Falling iron ore prices have glided through the top layer of the cost curve as a number of small Australian producers are reporting output cuts due to unprofitability. Low grade (58%) iron ore is fetching around $74 CFR China according to Fastmarkets. With C5 at around $20 this puts FOB values to miners around $54 which will begin to cut off marginal supply.

The Evergrande debacle highlights how we have passed the zenith of the Chinese real estate boom. Whilst China will continue to build out its urban infrastructure, it appears that it will do so at a slightly more modest pace as the government hopes to focus growth elsewhere. However we can't help but feel another economic slowdown would tempt further infrastructure stimulus.

Given this negative backdrop, it's reassuring for dry bulk that Chinese steel prices remain elevated. Waves of covid and power shortages have clearly dented steel demand, however the reduction in steel supply has shifted the supply-demand balance far into a deficit. Steel prices are a key piece to the puzzle.

With lower iron ore prices and a strategic focus on keeping healthy commodity reserves, we can expect Chinese iron ore imports to remain firm over the coming months. During 2017 & 2018 iron ore inventory in days of consumption was between 35-40, currently it is around 27 and therefore we see plenty of room for further stock builds to return to a more comfortable level of reserves.

However, the key story which is eclipsing the iron ore market is the output cuts on steel mills. Most media reports on the subject appear to follow the Chinese government line which states that the reason for the output cuts is emissions reductions. We tend to disagree as we wonder why the emphasis on carbon emissions has emerged so quickly and is being enforced so aggressively. In April and May, crude steel production hit two consecutive all-time highs, and then in August production posted the largest yearly decline on record. This striking change in direction over a few months is unlikely the result of a sudden dedication to reducing carbon emissions. We see the energy shortage as the principal driver.

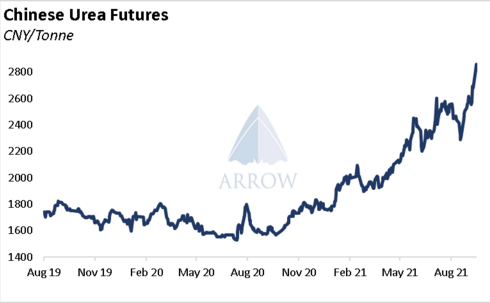

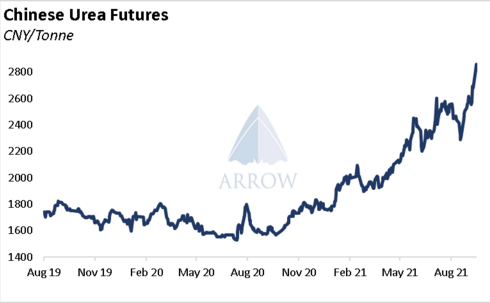

In normal times, capacity utilisation limits would not be placed on critical industries such as the fertiliser industry at a time when prices are sky high. The reason this is being done is that there is an energy shortage, and the same applies to the steel industry.

High steel prices combined with low industrial output is a stagflationary situation and one that Chinese authorities will want to avoid as soon as possible. We expect as the energy shortage eases, steel output will pick back up.

Source: Arrow

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

PIL launches Academy to strengthen workforce compet

PIL launches Academy to strengthen workforce compet  Coal shipments to advanced economies down 17% so fa

Coal shipments to advanced economies down 17% so fa  China futures market updates at close (Nov 14)

China futures market updates at close (Nov 14)  CISA: China's daily crude steel output down 5.7% in

CISA: China's daily crude steel output down 5.7% in  China futures market updates at close (Oct 31)

China futures market updates at close (Oct 31)  CISA: China's daily crude steel output down 1.2% in

CISA: China's daily crude steel output down 1.2% in