据Splash 247报道,前新加坡议员张松声先生可能会请新加坡主权基金来拯救处于困境的太平船务。

受制于过去几年的财务压力,张氏的太平船务今天透露, 淡马锡(世界第八大主权基金)旗下的Heliconia 资本管理公司将入资。

自今天开始,太平已经与Heliconia达成6个月的排他协议,两家商谈入资细节。

在给新加坡交易所的声明中,太平船务称其与15家债权人在协商债务还款时间表,并且已经获得大多数债权人的同意,应该是97.5%的债权人已经同意,延缓本、息支付时间至2020年年底,并且已经得到承诺年底前这些债权人不会采取任何强制措施。

太平正在与另外两家还没有达成还款协议的债权人协商债务的还款时间, 一家在5月11日发出催款通知要求十天内支付12,641,059.38 美元(新元?)。与另外一家出租人(相信是船舶的船东,船舶出租人)商谈还款事宜。

当然在给交易所的声明中,太平也提示了以下不能履约的风险:在其融资安排的合约包括2020到期的固定利率6000万新币债券等履行过程中,也有可能发生不能履行承诺的事件。

太平船务的船舶因为公司不能及时付租金或者燃油被扣押也是经常上头条;这家家族企业先后退出两大干线,3月份退出跨太平洋航线,4月份退出亚欧航线。 前不久也卖掉了在南太平洋经营的PDL资产, 2-3月份先后卖了几条万箱船。

胜狮货柜,张氏家族控股企业,太平船务也有1.477亿的债务大部分已经到期。

淡马锡救太平船务也不是第一次了。其实Alphaliner 2018年就透露,太平船务得到过一笔淡马锡控股的海城控股公司(SeaTown Holdings)的贷款。

如果淡马锡的Heliconia出手的话, 将成为全球最新的政府干预救助集装箱船公司的案例,这样的救赎在最近新冠肺炎爆发导致集装箱需求大降情况下中国大陆、韩国、中国台湾、法国政府出钱资助也屡见不鲜。

Heliconia的董事局主席Lim How Teck先生1979-2005在东方海皇工作。应该是航运专家。

Lim How Teck- Chairman

Heliconia Capital Management Pte Ltd is an investment firm that focuses on growth-oriented companies.

It is a wholly owned subsidiary of Temasek Holdings.

The Funds under our management are

●A direct investment fund which co-invests with other private equity investors 直投

●A mezzanine capital fund 夹层

●A fund of funds 基金的基金

另外这个消息丹麦的ShippingWatch 也报道了。

Singapore could become new investor in strained PIL

After rumors of financial woes at Singapore-based PIL, the family-owned shipping company now presents a plan for how it intends to reform its lending agreements. The state of Singapore could become a new investor.

BY TOMAS KRISTIANSEN

Published: 26.05.20 at 15:36

Strained Singapore-based shipping company Pacific International Lines (PIL), owned by the Teo family, is working to improve its loan agreements and bring a new investor into its ownership circle, reveals a statementsubmitted to the stock exchange in Singapore.

Rumors have circulated that PIL is going through financial problems and that suppliers have lost faith in the shipping company. But as of now, the shipping company has remained largely silent about its situation.

The shipping company now informs that it has already carried out several initiatives aimed at improving the company's financials, among these changes to the company's service offerings. However, these initiatives were not sufficient due to the additional effects caused by the coronavirus crisis. 尽管太平船务已经做了很多调整,但是远远不够,再加上新冠肺炎的影响。

The container line is now negotiating with 15 of its lenders to change loan agreements. According to the statement, lenders representing 97 percent of the company's debt have already given their in-principle approval on a deal with the shipping company to postpone repayment of loans and interest until Dec. 31 this year.

Two lenders have yet to approve the deal, including one that submitted a claim for repayment totaling USD 12.6 million on May 11 to be paid within ten business days.

In addition to negotiating with its lenders, PIL is also working to bring in an additional investor. In this connection, the shipping company has entered a six-month exclusivity deal with Heliconia Capital Management (淡马锡全资资产管理公司)to examine a potential investment.

If the parties come to an agreement, it is in fact the state of Singapore that will be joining as investor, as Heliconia Capital Management is owned by Temasek, one of the largest equity funds in the world, which is owned by Singapore.

