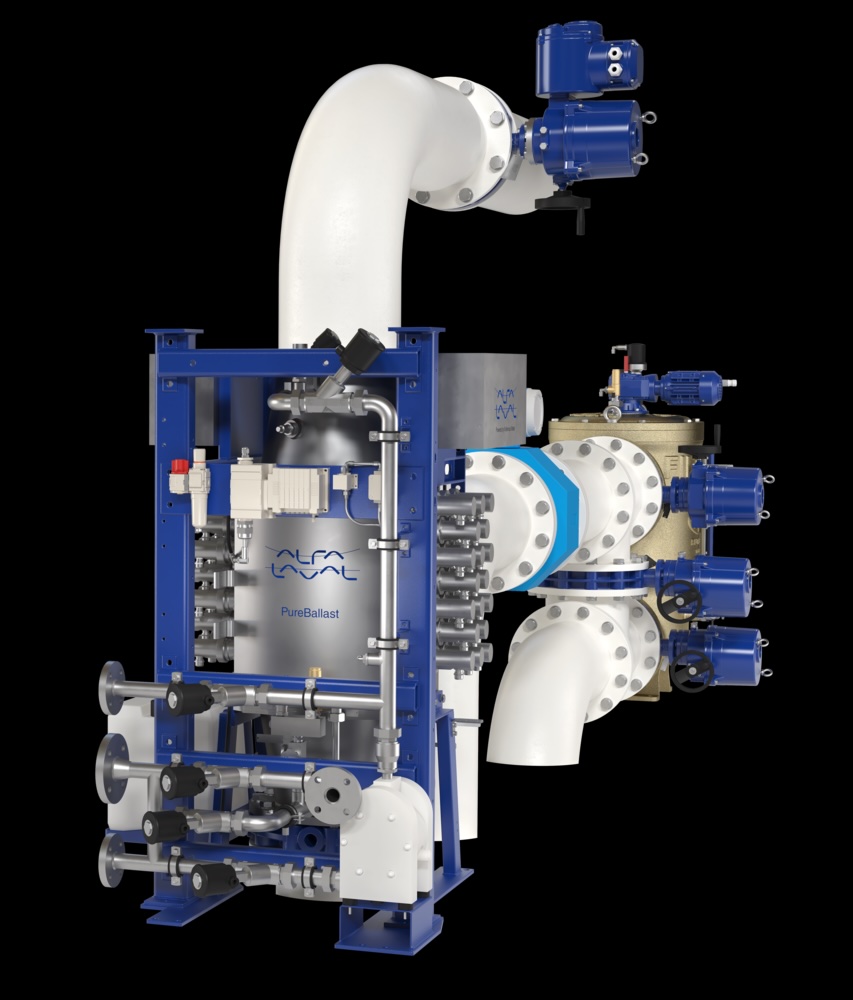

Alfa Laval expands its portfolio with ultrasonic an  Alfa Laval PureBallast 3 Ultra secures orders from

Alfa Laval PureBallast 3 Ultra secures orders from  RobotPlusPlus Wows Maritime Professionals with Carg

RobotPlusPlus Wows Maritime Professionals with Carg  Alfa Laval secures first contract for ammonia fuel

Alfa Laval secures first contract for ammonia fuel  GNV Tests RINA’s Machine Learning and Predictive

GNV Tests RINA’s Machine Learning and Predictive