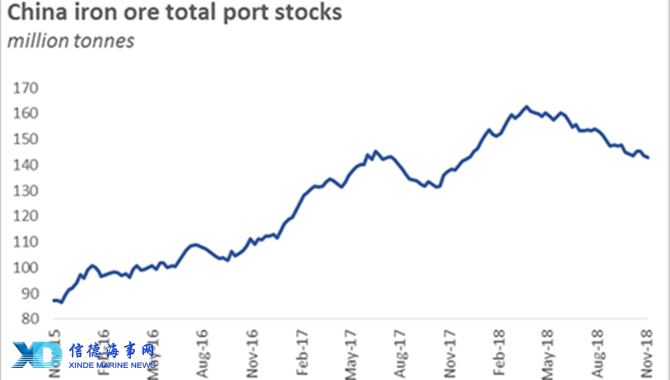

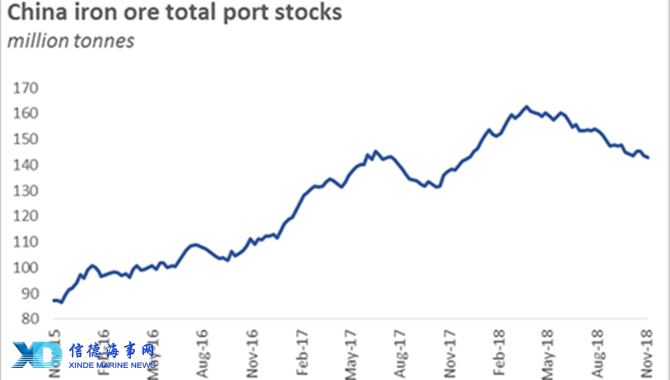

Chinese iron ore imports disappointed in the second half of the year as mills and traders favoured drawing stocks down to buying from the international markets. The latest data released earlier this week show that iron ore inventories held at major Chinese ports dropped to their lowest level in 11 months. As of last Friday (9th November), total stocks were at 142.8 million tonnes, down by about 20 million tonnes since the March peak.

Contrary to the popular view that the winter pollution controls would underpin the demand for high-grade iron ore and boost long-haul imports from Brazil, Chinese mills shifted their purchases to the cheaper material sitting at ports. It turns out that mills have broader objectives than simply minimising pollution and maximising productivity!

As steel prices soften and input costs rise, steel margins are moderating, undermining demand for top-grade ores and incrementally boosting demand for lower grade ones. This is reflected in the decline of the premium paid for 65% Fe iron ore over the index type material (62% Fe); while the price of 65% Fe iron ore remained practically unchanged since the beginning of October, 62% Fe benchmark price rose by 10%.

The demand shift towards cheaper material is also evident in the change in Brazilian inventories at ports. While total Brazilian iron ore stocks at ports rose by about 7.5 million tonnes since the beginning of August, lower grade Australian ore stocks dropped by over 18 million tonnes.

With the winter pollution controls failing to boost steel prices, and input costs remaining high, mills’ margins may come under further pressure and extend the inventory drawdown into the coming weeks. Although this would have a negative impact on import demand in the short run, it would also help to deflate the stubbornly high iron ore stocks at Chinese ports.

Any further narrowing of the high-grade premium will also incentivise mills to switch back to 65% Fe iron ore at some point. We are not sure at what level this could happen as it will not only depend on the premium but also on steel margins. However, if history is of any guidance we may not be too far away from the turning point.

In 2017, during when demand for higher grade iron ore surged, premium for 65%Fe over 62% Fe benchmark averaged $16 per tonne. The same was $18.5 per tonne during 1H18, before rising to $25.9 per tonne in 2H18*. Today** the premium stands at $19.3 per tonne, only slightly higher than the average seen throughout 2017 and 1H18.

Source:Arrow

Please Contact Us at:

admin@xindemarine.com