Following heightened focus on methane emissions at the UN Climate Change Conference in Glasgow, the challenge will turn to implementation efforts by countries and companies, with implications for the US natural gas sector.

Joining an initiative launched by the US and the EU, more than 100 countries signed the Global Methane Pledge at COP26 in November to cut methane emissions globally by 30% by 2030 from 2020 levels.

Prospects for a US fee on methane emissions recently plummeted with an impasse on budget reconciliation legislation, but concrete action on methane emissions is still expected through regulation.

Some analysts believe that could support long-term opportunities for the US gas sector as buyers grapple with CO2 reduction targets.

"Any announcements or pledges that have the US back on the global stage in addressing climate certainly are extremely positive for US industry," said Erin Blanton, a research scholar, most recently with Columbia's Center on Global Energy Policy. Concrete actions, like the US Environmental Protection Agency following through with its proposed methane regulation, could help bolster transparency, particularly compared to production from other countries like Algeria, Nigeria or Russia, she said.

Regulatory milestones

The US EPA aims by year-end 2022 to complete tougher methane regulations requiring US oil and gas producers to conduct increased emissions monitoring on new wells and to bring nearly 700,000 older wells into compliance. European regulators also are pursuing requirements for leak detection and repair to address venting and flaring.

The steps coincide with global market dynamics and prices recently favoring US gas exports.

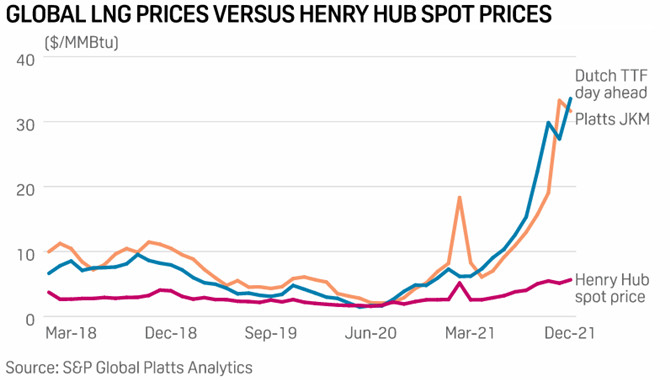

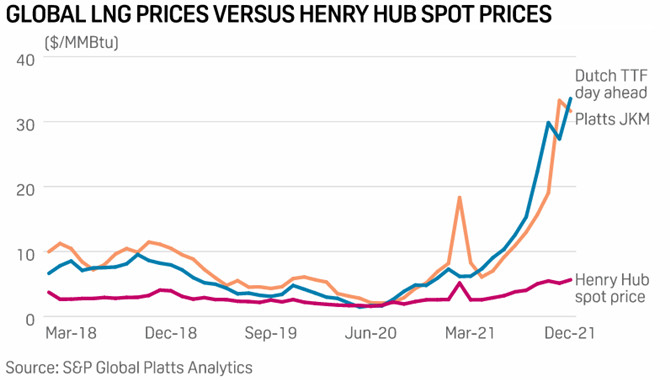

The Dutch TTF day-ahead price reached an all-time high on Dec. 21 near $60/MMBtu. It has since fallen to $31.87/MMBtu, as of Dec. 24. And Platts JKM, the benchmark for spot-traded LNG delivered to Northeast Asia, was assessed Dec. 28 at $32.467/MMBtu after hitting a record high of $56.33/MMBtu on Oct. 6.

Elevated global LNG prices have driven higher utilization rates for all US LNG export facilities in 2021 as well as new construction. The additional capacity coming into service led US LNG export rates to top 13 Bcf/d on Dec. 21, a record high as of that date, according to S&P Global Platts Analytics.

Provided that the overall cost of the proposed US regulations is not substantive for producing and delivering gas, the new EPA requirements may be fairly well supported by the sector, said Dan Klein, head of future energy pathways for Platts Analytics.

Some US exporters hope more consistent standards will help the US carve out a position as the source of low-carbon produced gas.

"We are very encouraged by what I think is growing alignment between the policymakers and the industry on upstream methane emissions," said Brian Lloyd, Sempra LNG regional vice president, external affairs. "Ultimately, when we talk about Europe but also Asia, there is a day coming soon where every cargo of LNG, the ultimate end use buyer is going to want or maybe need to know what the carbon content, [or] methane intensity, is, all the way back to the wellhead."

Implementation plans

Mark Brownstein, senior vice president of energy at the Environmental Defense Fund, said that after the pledges on methane, he would be watching for evidence of tangible action plans in 2022.

"The simple fact is that these countries now having signed this pledge now need to come to Egypt and COP 27 [in November] with concrete plans for how they're going to go about achieving the commitment they made."

In the US, EDF is urging the EPA to strengthen controls on routine flaring and address leaking abandoned wells, as the agency mulls a supplement in March to its proposed regulations.

It is also keeping pressure on the oil and gas industry's emissions performance. On Dec. 15, EDF released a study finding 40% of 900 oil and gas sites analyzed in the Permian Basin were leaking "significant plumes" of methane.

EQT CEO Toby Rice argued the consensus emerging at COP26 over turning away from coal for power generation creates a major opportunity for US gas.

"If you want to phase out coal, US natural gas in the form of LNG exports is the biggest green initiative on the planet, and it's not even close," he said.

In 2022, he predicted, "you're going to see this industry make a tremendous impact on communicating and also performing as it relates to methane emissions," he said. "I'm very optimistic that this industry is going to step up and knock out this one concern that a lot of people have."

Still, environmentalists suggested the shift in conversation at COP26 shows public trust in the oil and gas sector is at a low ebb.

In one development that has concerned the US gas sector, the US joined a side deal with 40 other countries opposing new public international finance of unabated fossil fuel projects. In 2022, industry and environmental stakeholders will be closely monitoring whether the US in practice will make exceptions to that for gas infrastructure in markets with large growth potential.

Source: Platts

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

PIL launches Academy to strengthen workforce compet

PIL launches Academy to strengthen workforce compet  Coal shipments to advanced economies down 17% so fa

Coal shipments to advanced economies down 17% so fa  China futures market updates at close (Nov 14)

China futures market updates at close (Nov 14)  CISA: China's daily crude steel output down 5.7% in

CISA: China's daily crude steel output down 5.7% in  China futures market updates at close (Oct 31)

China futures market updates at close (Oct 31)  CISA: China's daily crude steel output down 1.2% in

CISA: China's daily crude steel output down 1.2% in