Hong Kong-listed Cosco Shipping Energy Transportation has warned it is expecting to record an interim loss of between Rmb235m (US$34.5m) to Rmb305m, compared to a net profit of RMb865m notched up in the same period in 2017.

In a statement to the Hong Kong Stock Exchange CSET said a slow down in oil imports and capacity increases not sufficiently offset by rising scrapping trends had led to historically low freight rates.

The freight rate for very large crude carriers was just W43.22, representing a decrease of 18.5% compared to the 2017 interim. As the international fuel oil price increased by 28% year-on-year, the daily revenues for most oil carriers fell to their lowest levels for 20 years. The average daily revenue for a VLCC was just US$5,468 per day, representing a decrease of approximately 78% year-on-year. The daily revenue of other types of major crude oil vessels decreased by approximately 60% year-on-year.

At its annual general meeting on 28 June, CSET warned shareholders of the continuing poor performance of the crude oil carriage sector but said that the company was making progress in the transformation of the company into a “full-scale tanker transportation service provider” that was looking at ways to exploit LNG and clean energy transportation including, methanol, ethanol and ethane.

In signs of a rapidly deteriorating shipping market, marine container manufacturing company Singamas has also issued a profit warning for the first six months of 2018.

Sources:Cosco Shipping Energy

Please Contact Us at:

admin@xindemarine.com

Sea-Cargo and Norsepower continue their collaborati

Sea-Cargo and Norsepower continue their collaborati  Alfa Laval expands its portfolio with ultrasonic an

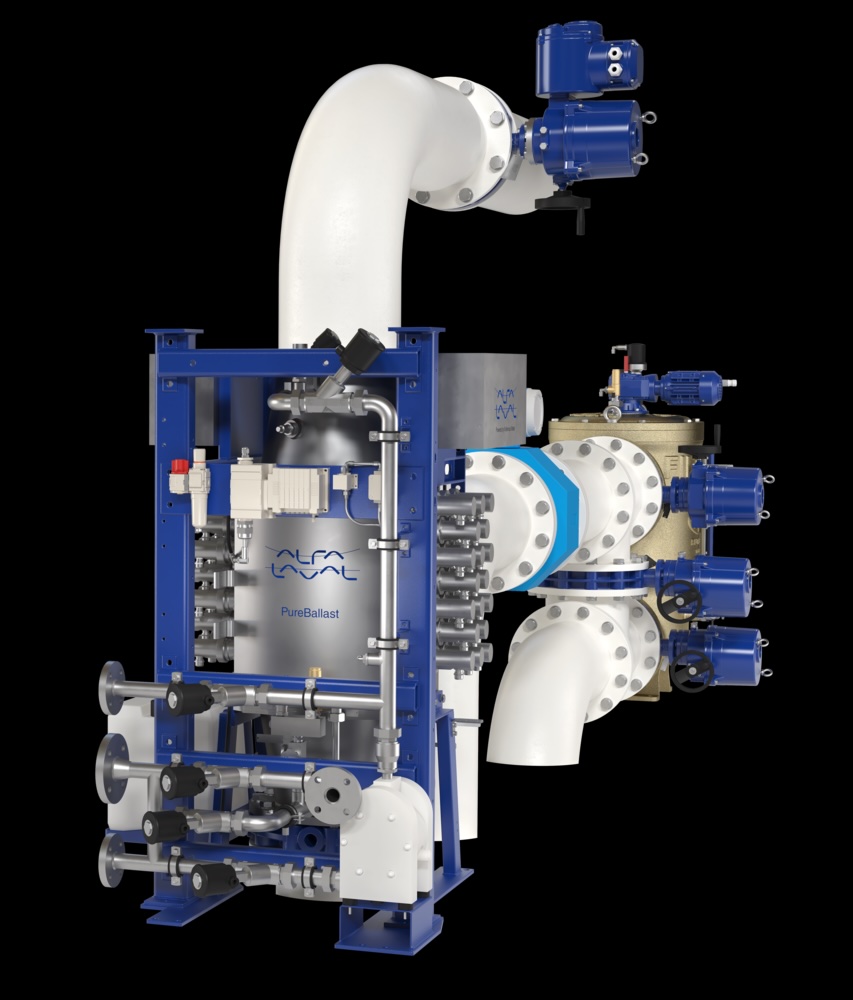

Alfa Laval expands its portfolio with ultrasonic an  Alfa Laval PureBallast 3 Ultra secures orders from

Alfa Laval PureBallast 3 Ultra secures orders from  RobotPlusPlus Wows Maritime Professionals with Carg

RobotPlusPlus Wows Maritime Professionals with Carg  Alfa Laval secures first contract for ammonia fuel

Alfa Laval secures first contract for ammonia fuel  GNV Tests RINA’s Machine Learning and Predictive

GNV Tests RINA’s Machine Learning and Predictive