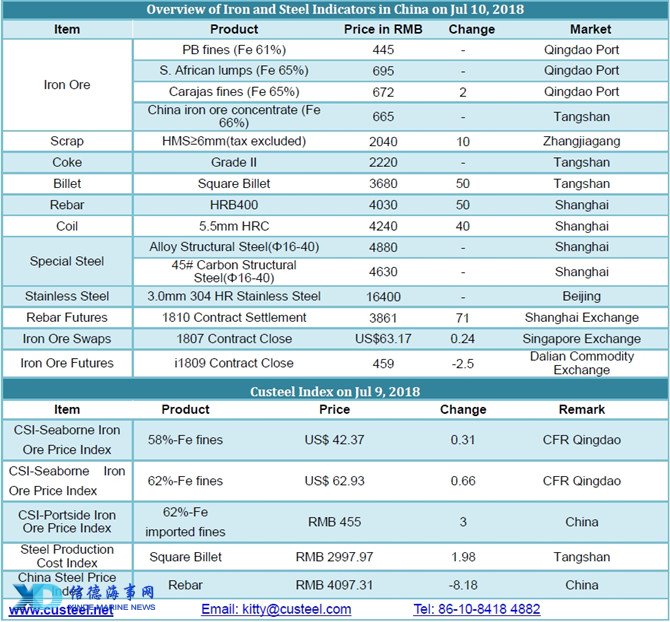

Iron ore futures market extended narrow fluctuation, which dampened traders’ sentiment, resulting in a RMB3-5/tonne decline in quotation. Traders who traded mainstream iron ore resources were active in offers and showed strong desire to deliver, while those with low alumina resources were holding prices. PB fines in Yangtze Rivers ports were ample and saw low trading volumes since surrounding mills mainly procure long-term contracted cargoes adding some spot resources. Traders might hike prices slightly as the previous decline caused losses. Steel mills showed weak buying interests at other ports, focusing on PB fines, Newman fines, lumps, Carajas fines and Brazilian fines. PB fines were traded at RMB452/tonne in Shandong, BRBF at RMB513/tonne. For the coming market, Australian resources will see prices vibrate at low level and the high grade iron ore resources with low alumina content will stay robust.

Sources:XINDE MARINE NEWS

Please Contact Us at:

admin@xindemarine.com