LNG bunkering demand is estimated to grow to 9 million mt by 2025 and just under 30 million mt by 2030, with LNG bunkering fleet growing to more than 8,000 by 2030 from an existing fleet of 556, Alan Heng, managing director for Asia at Pavilion Energy, said Sept. 10.

“We project that by 2030, Singapore will have a 20% global LNG share, consistent with its position as the largest bunkering port in the world,” Heng said at the Gastech Virtual Summit.

Addressing the short-term impact from COVID-19 on the LNG bunker market, he said that it has resulted in slower growth in shipping and fleet replacement.

Furthermore, lower oil prices had also led to thinner spreads between conventional IMO 2020 compliant fuels and LNG, making economic justifications to fleet replacement and new fuels more difficult. “But we believe that the fundamentals for LNG as a greener fuel remains strong,” Heng said.

However in the mid-to-long term, after the world tides over the pandemic, Pavilion expects the LNG bunkering demand outlook to trend along the original projections of achieving a 30-fold increase in demand in the next ten years and for Singapore to become the major hub for LNG bunkering.

Moreover, Heng highlighted the opportunity of lower shipbuilding costs and LNG prices that the LNG bunker market could take to “reposition for the future.”

Existing challenges, mitigations

Common concerns to the adoption of LNG as a bunkering fuel include the lack of a global network, infrastructure, scale and economics, and presence of higher costs. “We disagree, we think that these issues are being dealt with rapidly and believe that LNG bunkering will over time be the fuel of choice for this industry,” he said.

With regards to the point on presence of higher costs, Heng said that such opponents might not have considered the “cost of carbon abatement and the cost to environment.”

He added further that government and port authorities play a crucial role in establishing regulations that would encourage green investments and use of cleaner fuels. “Institutional investors and financiers can further encourage shipowners to transition to a lower carbon footprint,” Heng added.

Heng raised four main issues that the LNG industry needs to tackle in order to facilitate the growth of the LNG bunker market.

An acceleration of developments in LNG bunker infrastructure would be pivotal. “Most of [the 60] active locations [delivering LNG bunker fuel] deliver LNG by trucks, and there are only 15 ports capable of ship-to-ship LNG delivery,” he said, highlighting that ship-to-ship LNG bunkering is key as it “remains the most effective way to deliver bunker volumes to ocean-going vessels, particularly the long-haul transcontinental voyages,” Heng said.

While major progress is being made in Europe and Asia, with an additional 15 ports and 16 bunker vessels coming online shortly, a “steady stream of investment in bunkering infrastructure” is required to attain the 2030 forecast of 30 million mt, with an estimate of another 100 LNG bunker vessels to be added to the existing fleet.

Another major challenge that the LNG industry has to overcome would be adaptation to LNG commercial agreements, to achieve “fit-for-purpose agreements with diversity across pricing index, supply and tenure, as well as flexibilities.”

Pavilion Energy aims to devise a standard General Terms and Conditions to make contracting an easier process. “It is not about the LNG industry adapting fully to marine customer and giving them everything they want, nor is it the converse. This is about two sides finding common ground to arrive at workable solutions in a new business area,” Heng said.

Source:Platts

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU  Shanghai Yangshan Port Bunkered Two LNG Powered Con

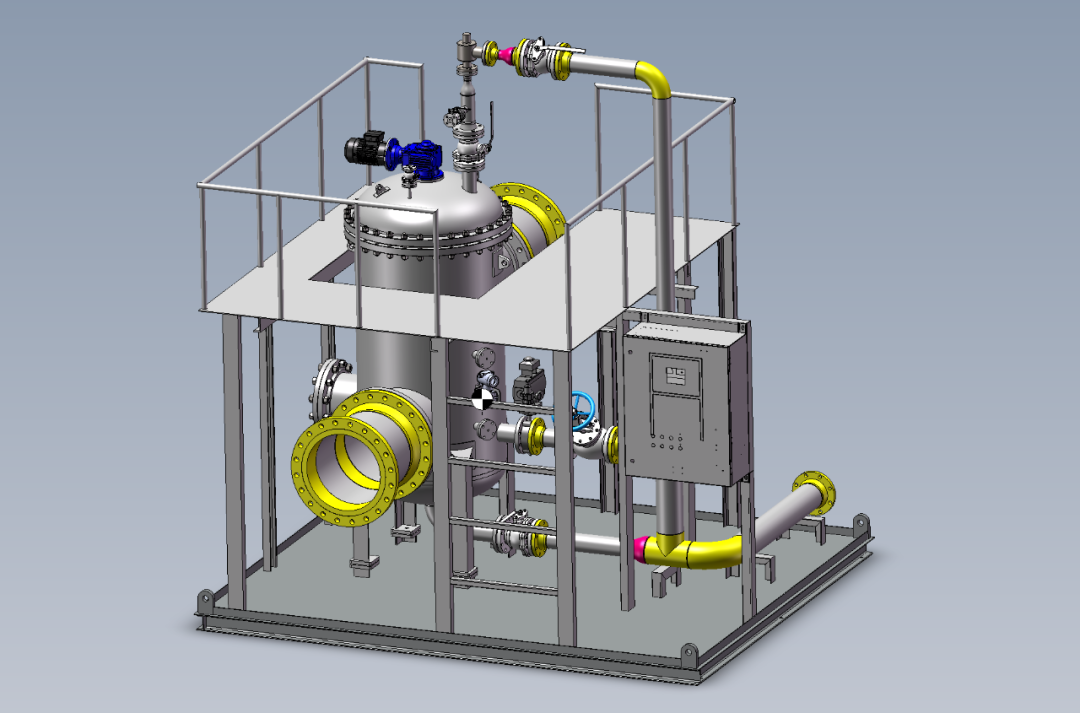

Shanghai Yangshan Port Bunkered Two LNG Powered Con  Headway successfully delivers filtration skid solut

Headway successfully delivers filtration skid solut  Celebrating the Launch of “Green Energy Pearl” –

Celebrating the Launch of “Green Energy Pearl” –  PIL and SSES complete the inaugural LNG bunkering o

PIL and SSES complete the inaugural LNG bunkering o  BW LNG secures e-procurement deal with Procureship

BW LNG secures e-procurement deal with Procureship