The oil complex moved sharply lower Tuesday as a second day of sliding equities increased concerns that global macroeconomic woes could pressure oil demand.

ICE January Brent settled $4.26 lower at $62.53/b and NYMEX January WTI settled $3.77 lower at $53.43/b. Prompt-month Brent and WTI futures fell to levels last seen in November and October 2017, respectively.

"Equity markets are cratering today and it is ratcheting up fears that there is a slow down in the global economy, and possibly slower or no demand growth," Tradition Energy analyst Gene McGillian said.

The oil complex moved lower early Tuesday after declines in US equity markets extended. But the selloff accelerated in afternoon trading as the stock markets moved further into negative territory.

The S&P 500 index was trading down around 1.8% below Monday's close soon after the market settle.

"I think there is fear of a total market meltdown, and that demand is going to fall off the map," Price Futures Group senior markets analyst Phil Flynn said.

Several bearish indicators suggested that the market has priced in further downside. Implied volatility for at the money prompt-month WTI puts rose to above 55% amid the market selloff Tuesday, up from around 37% on Monday, according to data providers CQG and MarketView. Implied volatility often correlates with increased risk in the market, especially to the downside.

Additionally, the volume of puts at the $50/b strike price spiked Tuesday to around 7,421 contracts in midafternoon trading, against a total open interest of 12,590 contracts as of Monday.

Products futures also dropped sharply in afternoon trading.

Source:S&P Global Platts

Please Contact Us at:

admin@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

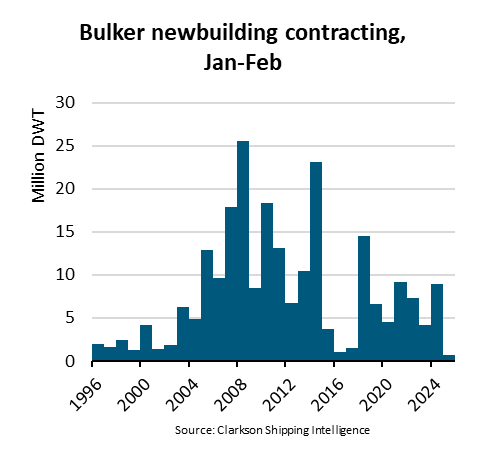

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar