What is happening?

An attempted coup is underway in Guinea. A military group seized power in the capital city of Conakry yesterday detaining the president, dissolving the constitution and closing the country's borders.

Which commodities are exposed to potential export disruptions?

Bauxite - almost exclusively. Bauxite shipments amounted to 44.7 million tonnes over the first half of 2021, accounting for 99.5% of total seaborne exports. Meanwhile, alumina and iron ore shipments totalled just over 200,000 tonnes.

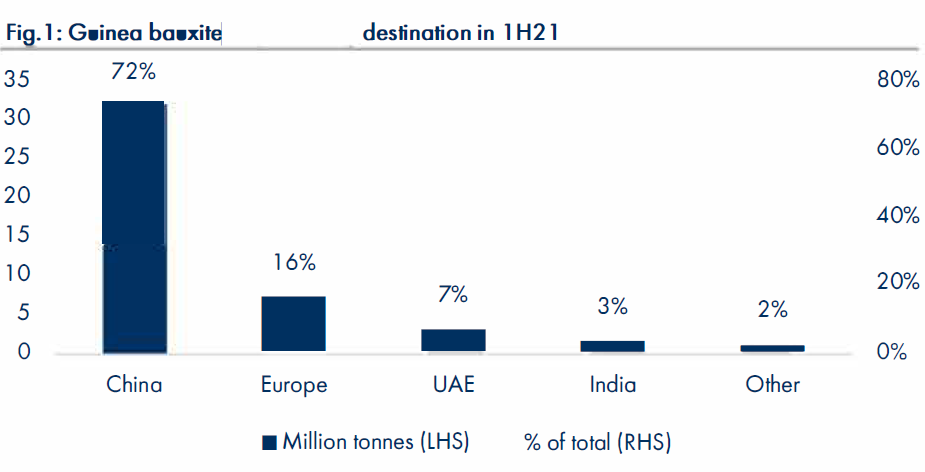

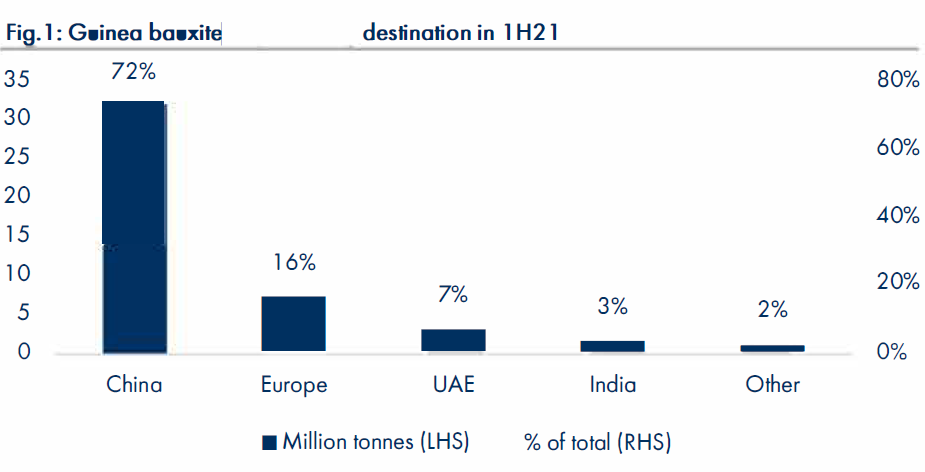

Which are the biggest buyers of Guinean bauxite?

Over the past few years, consistently over 70% of Guinean bauxite shipments were shipped to China. Europe constitutes another major destination, while the UAE & India are receiving about 10% of Guinea's seaborne bauxite exports combined.

Which vessel types are more exposed?

Which vessel types are more exposed?

Capes account for 80% of total bauxite shipments out of Guinea. The lion's share is loaded on standard Capes, but larger stems are emerging. In 1H21, 29% of total shipments were loaded on Newcastlemaxes and 1 0% on VLOCs, up from 21 % and 7% respectively in 1H20. Over the same period, the market share of standard Capes dropped from 52% to just over 40%.

Approximately 90% of all Capesize cargoes are headed to China, with the rest sailing to India and the UAE.

As for Panamax stems, which account for 1 2% of total, they are largely shipped to the North Atlantic, with 80% destined for Europe and 17% for Canada's Atlantic coast.

How many ships are currently waiting to load in Guinea?

As of 6 September, a total of 14 ships are waiting off Guinean ports: 1 Newcastlemax, 8 standard Capes, 2 Panamaxes, 2 Ultramaxes and 1 Supramax.

How have markets reacted so far?

Aluminium futures prices spiked bath on the LME and in China fuelled by concerns over bauxite supply. Guinea accounts for 60% of global bauxite shipments* supplying 2.5 times more volumes to the seaborne market than the next biggest supplier, Australia, over 1H21.

Aluminium prices had already been trending near multi-year highs in recent weeks on the back of a global economic recovery boosting demand, rumours that China will curb output and logistical issues at a Jamaican producer further tightening the market.

Potential implications

The situation remains extremely fluid and it is difficult to gauge how things will play out. There could be further complications down the line. But given that bauxite accounts for practically l 00% of Guinea's seaborne dry bulk exports, no government - military or otherwise - con afford to jeopardise their major source of income. We have already been hearing from local agents that operations at the port of Conakry have resumed.

Even if more logistical disruptions arise in the coming days, they should be short-lived and their impact could be lessened by the ongoing rainy season, when shipments seasonally drop.

Overall, we expect shipments to bottom out as we approach the end of the rainy season and ramp up as normal over Q4 despite any potential disruptions.

Source: Arrow

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com