A few months ago, it emerged that container supplier Singamas Container Holdings was in negotiations with PIL to reach a repayment agreement.

"The Company understands that the PIL Group is discussing with its other creditors for similar arrangements amid the challenging market conditions and recent global impact by COVID-19, the discussion is progressing well with good supports from the creditors," wrote Singamas in a statement at the time.

Singamas has PIL as a major stakeholder.

其实在5月22日的时候,Maritime Network 有如下的报道

Singaporean state investment firm Temasek mum on (secretly exploring) PIL bailout

22 May 2020

The Singapore government’s investment company Temasek Holdings is remaining tight-lipped on market talk that it may take a stake in embattled liner operator Pacific International Lines (PIL).

Privately held PIL, owned by the family of MD Teo Siong Seng, has admitted to being under financial strain amid the Covid-19 pandemic.

PIL is understood to have fallen behind on charter hire payments to its tonnage providers, which include Japanese ship owners. In recent months, PIL has taken steps to improve...

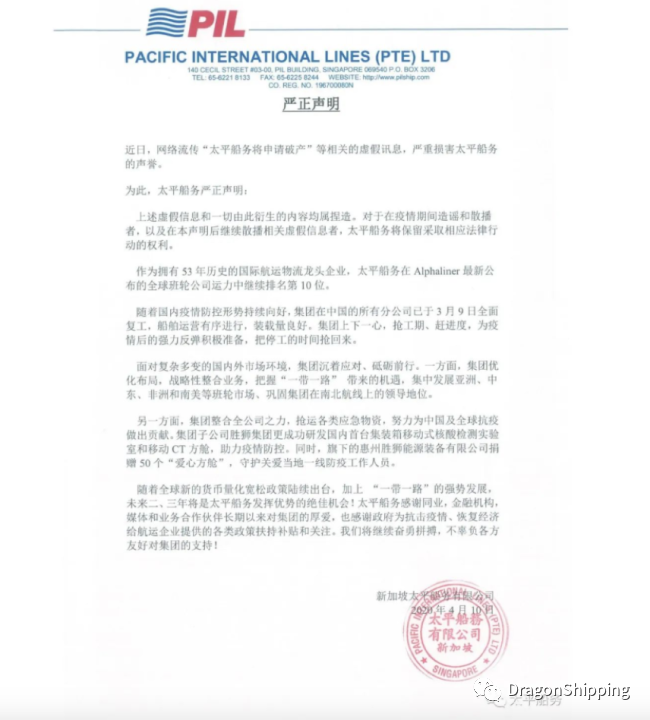

Pacific International Lines (PTE) LTD Statement- 10th April 2020

PIL fights the rumors

At 16:12 hrs Beijing time, PIL, the Singapore based world’s 10th container line published a statement on its WeChatAccount. (WeChat ID PILSHIP)

To respond to the rumors such as ‘PIL is applying bankruptcy protection’, the company officially releases this statement.

Roughly, it says

1) The rumors are fabricated and groundless;

2) The company reserves the right to take legal actions to those who fabricate and spread the false information;

3) As a good shipping and logistics company with a history of 53 years, PIL has been listed as the 10th largest liner company, and its offices in China have been open and in operation since 10th March 2020 and the company is working hard to get back the business.

4) The company, strategically, will allocate resources and integrate its business seizing all opportunities brought by One Belt One Road Initiative to develop Asia, Middle East, Africa and South America business and strength its competitiveness on South/North services .

5) On the other hand, the company has been taking social responsibilities by helping to deliver counter virus materials globally. Its subsidiary, Singamas, invented the first mobile container virus test lab and mobile CT test and donated 50 labs to the frontline medics;

6) In the years to come, PIL will work with all parties concerned to develop the business and also PIL thanks all the supports rendered to it by governments and all parties concerned.

If you want the precise statement, please read the Chinese version as attached.

04-02 来源:信德海事网

05-09 来源:信德海事网

10-12 来源: Drewry德路里

01-16 来源:信德海事网

10-18 来源:信德海事

05-29 来源:信德海事网

07-12 来源:SinorigOffshore

01-01 来源:信德海事网

10-20 来源:信德海事网 马琳

03-25 来源:世界海运 作者李姗晏,李永志等